Global| Aug 07 2020

Global| Aug 07 2020Wholesale I/S Ratio Returns to More Typical Recessionary Levels in June

Summary

• Wholesale inventory-to-sales ratio falls to 1.38 in June. • Inventories declined 1.4% while sales jumped 8.8%. • Inventory swings can have a meaningful impact on GDP. However, while large, the Q2 inventory contribution was small [...]

• Wholesale inventory-to-sales ratio falls to 1.38 in June.

• Inventories declined 1.4% while sales jumped 8.8%.

• Inventory swings can have a meaningful impact on GDP. However, while large, the Q2 inventory contribution was small relative to the collapse in demand.

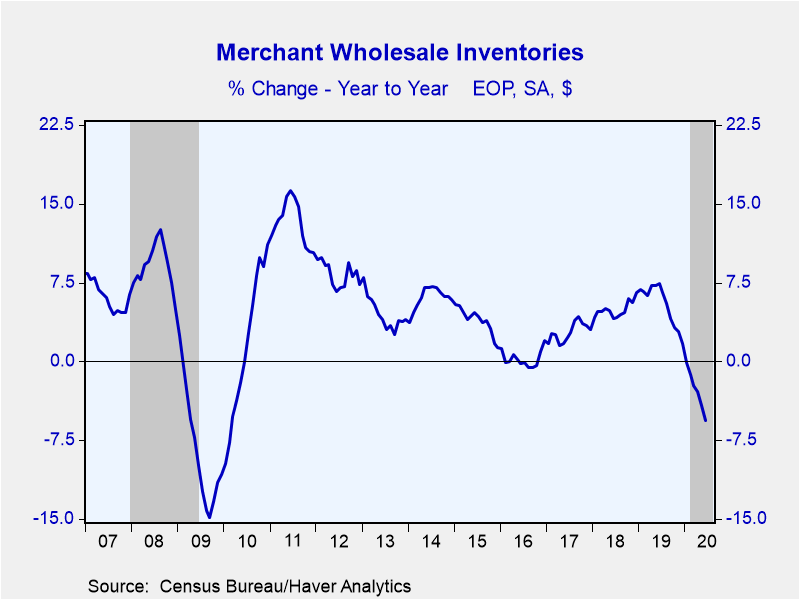

Wholesale inventories decreased a less-than-expected 1.4% in June (-5.6% year-over-year). The Informa Global Markets Survey anticipated a 2.0% contraction. Wholesale inventory swings can have a meaningful impact on GDP. In the latest GDP report, second quarter inventory drawdowns led to a 3.98 percentage point drop in GDP, however, that was small relative to the contributions from the collapse in consumption and investment.

Both durable and nondurable goods declined, -1.7% and 1.0% respectively (-6.9% and -3.5% y/y). Seven of the eight major durable categories were down, with automotive, the largest, falling 2.1% (-12.0% y/y). Drug inventories, which make up over a quarter of nondurable inventories, decreased 2.8% (+4.0% y/y). Groceries, the second largest category, increased 1.7% (3.9% y/y).

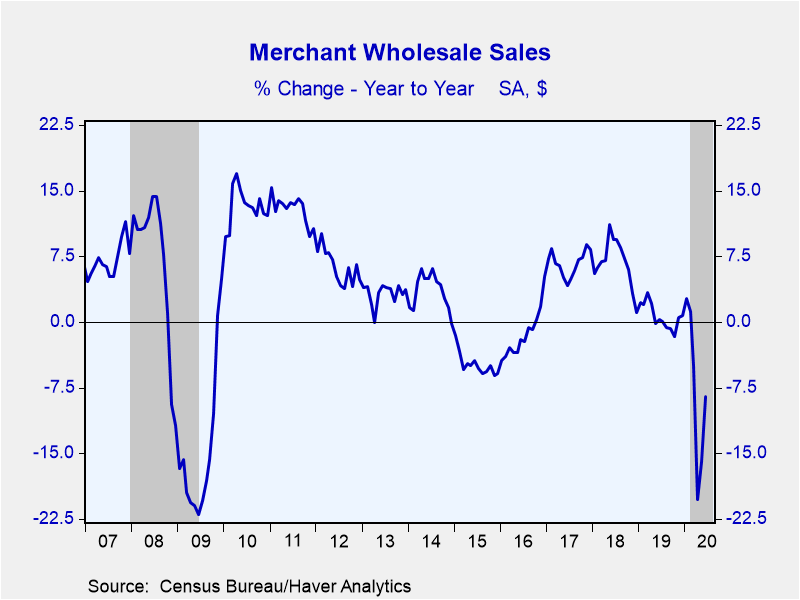

Wholesale sales grew a greater-than-expected 8.8% during June (-8.5% y/y). The Action Economics Forecast Survey anticipated a 4.8% rise. Durable goods sales increased 8.0% (-6.2% y/y) as auto sales jumped 25.5% (-10.8% y/y). Nondurable wholesales gained 9.5% (-10.6%) as petroleum products fired up 25.2% (-42.3% y/y), likely the result of a 39.0% gain in seasonally adjusted increase oil prices (-29.4% y/y).

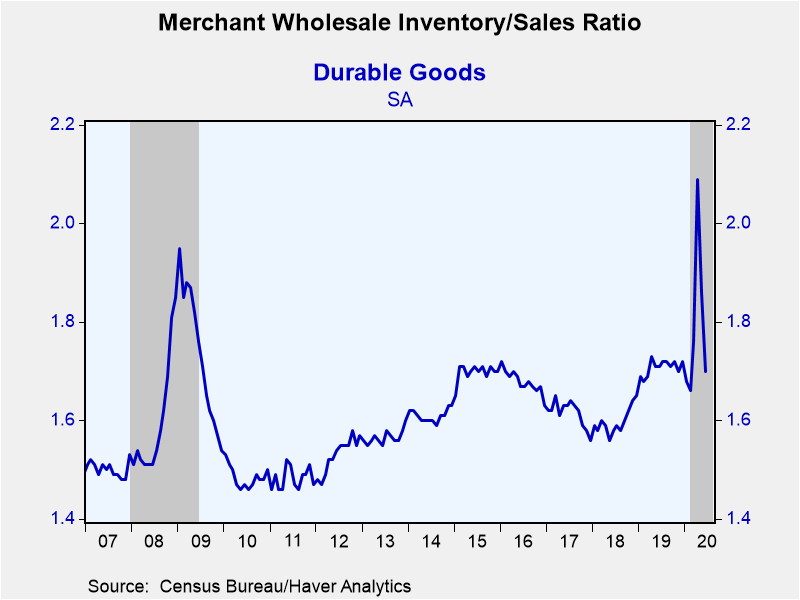

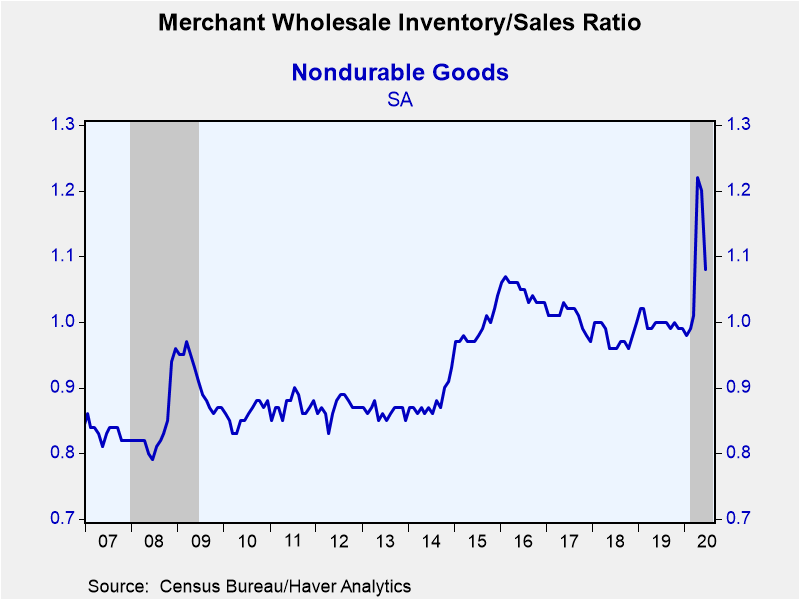

The inventory-to-sales (I/S) ratio at the wholesale level dropped to 1.38 in June from 1.53 in May and a record 1.63 in June (data goes back to 1980). I/S ratios of around 1.40 are not uncommon during recessions. The durable goods ratio fell to 1.70, a level it was hovering around prior to COVID-19. Meanwhile, the nondurable I/S ratio remains extremely elevated, though down meaningfully from April's 1.22 record. The durable and nondurable series go back to 1992.

The wholesale trade figures and oil prices are available in Haver's USECON database. The expectations figure for inventories is contained in the MMSAMER database. Expectations for sales are in the AS1REPNA database.

| Wholesale Sector - NAICS Classification (%) | Jun | May | Apr | Jun Y/Y | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Inventories | -1.4 | -1.2 | 0.2 | -5.6 | 1.7 | 6.5 | 3.0 |

| Sales | 8.8 | 5.7 | -16.4 | -8.5 | 0.6 | 6.8 | 6.7 |

| I/S Ratio | 1.38 | 1.53 | 1.63 | 1.34 (Jun '19) | 1.34 | 1.28 | 1.30 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates