Global| Jan 18 2008

Global| Jan 18 2008UK Retail Sales Take a Hit

Summary

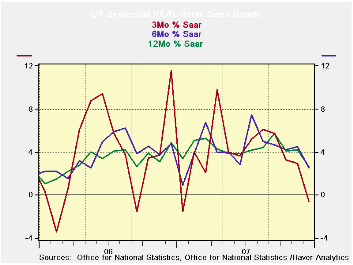

The hit to UK retail sales was severe enough to reverberate in the exchange markets where sterling suffered a set back in trading after the retail figures were made public. The chart tells the story without the benefits of numbers. [...]

The hit to UK retail sales was severe enough to reverberate in

the exchange markets where sterling suffered a set back in trading

after the retail figures were made public. The chart tells the story

without the benefits of numbers. The pattern clearly shows a loss in

headline momentum and a loss in momentum on all major horizons. Real

excl auto sales echos that pattern.

In numbers retail sales drop by 0.4% (ex autos) in real terms

in December, and that drop is never a good sign. For the full quarter,

however, real retail sales ex autos continue to grow at a pace of 1.9%.

But the slip in the three month growth rate is a negative indicator for

momentum and the period ahead. Food sales were up in December with

nonfood spending weak. UK indicators have been touch and go in recent

months, This one pushes the BOE closer to being truly concerned about

growth and may be enough to get a rate cut from it. But since inflation

data are not cooperative and the EMU region is slowing but holding

policy pat, it is not yet clear if the UK will follow the US lead to

lower rates or to be stoic and stay with continental Europe. The UK

economy seems to be on the cusp.

| UK Real and Nominal Retail Sales | |||||||

|---|---|---|---|---|---|---|---|

| Nominal | Dec-07 | Nov-07 | Oct-07 | 3-Mo | 6-Mo | 12-Mo | Year Ago |

| Total Retail | -0.6% | 0.4% | 0.0% | -0.9% | 0.5% | 1.7% | 4.8% |

| Food Beverages & Tobacco | 0.4% | 0.5% | 0.1% | 4.2% | 5.4% | 3.2% | 5.0% |

| Clothing footwear | 0.0% | -0.7% | -0.9% | -6.2% | -0.1% | -0.5% | 8.1% |

| Real | |||||||

| Retail excl auto | -0.4% | 0.4% | -0.1% | -0.6% | 2.5% | 2.7% | 4.9% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.