Global| Feb 14 2007

Global| Feb 14 2007UK Unemployment Steadies; Modest Employment Growth

Summary

Employment in the UK rose 7,000 in the November period, a third successive monthly increase in this 3-month moving average. Over the last three months (the style of comparison that the UK's Office for National Statistics [ONS] [...]

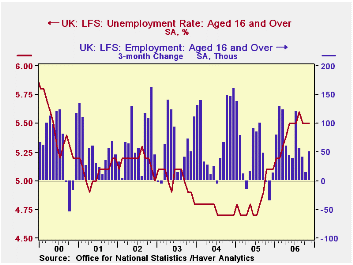

Employment in the UK rose 7,000 in the November period, a third successive monthly increase in this 3-month moving average. Over the last three months (the style of comparison that the UK's Office for National Statistics [ONS] generally emphasizes) employment went up by 50,000. The advances were more than accounted for among part-time workers, who increased 80,000 over three months ago, in contrast to a 30,000 decline in full-time workers.

The unemployment rate has held flat at 5.5% since September, and is 0.1% below its August reading. This resulted from an outright decrease in the number unemployed of 24,000 since August, helped by the increase in employment and also by a smaller gain in the number of people "in economic activity" (what the US calls the "labor force"), 26,000, than in the total population over age 16, 92,000. This cut the ratio of the labor force to the population from 63.7% in the August period to 63.6% in November.

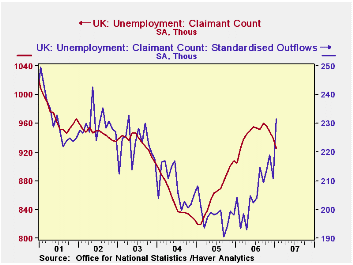

The UK's alternative unemployment measure, the "claimant count", shows more unambiguous improvement, albeit modestly so; the number of claimants (similar to the US measure of the number of people receiving unemployment insurance) fell 9,300 in December and 13,500 in January. The resulting "claimant rate" was 2.9% in January, down from 3.0% for the previous 10 consecutive months. "Inflows" to this group have had a choppy, but trendless pattern in recent months, while the number of "outflows" has increased consistently over almost the past year, suggesting increased hiring of benefit recipients.

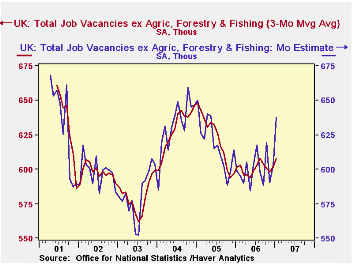

An increase in job vacancies in January hints that the recent hesitant but favorable labor market trend might continue. For January alone, vacancies were 637,700, up almost 35,000 from December. This put them at their highest level since the spring of 2005. The 3-month moving average rose slightly to 607,900, about even with last August and still well below the early-2005 amounts. So signs of improvement remain tentative, but the marginal adjustments in the labor market, new hires and vacancies, show a potential for further advance.

| UK Labor Force Survey & Related Labor Data | Jan 2007 | Dec 2006 | Nov 2006 | Oct 2006 | Year Ago | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|---|

| Employment* (3Mo Avg, SA, Thous) |

-- | -- | 29,036 | 29,029 | 28,758 | 28,960 | 28,730 | 28,465 |

| Chg from 1 & 3 Months Ago | -- | -- | +7/50 | +24/14 | +23 (MoAvg)1% y/y | 0.8% | 0.9% | 1.0% |

| Unemployment Rate* (3Mo Avg, SA, %) |

-- | -- | 5.5% | 5.5% | 5.1% | 5.4% | 4.8% | 4.8% |

| Claimant Count (Monthly, Thous) |

925.8 | 939.3 | 948.6 | 956.5 | 905.1 | 944.1 | 861.8 | 853.5 |

| Vacancies (Monthly, Thous) | 637.7 | 602.8 | 590.7 | 619.1 | 598.8 | 599.4 | 618.6 | 631.9 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.