Global| May 20 2008

Global| May 20 2008ZEW Indicator: Current Conditions In Germany Up, Expectations Down--Current Conditions In Euro Area Down, [...]

Summary

The Center for European Economic Research (ZEW) released today the results of its latest survey of some 300 analysts and institutional investors. While these representatives of the financial community reported an improvement in their [...]

The Center for European Economic Research (ZEW) released today the results of its latest survey of some 300 analysts and institutional investors. While these representatives of the financial community reported an improvement in their appraisal of the current German situation, they down graded slightly their appraisal of its future. In May the percent balance between those who saw an improvement in the current situation and those who saw a worsening was 38.6%, up from 33.2% in April. The percent balance between those who saw a worsening of the outlook and whose who saw an improvement was -41.4%, 0.7 percentage points below the April balance of -40.7%

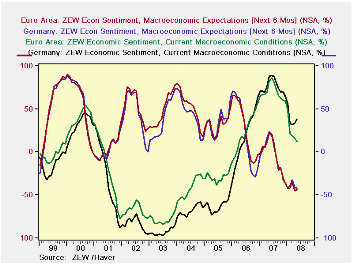

In addition to its survey of the financial community's opinions on Germany, ZEW also surveys their opinions of current conditions and expectations for the future of the Euro Area. The trends in opinions for the Euro Area in May were the opposite of those shown for Germany. In May the percent balance on those seeing an improvement over those seeing a deterioration in current conditions fell from 15.5% in April to 11.4% in May. and the percent balance between those expecting worsening of the outlook over those expecting an improvement decreased by 1.2 percentage points from -44.8 in April to -43.6 in May. The first chart shows the current conditions and expectations for the future for both Germany and the Euro Area. For the most part, there is a close correlation between the opinions for Germany and those for the Euro Area.

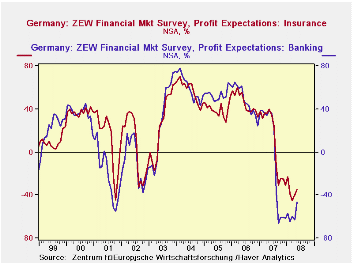

Although still negative, profit expectations in Germany have begun to improve, particularly in those industries that were hardest hit by the fallout from the sub prime crisis in the United States. The second chart shows the profit expectations for the banking and insurance industries.

| ZEW INDICATORS (% BALANCE) | May 08 | Apr 08 | May 07 | M/M Chg | Y/Y Chg | 2007 | 2006 | 2005 |

|---|---|---|---|---|---|---|---|---|

| Germany | ||||||||

| Current Conditions | 38.6 | 33.2 | 88.0 | 5.4 | -49.4 | 75.4 | 18.3 | -61.8 |

| Expectations | -41.4 | -40.7 | 24.0 | -0.7 | -65.4 | -3.0 | 22.3 | 34.8 |

| Euro Area | ||||||||

| Current Conditions | 11.4 | 15.5 | 86.8 | -4.1 | -70.4 | 70.0 | 23.8 | -29.7 |

| Expectations | -43.6 | -44.8 | 22.3 | 1.2 | -65.9 | -3.5 | 26.6 | 32.3 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates