Global| Mar 16 2007

Global| Mar 16 2007World Oil Consumption Reaches Record 87 Million Barrels/Day; Developing Country Share Expands

Summary

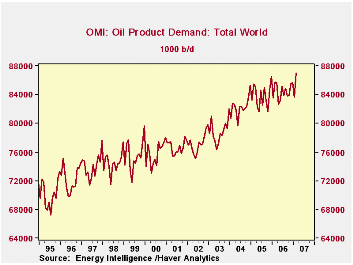

There are 86,400 seconds in a day: 24 hours x 60 minutes x 60 seconds. In February, according to the Oil Market Intelligence publication of industry consulting firm Energy Intelligence, the world consumed 87,069 million barrels of [...]

There are 86,400 seconds in a day: 24 hours x 60 minutes x 60 seconds. In February, according to the Oil Market Intelligence publication of industry consulting firm Energy Intelligence, the world consumed 87,069 million barrels of petroleum products, a new monthly record. That amount equals 1,007 barrels every second. Haver carries the daily average demand information in its OMI database, offered in partnership with Energy Intelligence. The idea for this time calculation is not ours, though. It comes from an investment consultant in the field, Peter Tertzakian, author of a book published last year titled, appropriately enough, "A Thousand Barrels a Second".

February's daily oil consumption for the total world was up 3.4 million barrels from January (4.1%), although February demand is frequently high, and this was just 1.5% above February 2006. A notable part of the increase came in the US, where demand was 21.6 million barrels daily, 5.4% more than a year ago. The US experience is clearly a spike and as with other economic data for the month -- jobs in the construction industry and retail sales, for examples -- was likely related to the swing to unusually cold weather, particularly compared with mild February weather last year.

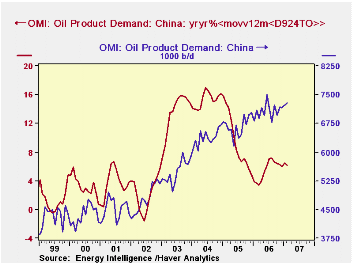

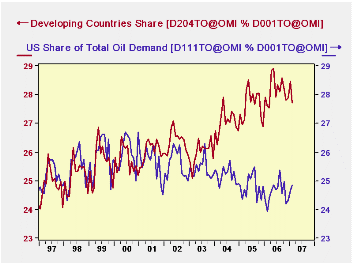

Even with this February rise, the US share of world oil consumption is no higher than it has been running over the last couple of years: just under 25%. These data illustrate well what we've heard more casually elsewhere: the significant growth in oil consumption is coming from developing regions of the world. For instance, in China, the last 12 months' average has been 7.1 million barrels daily, 6.2% ahead of the 12 months ended February 2006.

From the third graph, we can see that the US share of the world total over a longer period, since 2000, has actually declined. In dramatic contrast, the OMI grouping called "developing countries"* has gained share. From 26.4% in 2002, those countries expanded to 28.0% in 2006.

These graphs illustrate some upcoming innovations in Haver's DLXVG3 software. In the Chinese example, we were able to take a percent change in a moving average, utilizing a new "nested function" capability. In the market share graph, we were able to make two separate calculations involving three different series. Elsewhere this past week in several of Robert Brusca's articles, you have seen three or even four series on a single graph. These new features will be available to clients soon and we're very excited about them.

| Daily Average Oil Demand: Thousand Barrels | Feb 2007 | Jan 2007 | Feb 2006 | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|

| Total World | 87,069 | 83,653 | 85,796 | 84,475 | 83,838 | 82,287 |

| Yr/Yr % Change | 1.5 | 0.1 | 0.3 | 0.8 | 1.9 | 4.3 |

| United States | 21,632 | 20,618 | 20,518 | 20,768 | 20,799 | 20,731 |

| China | 7,276 | 7,222 | 7,107 | 7,074 | 6,675 | 6,367 |

| Developing Countries* | 24,135 | 23,804 | 23,675 | 23,760 | 23,160 | 22,251 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.