Global| Apr 01 2020

Global| Apr 01 2020Weather-Driven Drop in U.S. Construction Spending in February

Summary

• Construction spending fell 1.3% higher in February after jumping 2.8% in January. • A return to more somewhat more seasonal weather in February after a very warm January likely played a role. The value of construction put-in-place [...]

• Construction spending fell 1.3% higher in February after jumping 2.8% in January.

• A return to more somewhat more seasonal weather in February after a very warm January likely played a role.

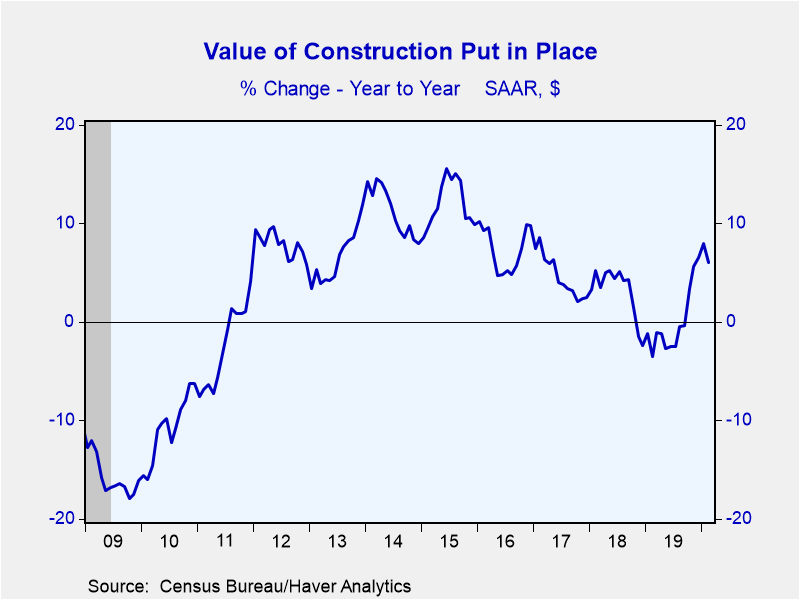

The value of construction put-in-place dropped 1.3% in February (+6.0% year-on-year). Both January and December were revised higher to 2.8% and 0.4% respectively from 1.8% and 0.2%. The Action Economics Forecast Survey expected a 0.6% rise in February. U.S. population-weighted heating was 66 degree-days below normal in February, which is still warmer than normal, but much more seasonable than January's -176 degree day reading. The only warmer January by this measure occurred in 2006.

Based on the revisions to December data, the construction spending portion of fourth quarter GDP is likely to be revised slightly higher. In the fourth quarter GDP report released last week private construction spending (nonresidential + residential) had a negligible impact, adding 0.03 percentage point to GDP growth.

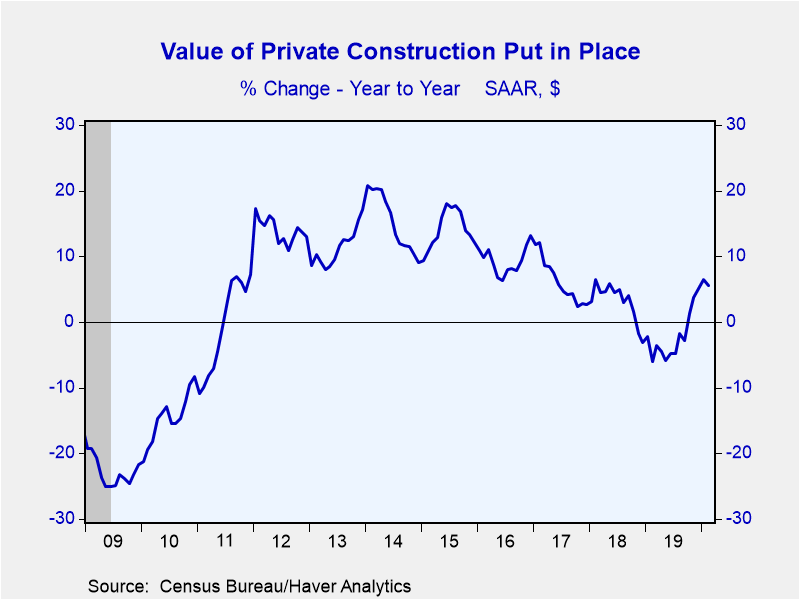

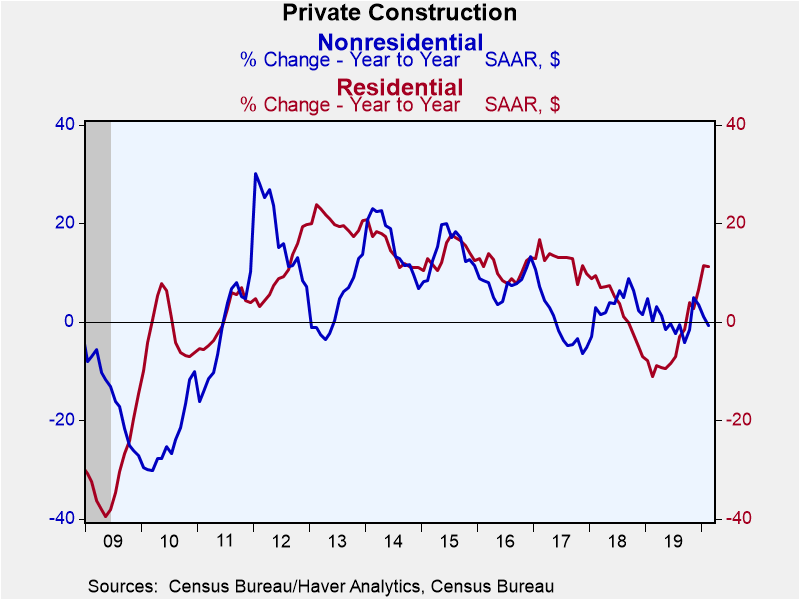

Private construction fell 1.2% (+5.6% y/y) in February while public dropped 1.5% (+7.4% y/y). The declined in private construction was led by a 2.0% contraction in nonresidential construction (-0.7% y/y) with the four largest sectors -- power, commercial, manufacturing, and office all down in February.

Residential construction decreased 0.6% (+11.3% y/y) with gains in single and multi-family (3.9% and 0.1% respectively; 16.1% and -5.7% y/y) offset by a 7.2% drop in home improvement (+10.0% y/y).

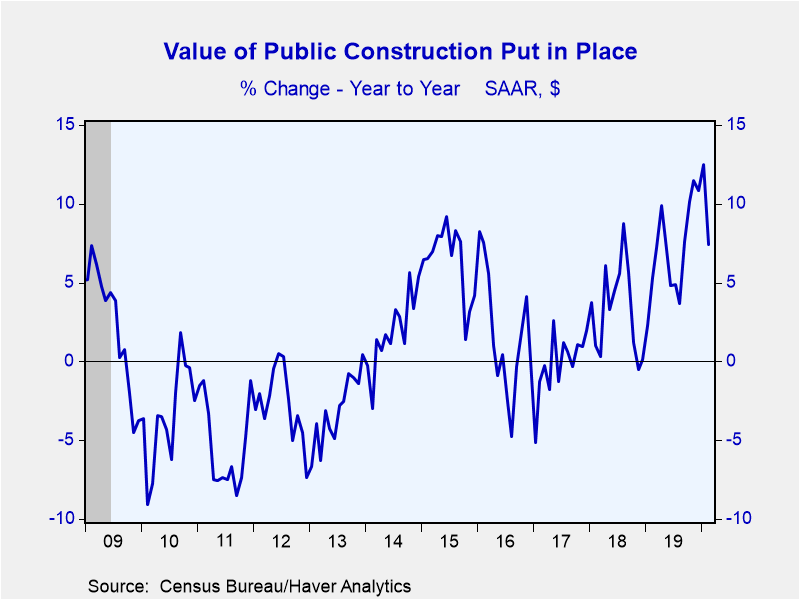

Nonresidential public construction, which makes up 98% of public construction, fell 1.5% in February (+7.2% y/y), with both school spending and road building on the decline.

The construction spending figures, some of which date back to 1946, as well as and US Population-Weighted Heating and Cooling Days can be found in Haver's USECON database. The expectations reading can be found in the AS1REPNA database.

| Construction Put in Place (SA, %) | Feb | Jan | Dec | Feb Y/Y | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Total | -1.3 | 2.8 | 0.4 | 6.0 | -0.3 | 3.3 | 4.5 |

| Private | -1.2 | 2.5 | 0.6 | 5.6 | -2.5 | 3.2 | 6.0 |

| Residential | -0.6 | 3.8 | 2.0 | 11.3 | -4.7 | 2.8 | 12.4 |

| Nonresidential | -2.0 | 1.0 | -1.0 | -0.7 | 0.0 | 3.7 | -0.7 |

| Public | -1.5 | 3.5 | -0.4 | 7.4 | 7.1 | 3.6 | -0.1 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates