Global| Mar 15 2006

Global| Mar 15 2006UK Employment Conditions Continue To Erode

Summary

Since we last reported on the UK labor market here in mid-January, conditions have continued to soften. Measured by 3-month centered moving averages, employment and unemployment have both deteriorated. In the December period [...]

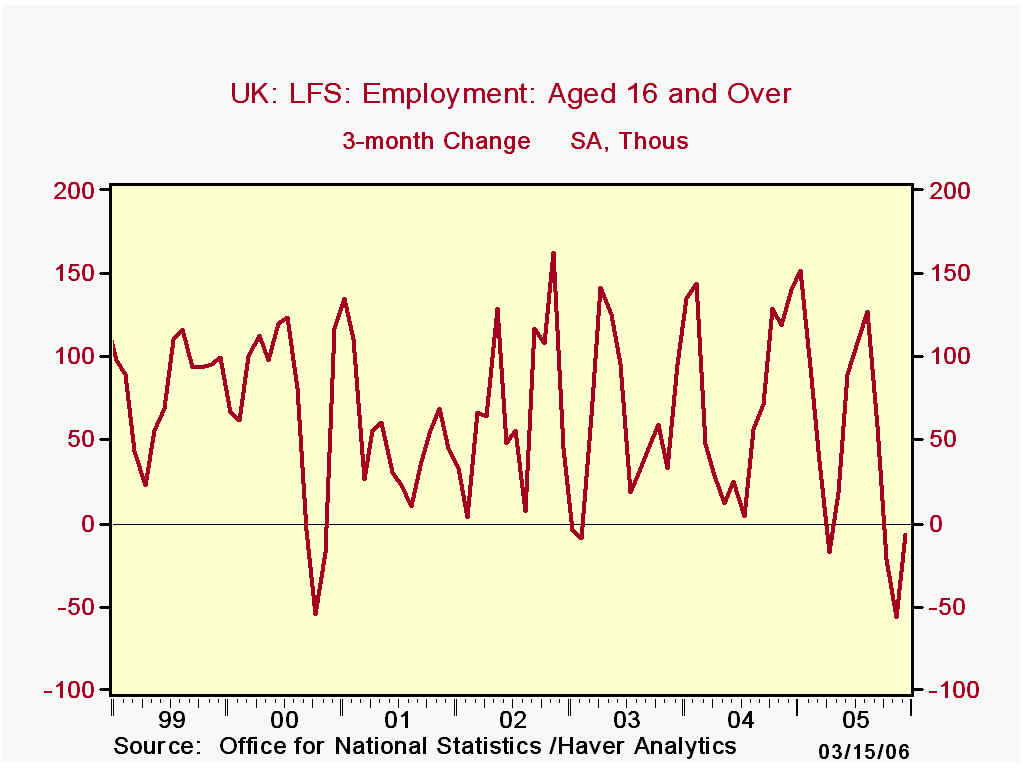

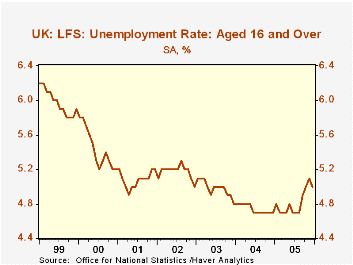

Since we last reported on the UK labor market here in mid-January, conditions have continued to soften. Measured by 3-month centered moving averages, employment and unemployment have both deteriorated. In the December period (November, December and January), employment was off 7,000 from three months before (the usual UK comparison), following a 56,000 decline in the November period and 22,000 in October. The unemployment rate reached 5.1% in the November period and edged lower in December to 5.0%. It had averaged 4.8% for all of 2005.

The unemployment rate reached 5.1% in the November period and edged lower in December to 5.0%. It had averaged 4.8% for all of 2005.

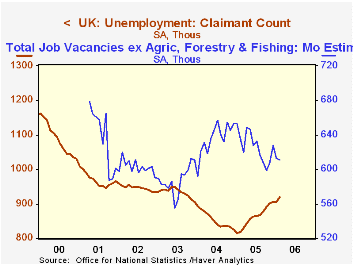

More current data on claims for unemployment benefits and job vacancies point toward further possible labor market softening. The so-called "claimant count" shows that 919,700 people were collecting benefits in February, up from 901,900 in December and an average of 861,100 for 2005. The number of job vacancies is decreasing, pointing to fewer new opportunities for work: there were 610,700 reported vacancies in February, down from 627,900 in December and 626,700 for all of 2005. Other indicators of less-than-full participation in employment are also showing negative patterns. The number of employees who are working part-time because they can't find full-time work is rising. And the number of temporary workers who are working "temp" because they can't find permanent work has been ratcheting upward for several months.

Finally, as might be expected from a pattern of diminished demand for labor, workers' earnings are remaining on soft side. The headline series* for the average earnings index was 3.5% in January, flat with December and down from 4.0% in 2005 and 4.5% in 2004.

| United Kingdom | Feb 2006 | Jan 2006 | Dec 2005 | Nov 2005 | 2005 | 2004 | 2003 |

|---|---|---|---|---|---|---|---|

| Employment (3Mo Avg, SA, Thous) | -- | -- | 28,806 | 28,769 | 28,743 | 28,465 | 28,183 |

| Chg from 1 & 3 Months Ago | -- | -- | +37/-7 | +5/-56 | 1.0 | 1.0 | 1.0 |

| Unemployment Rate (3Mo Avg, SA, %) |

-- | -- | 5.0 | 5.1 | 4.8 | 4.8 | 5.0 |

| Claimant Count (Monthly, Thous) | 919.7 | 905.1 | 906.2 | 901.9 | 861.1 | 853.6 | 933.3 |

| Vacancies (Monthly, Thous) | 610.7 | 612.9 | 627.9 | 607.6 | 626.7 | 635.5 | 587.4 |

| Average Earnings Index inc Bonus (Headline Rate*) | -- | 3.5 | 3.5 | 3.4 | 4.0 | 4.5 | 3.4 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.