Global| May 10 2006

Global| May 10 2006UK Trade Flows Show Strengthening Trend; Deficit Narrows in March

Summary

UK trade flows are strong. In both directions. A quick glance at today's March report would likely draw the most attention to a widening tendency in monthly deficit. The March figure, £3.84 billion, came down from February's £5.38 [...]

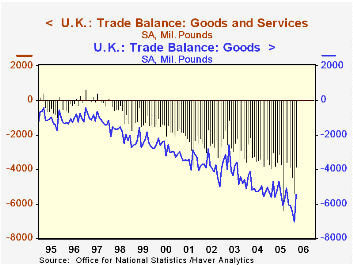

UK trade flows are strong. In both directions. A quick glance at today's March report would likely draw the most attention to a widening tendency in monthly deficit. The March figure, £3.84 billion, came down from February's £5.38 billion, but the general run has been toward larger gaps. See the first chart.

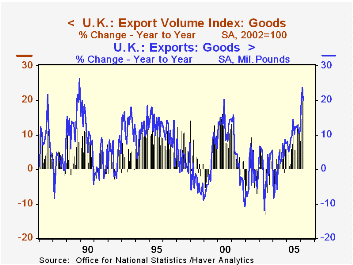

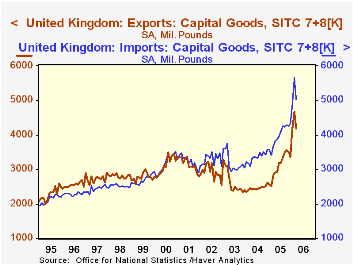

Nonetheless, the growth of exports as well as imports has been impressive. Exports are up13.7% from a year ago, with goods alone up 19.8%. Imports have risen 15.0%, with the goods portion up 18.9%. While some of this is a pick-up in prices, the volume indexes have also shown vigor: exports of goods are up 16.0% and imports, 13.3%.

Oil exports and imports are obviously up in value terms, and the trend may be shifting in the volume of oil exports. These are still below year ago amounts, but the one-month increase for March over February was a whopping 61.3%. Imports are quite erratic month-to-month, but for the first quarter as a whole, the amount of crude oil imported was 4.2% larger than in last year's first quarter. As seen in the table below, the overall "fuel" account recovered a bit in March from its recent unprecedented deficits. The recent high oil prices may be making it more economical for UK producers to raise the volume they pump, and indeed, the volume index for fuel, at 94 (2002=100) is the highest since last March, when it was 101.

Non-oil trade has generally been on an upswing as well, and many countries are increasing their purchases from the UK. The ONS cautions that some of the apparent gains may be due to the results of VAT fraud investigations, but even so, their carefully worded text suggests that much of the gains are genuine. The ONS release is available here.

| UK Trade, SA, Bil.£ | Mar 2006 | Feb 2006 | Jan 2006 | Mar 2005 | Monthly Averages|||

|---|---|---|---|---|---|---|---|

| 2005 | 2004 | 2003 | |||||

| Trade Balance: Goods & Services | -3.84 | -5.38 | -4.45 | -3.04 | -3.91 | -3.25 | -2.58 |

| Exports | 29.29 | 28.81 | 28.68 | 25.76 | 26.33 | 24.49 | 23.52 |

| Imports | 33.12 | 34.20 | 33.13 | 28.80 | 30.23 | 27.74 | 26.10 |

| Goods | -5.46 | -7.05 | -6.14 | -4.72 | -5.47 | -5.04 | -3.99 |

| Fuels | -0.28 | -0.71 | -0.81 | 0.35 | -0.23 | 0.09 | 0.42 |

| Exports | 2.34 | 1.86 | 2.01 | 1.90 | 1.80 | 1.49 | 1.38 |

| Imports | 2.62 | 2.57 | 2.82 | 1.55 | 2.03 | 1.40 | 0.96 |

| Services | 1.62 | 1.66 | 1.96 | 1.68 | 1.56 | 1.79 | 1.41 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates