Global| Jan 29 2008

Global| Jan 29 2008UK Retail Sector Continues to Ramp Down

Summary

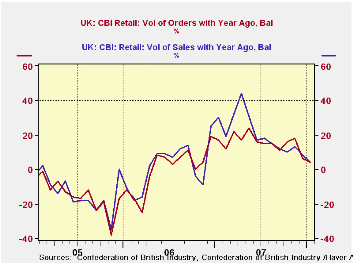

Weakness remains in play in the UK retail sector. In January the ‘+4’ orders and sales results continue a trend of progressively weaker net balance results that extends back to early 2007. Still those readings bested the ‘-5’ for [...]

Weakness remains in play in the UK retail sector. In January

the ‘+4’ orders and sales results continue a trend of progressively

weaker net balance results that extends back to early 2007. Still those

readings bested the ‘-5’ for sales and the ‘-9’ for orders that

retailers themselves had expected. So while conditions have steadily

worsened, they have still exceeded the expectations of the

participating retailers themselves, at least in December. Expectations

for sales ‘for the time of year’ were a weak ‘-16’ for January,

however, and that reading resided in the bottom 22 percentile of its

range. Looking ahead to February ‘time of year sales’ is still negative

at ‘-5’, but retailers appear to have scaled back on their pessimism.

Sales and orders compared to a year ago are expected to be in the ‘+10”

range. If so that would pose a bit of a reversal to the ongoing down

trend. But January was the first positive sales surprise in the past

five months and only the second in the past nine. Retailers have had a

reason for their pessimism.

| UK Retail volume data CBI Survey | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Reported: | Feb 08 |

Jan 08 |

Dec 07 |

Nov 07 |

12Mos Avg | %tile | Max | Min | Range |

| Sales/Year Ago | -- | 4 | 8 | 13 | 19 | 42% | 57 | -35 | 92 |

| Orders/Year Ago | -- | 4 | 6 | 18 | 15 | 53% | 42 | -38 | 80 |

| Sales: Time/Year | -- | 0 | -5 | -3 | 4 | 47% | 41 | -37 | 78 |

| Stocks: Sales | -- | 9 | 24 | 18 | 13 | 30% | 30 | 0 | 30 |

| Expected: | Feb-08 | ||||||||

| Sales/Year Ago | 10 | -5 | 11 | 15 | 16 | 46% | 49 | -23 | 72 |

| Orders/Year Ago | 10 | -9 | 10 | 12 | 11 | 61% | 38 | -34 | 72 |

| Sales: Time/Year | -5 | -16 | 3 | 2 | 3 | 41% | 29 | -29 | 58 |

| Stocks: Sales | 11 | 24 | 11 | 12 | 10 | 38% | 24 | 3 | 21 |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.