Global| Jul 07 2020

Global| Jul 07 2020UK Still Travelling in the Slow Lane

by:Andrew Cates

|in:Economy in Brief

Summary

With lockdown measures having been partially lifted in recent weeks, prospects for the UK economy seem to have improved. On the data front there has been some validation for that view as the composite PMI jumped sharply to 47.5 in [...]

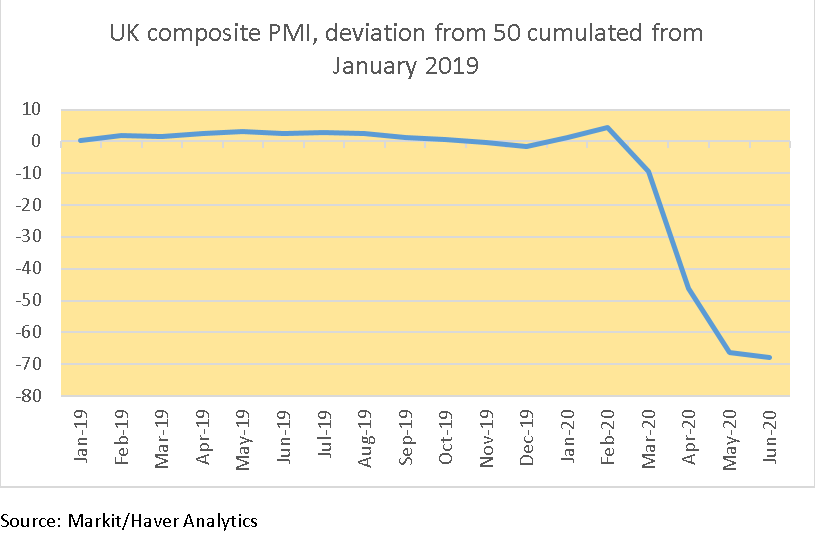

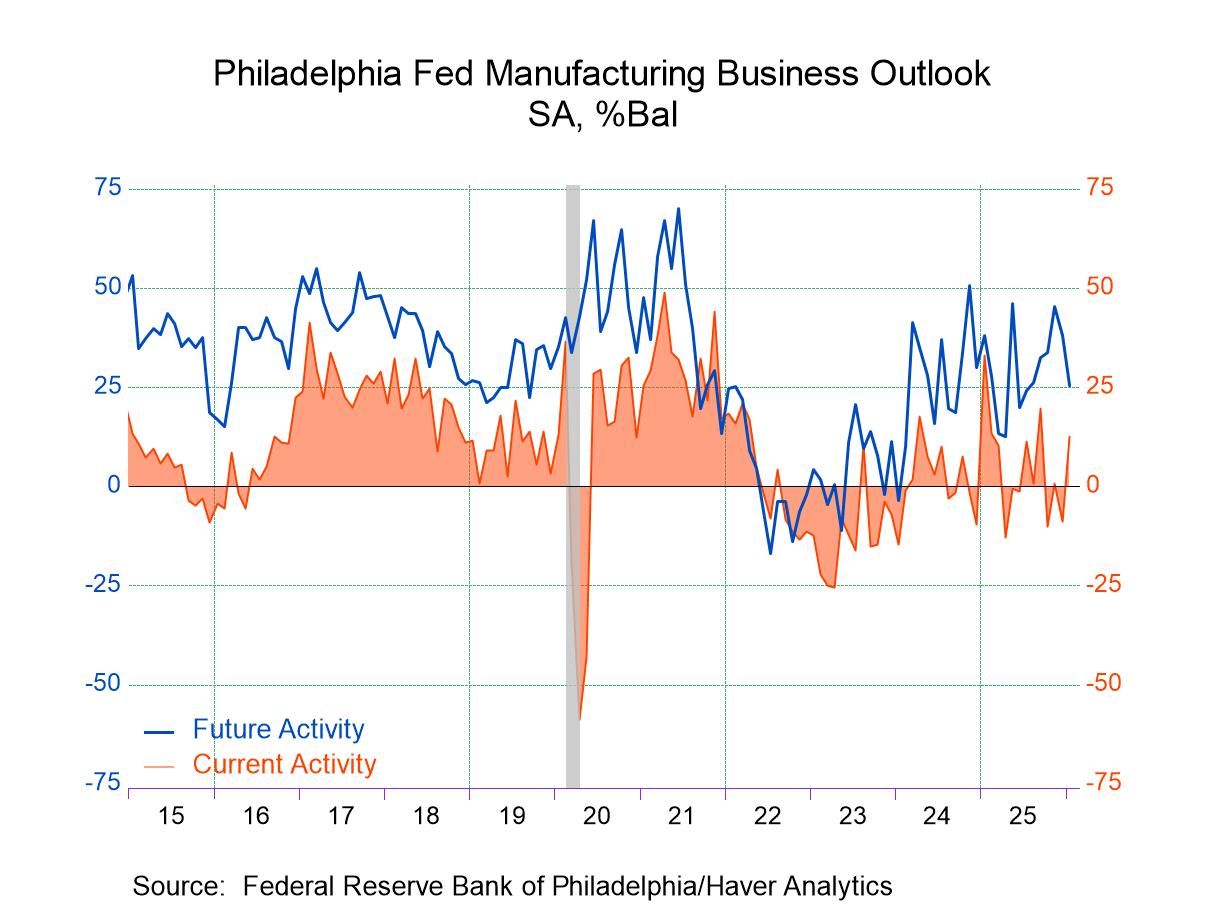

With lockdown measures having been partially lifted in recent weeks, prospects for the UK economy seem to have improved. On the data front there has been some validation for that view as the composite PMI jumped sharply to 47.5 in June from 30.0 in May, its highest level since February. That data however underscore that an 'improvement' is a relative term. The underlying base from which this index recovered was extraordinarily low. And a sub-50 level for the PMI still suggests that output is contracting. Further perspective on that point can be seen in the first figure above showing the deviation of the UK monthly composite PMI from 50 cumulated from January 2019. Successive readings below 50 in recent months suggest the level of output is a long way from normal and that much excess capacity now exists in the broader economy.

Andy Haldane, the chief economist at the Bank of England, was reported to be optimistic about UK recovery prospects last week arguing that recent data were in tune with the idea that a V-shaped recovery profile was taking shape. A closer examination of Haldane's speech suggests a more nuanced take. He was arguably simply stating that the economy could prove to be stronger than the BoE had previously been anticipating. Since the base from which the economy is destined to recover is so low, he was further arguing that many economic indicators could indeed bounce back strongly not least now that lockdown restrictions are easing.

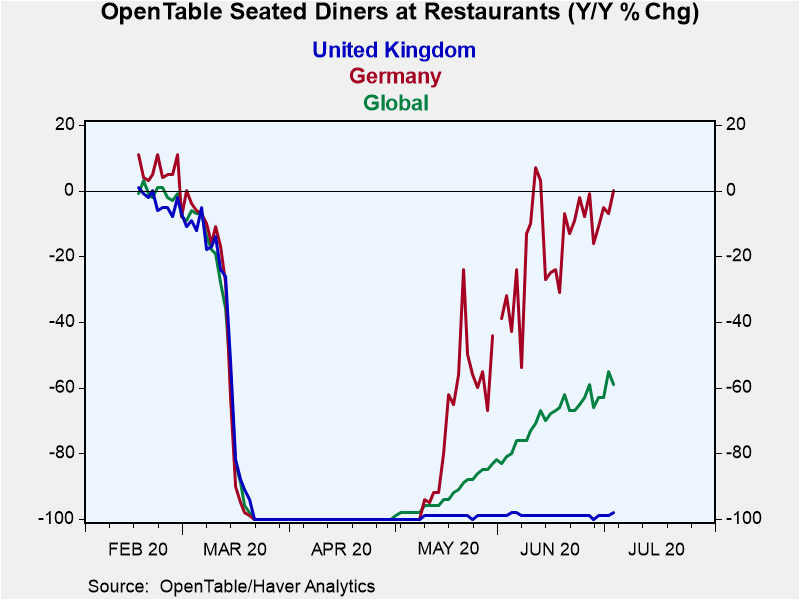

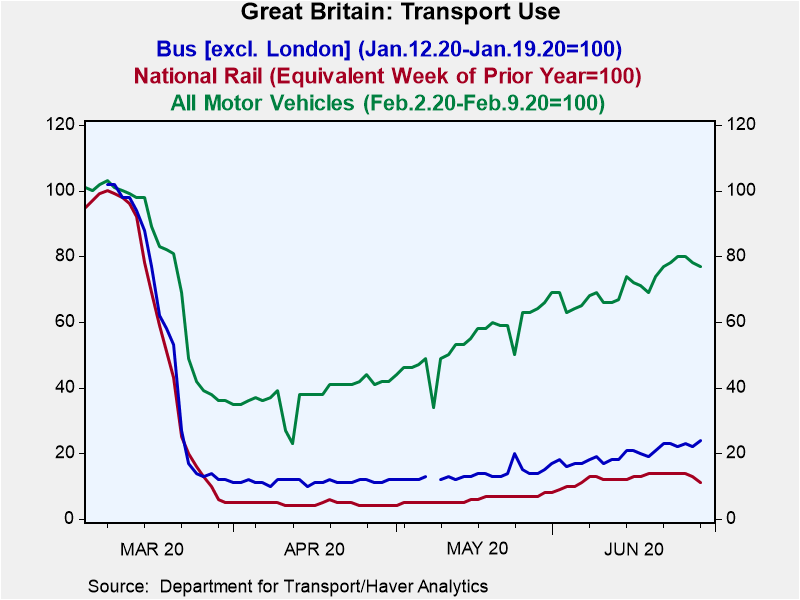

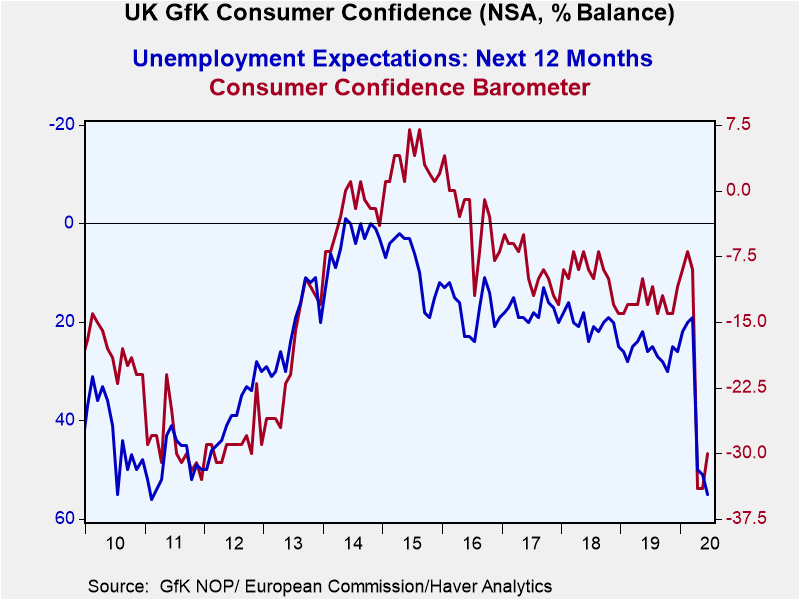

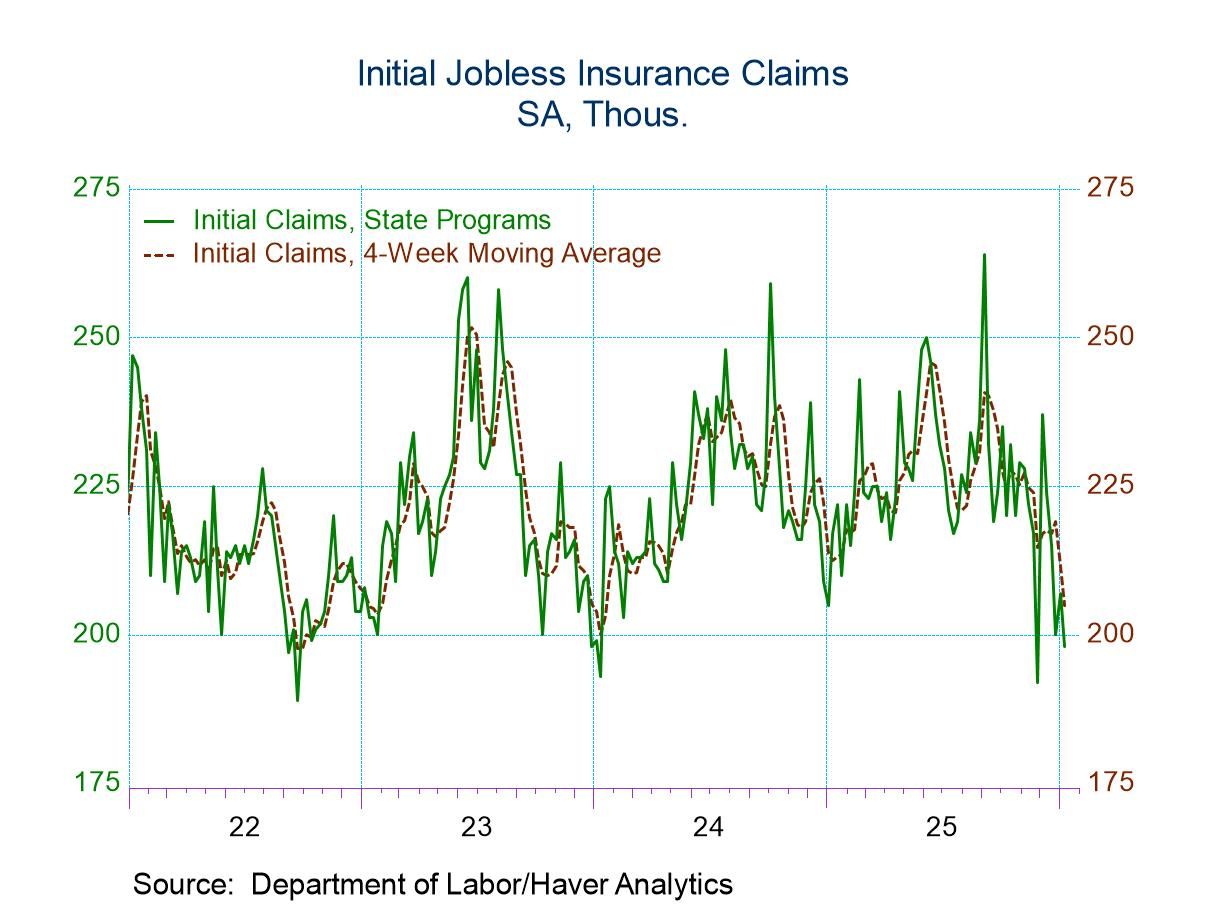

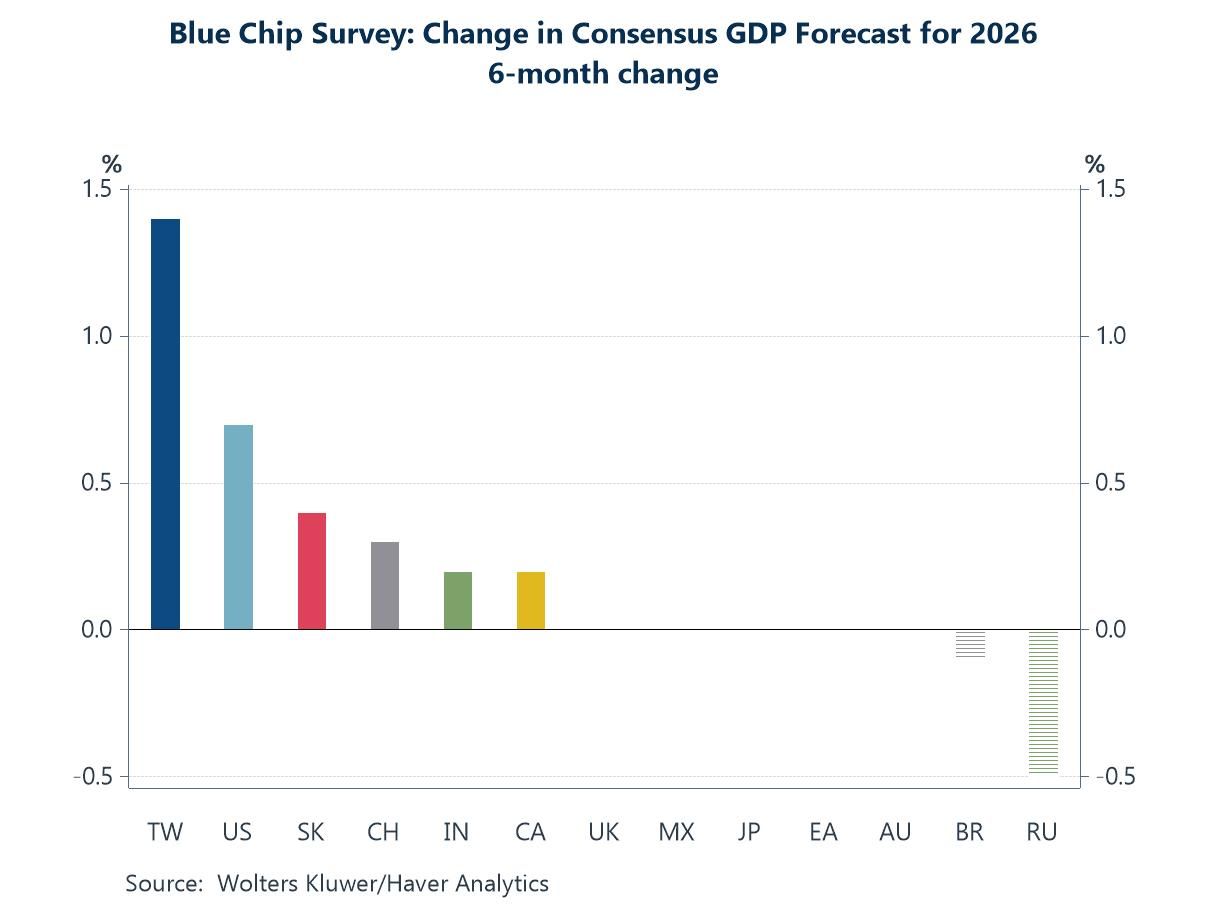

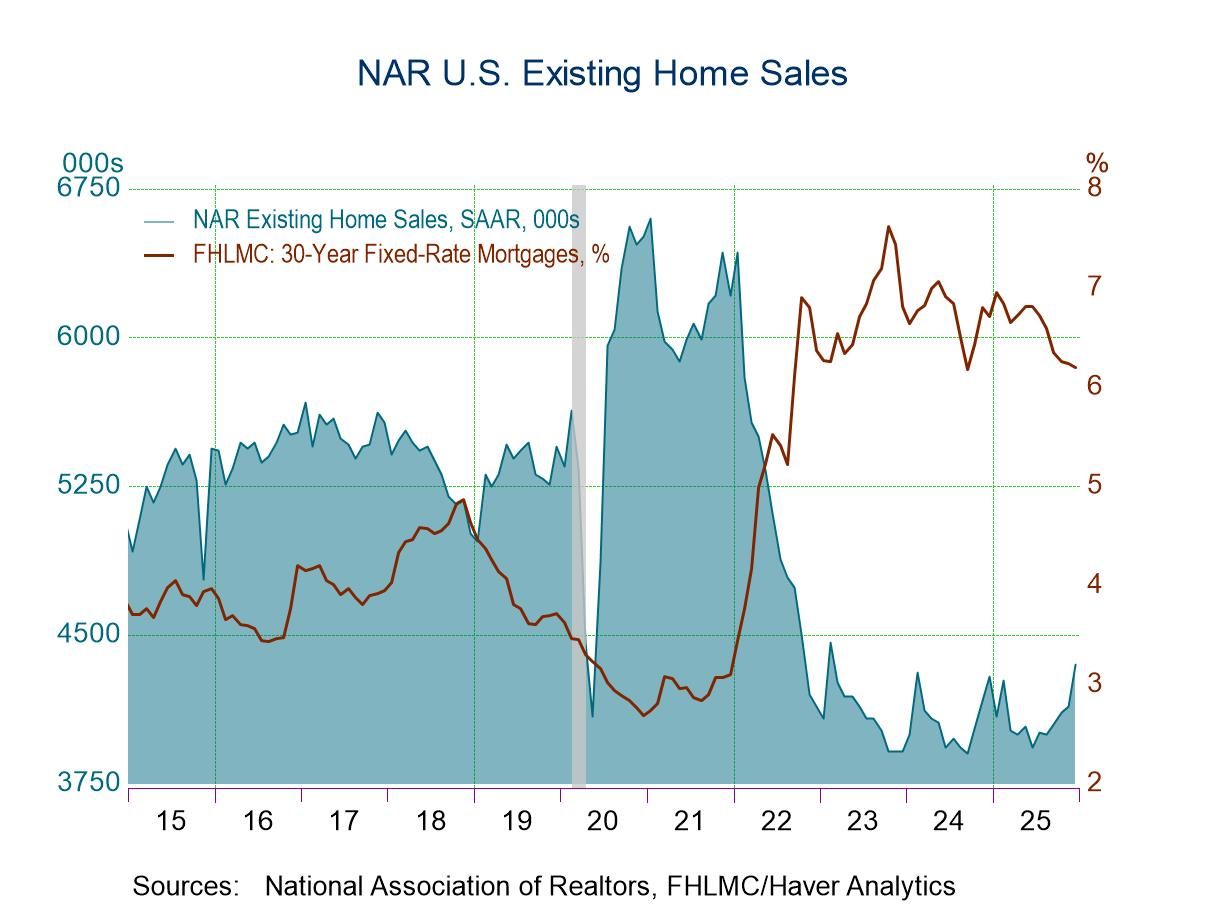

There are still many other non-traditional high frequency data points that continue to paint a bleak picture of the UK economy at present. Footfall at retail establishments, for example, is languishing at only around 40% of normal levels and restaurant table bookings are still down 98% on last year (in stark contrast to many other European countries such as Germany - see second figure). Car usage in the meantime has certainly picked up but rail and buses remain fairly empty (see third figure). Most importantly – as Haldane further acknowledged - the labour market is still mired in uncertainty. Job adverts across all industries remained around half of their 2019 average in the week from 19 June to 26 June. And around 23% of the UK workforce is presently on furlough, with 68% of those receiving wage top-ups from their employer according to the latest Business Impact of Coronavirus Survey (BICS) collected from 15 to 28 June. With government furlough schemes destined to come to an end in October, consumer confidence is clearly hostage to high levels of job insecurity and reduced rates of income formation (see fourth figure). A strong recovery of consumer spending remains an unlikely prospect against that backdrop in the immediate weeks ahead.

Viewpoint commentaries are the opinions of the author and do not reflect the views of Haver Analytics.Andrew Cates

AuthorMore in Author Profile »Andy Cates joined Haver Analytics as a Senior Economist in 2020. Andy has more than 25 years of experience forecasting the global economic outlook and in assessing the implications for policy settings and financial markets. He has held various senior positions in London in a number of Investment Banks including as Head of Developed Markets Economics at Nomura and as Chief Eurozone Economist at RBS. These followed a spell of 21 years as Senior International Economist at UBS, 5 of which were spent in Singapore. Prior to his time in financial services Andy was a UK economist at HM Treasury in London holding positions in the domestic forecasting and macroeconomic modelling units. He has a BA in Economics from the University of York and an MSc in Economics and Econometrics from the University of Southampton.