Global| Jan 16 2007

Global| Jan 16 2007UK December Inflation--3%: The Cause of the BOE Rise in the Base Rate to 5.25%

Summary

The UK inflation rate, based on the Harmonized Consumer Price Index (HCPI) rose to 3.0% in December from 2.7% in November. The rise was no surprise since the principal reason given for the Bank of England's increase in the base rate [...]

The UK inflation rate, based on the Harmonized Consumer Price Index (HCPI) rose to 3.0% in December from 2.7% in November. The rise was no surprise since the principal reason given for the Bank of England's increase in the base rate by 25 percentage points to 5.25% on January 11 was that the Bank had seen the December figure before its release to the public. The uncertainty since then lay in whether the December rise would be more than 1 percentage point above the inflation target of 2%. If that were the case, the Governor of the Bank of England would have had to write an open letter to the Chancellor of the Exchequer explaining why the inflation rate had risen by more than one percentage point above the 2% inflation target. Since the inflation rate was just short of the one percentage point, no letter will be required. Nevertheless, the increase in the inflation rate is a big one.

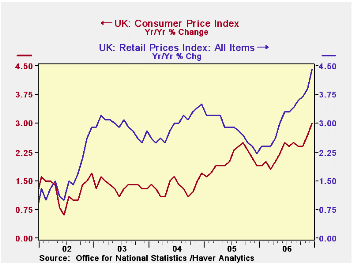

The HCPI was adopted on December 10, 2003 to insure comparability with other members of the European Union. In the UK it is known as the CPI. Prior to that time, the measure of inflation in the UK was based on the Retail Price Index (RPI) or the Retail Price Index excluding mortgage interest payments (RPIX). Inflation measures based on the CPI and on the RPI are shown in the first chart. Since the middle of 2002, inflation based on the RPI has been greater than that based on the CPI except for early 2005 when they were almost equal. The office of National Statistics publishes data explaining the difference between the CPI and the RPI. In December, of the -1.46 difference between the CPI and the PRI, -0.91 was due to the exclusion of mortgage interest payment and other housing components from the CPI, +.23 due to other differences of coverage, -0.56 due to differences in the formulas used to calculate the totals and -0.22 due to other differences including weights.

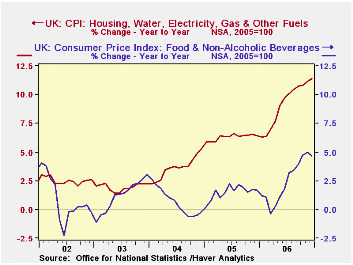

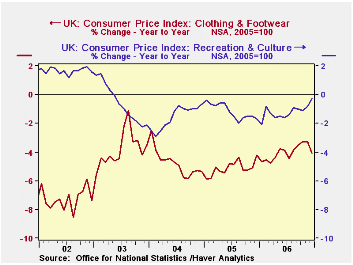

Among the factors contributing to the December rise in the CPI were the 11.38% increase in the prices of the Housing, Water, Electricity, Gas and Other Fuels component of the index and the 4.67% increase in the price of Food and Nonalcoholic Beverages component. The inflation in both of these rose sharply in the latter part of 2006, as can be seen in the second chart. Declines in the prices of Clothing and Footwear and Recreation and Culture components, shown in the third chart, helped to mitigate the overall rise in the index.

| INFLATION IN THE UNITED KINGDOM (%) | Dec 06 | Nov 06 | Oct 06 | Sep 06 | 2006 | 2005 | 2004 | 2003 |

|---|---|---|---|---|---|---|---|---|

| HCPI | 2.97 | 2.68 | 2.48 | 2.39 | 2.33 | 2.05 | 1.34 | 1.36 |

| RPI | 4.43 | 3.87 | 3.67 | 3.63 | 3.19 | 2.83 | 2.96 | 2.91 |

| RPIX | 3.79 | 3.43 | 3.17 | 3.17 | 2.93 | 2.27 | 2.21 | 2.81 |

| Housing, water, elec, gas, etc | 11.38 | 11.14 | 10.82 | 10.72 | 8.25 | 6.31 | 3.65 | 1.95 |

| Food, non alcoholic beverages | 4.67 | 5.00 | 4.72 | 3.81 | 2.50 | 1.51 | 0.66 | 1.18 |

| Recreation and Culture | -0.30 | -0.80 | -1.10 | -1.00 | -1.20 | -1.16 | -1.56 | -0.60 |

| Clothing and footwear | -4.10 | -3.28 | -3.30 | -3.50 | -4.04 | -2.0 | -4.76 | -3.82 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates