Global| Jun 29 2005

Global| Jun 29 2005US GDP & Corporate Profit Growth Revised Up

by:Tom Moeller

|in:Economy in Brief

Summary

US real GDP growth in 1Q '05 was revised up further to 3.8% (AR), in line with Consensus expectations. Corporate profit growth (w/IVA & CCA) also was revised up to 6.0% (15.4% y/y) versus the preliminary estimate of a 4.5% increase. [...]

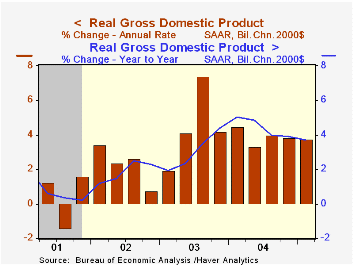

US real GDP growth in 1Q '05 was revised up further to 3.8% (AR), in line with Consensus expectations.

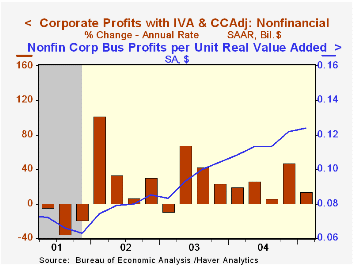

Corporate profit growth (w/IVA & CCA) also was revised up to 6.0% (15.4% y/y) versus the preliminary estimate of a 4.5% increase. Profitability amongst US nonfinancial corporations rose 3.4% (22.6% y/y) instead of declining 0.8% as initially estimated.

The upward revision to profits stemmed from an increase in profit margins which were initially estimated to have declined.

Growth in domestic demand growth also was revised up to 3.5% Growth in business investment was raised slightly to 4.1% (10.9% y/y) and growth in residential building was raised sharply to 11.5% (8.1% y/y). Real PCE growth was left unchanged at 3.6% (3.6% y/y).

The drag on US output growth from a larger foreign trade deficit was little changed as exports grew 8.9% and imports rose 9.6% while the contribution to GDP growth from faster inventory accumulation also was little revised at 0.7%.

The chain price index was revised down to 2.9% growth as the price index for domestic demand was lowered to 2.7% (2.7% y/y).

| Chained 2000$, % AR | 1Q '05 (Final) | 1Q '05 (Prelim.) | 4Q '04 | Y/Y | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|---|

| GDP | 3.8% | 3.5% | 3.8% | 3.7% | 4.4% | 3.0% | 1.9% |

| Inventory Effect | 0.7% | 0.8% | 0.5% | 0.2% | 0.4% | -0.1% | 0.4% |

| Final Sales | 3.0% | 2.7% | 3.4% | 3.5% | 4.0% | 3.1% | 1.4% |

| Foreign Trade Effect | -0.6% | -0.7% | -1.4% | -0.6% | -0.4% | -0.3% | -0.7% |

| Domestic Final Demand | 3.5% | 3.2% | 4.5% | 4.1% | 4.4% | 3.4% | 2.1% |

| Chained GDP Price Index | 2.9% | 3.2% | 2.3% | 2.4% | 2.2% | 1.8% | 1.7% |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.