Global| Apr 05 2011

Global| Apr 05 2011UK: To Raise Or Not To Raise Interest Rate on April 11?

Summary

What will the Bank of England's Monetary Policy Committee do about the official bank rate when it meets on April 11? The rate has been held at 0.5% since March 5, 2009 and inflation concerns are rising. The incoming data continue to [...]

What will the Bank of England's Monetary Policy Committee do about the official bank rate when it meets on April 11? The rate has been held at 0.5% since March 5, 2009 and inflation concerns are rising. The incoming data continue to be mixed. Today there were data releases on the price of oil, the report on conditions in manufacturing and the service industries by the British Chambers of Commerce and the Purchasing Managers Survey of the Services Industry.

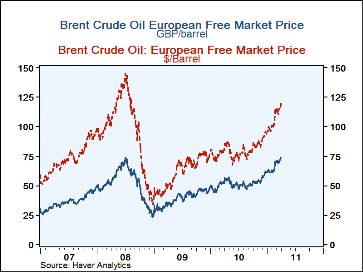

Inflation, as measured by the year to year change in the Consumer Price Index, has been above the Bank's target of 2% for more than a year. In February it reached 4.34% . The very recent rise in the oil price is ominous. Yesterday the price a barrel of Brent Crude European Free Market reached $119.64. In terms of pounds, the price of oil is now higher than it was at the peak of 2008 in contrast to the price in dollar terms as shown in the first chart.

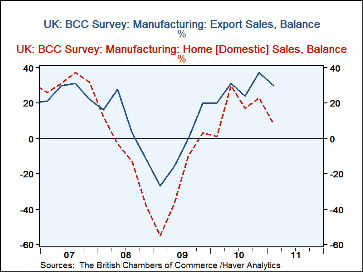

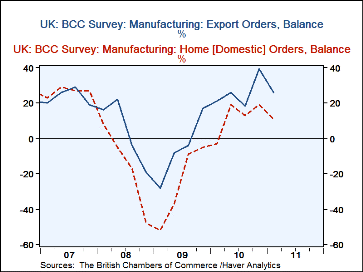

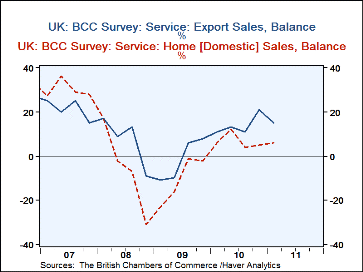

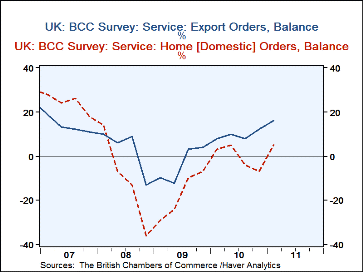

Today, the British Chambers of Commerce released their first quarter report on business trends. The Chambers found that sales and orders in manufacturing, both at home and abroad, fell off in the first quarter. The much more important service industries did better. (In 2009, manufacturing accounted for 9% of GDP while the service industry accounted for 78%) There was a decline in export sales in the service industries but home sales and orders both at home and abroad improved. Nevertheless, the Chambers warned that the recovery is still very fragile and urged the Bank to refrain from raising the interest rate. Charts showing sales and orders at home and abroad in the manufacturing and service industries are attached.

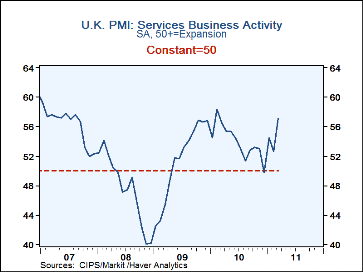

Also released today was the purchasing managers survey of the service industry in the United Kingdom. The diffusion index jumped from 52.60% in February to 57.10% in March. This was well above consensus estimates and solidly in expansion territory, that is, above 50%, as can be seen in the last chart.

These data suggest that pressures for an increase in interest rates are heating up. If a rate rise in April is avoided, it should not be too long before rates begin to increase.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates