Global| Dec 21 2005

Global| Dec 21 2005UK Institutional Investors Diversify Holdings Through Q3; More Interest Abroad Is Evident

Summary

The UK Office of National Statistics today released data on institutional investors' activity in financial markets during Q3 2005. The table below gives an overview of this widely monitored information, generally known as the "MQ5" [...]

The UK Office of National Statistics today released data on institutional investors' activity in financial markets during Q3 2005. The table below gives an overview of this widely monitored information, generally known as the "MQ5" data. Today's report is the "First Release"; all the MQ5 figures are available, but the full, official release will come January 6, 2006. These data were added several months ago to Haver's "UK" database, in the Financial Data menu under "MQ5", listed at the bottom.These investors include insurance companies, pension funds, investment trusts and unit trusts, four key capital market participants.As evident just in the summary table below, the amount of detail offered is considerable, and also includes some balance sheet information and figures on asset acquisitions and liquidations as well.

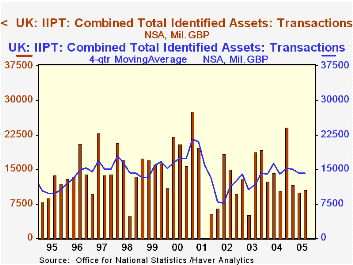

One aspect of the data for the first three quarters of 2005 is that these investments so far this year look to be running below the pace of the last several years. However, we also see considerable movement among various asset categories and the accompanying graph illustrates that there is considerable volatility from quarter to quarter. So it may be that Q4 would see a more sizable flow, as happened last year. In the graph, it is seen that a four-quarter moving average of this total has been fairly steady since late 2003.

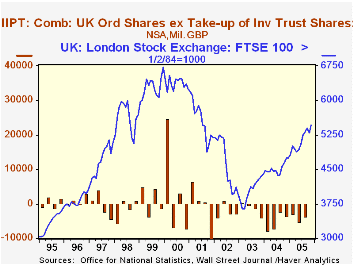

Another facet of these data is the perhaps unexpected trend of net liquidation of UK company shares. This has occurred every single quarter beginning with Q2 of 2003, more than two years ago. UK equity prices continue to rise, though, indicating that other investors are taking up the slack. Further, these institutions continue as net purchasers of other UK company securities and of foreign company securities. These developments, rather than showing some disaffection with British business, may instead serve as more evidence of the fluidity of world capital markets and the ease and ability of investors to shift their holdings.

Finally, over the last two quarters, the largest entry in our table is "Other". This includes, as noted in the footnote, loans, mortgages, land (plus property and ground rents) and several other security types, some denominated in foreign currency. More concretely, these include overseas loans and mortgages, direct investment interests and balances of overseas branches. All of these items, as in the prior interpretation of flows among various corporate securities, point to the increasing globalization of capital markets. These firms' portfolio and direct investments abroad are increasing, and moreover, they are putting incremental funds in new and different categories, both domestic and foreign, not simply government bonds, in which their flows remain quite modest.

| UK: Net Investment by Institutional Investors (Millions of Pounds Sterling) |

Q3 2005 | Q2 2005 | Q1 2005 | Quarterly Average|||

|---|---|---|---|---|---|---|

| 2004 | 2003 | 2002 | ||||

| Total Identified Assets | 10.7 | 10.1 | 11.8 | 15.2 | 14.0 | 12.4 |

| Short-Term Assets | 1.0 | 7.3 | 1.2 | 3.1 | 0.2 | -1.8 |

| British Govt Sterling Securities | 3.7 | -5.1 | 4.4 | 4.2 | 5.0 | 1.5 |

| UK Company Shares | -3.7 | -5.1 | -2.9 | -5.2 | -1.3 | -3.1 |

| Other UK Company Securities | 0.2 | 0.7 | 3.7 | 5.1 | 6.4 | 6.7 |

| Overseas Company Shares | 3.9 | 5.0 | -0.7 | 3.6 | 0.9 | 5.5 |

| Other Overseas Company Securities | -1.4 | 1.3 | 1.7 | 2.4 | 1.7 | 1.7 |

| Overseas Govt Securities | -0.4 | 0.4 | 0.6 | -1.0 | -0.9 | -0.3 |

| All Other Assets* | 7.4 | 5.6 | 3.7 | 3.1 | 2.0 | 1.2 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates