Global| Mar 17 2009

Global| Mar 17 2009ZEW Survey: German Finance Types More Pessimistic On Current Conditions, Less Pessimistic On Expectations

Summary

The German investors and analysts who participated in the ZEW survey conducted between March 2 and March 16, were slightly less pessimistic about expectations six months ahead and slightly more pessimistic about current conditions. [...]

The German investors and analysts who participated in the ZEW

survey conducted between March 2 and March 16, were slightly less

pessimistic about expectations six months ahead and slightly more

pessimistic about current conditions. The excess of pessimists over

optimists regarding the outlook declined from 5.8% in February to 3.5%

in March, while the excess of pessimists regarding current conditions

increased from 86.2% in February to 89.4% in March.

The German investors and analysts who participated in the ZEW

survey conducted between March 2 and March 16, were slightly less

pessimistic about expectations six months ahead and slightly more

pessimistic about current conditions. The excess of pessimists over

optimists regarding the outlook declined from 5.8% in February to 3.5%

in March, while the excess of pessimists regarding current conditions

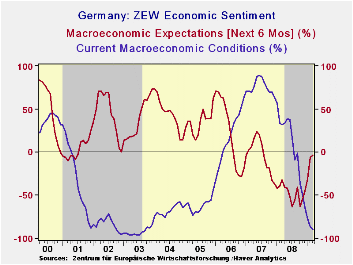

increased from 86.2% in February to 89.4% in March.  The percent

balances on current conditions and expectations are shown in the first

chart.

The percent

balances on current conditions and expectations are shown in the first

chart.

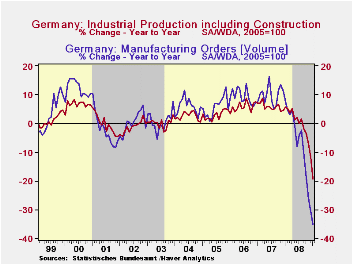

The release of the January data for new orders in

manufacturing and industrial production during the period of the

survey, provided little evidence that current economic conditions were

improving. Industrial production fell 7.5% in the month of January and

new orders were down 8.0%. The year over year declines in new orders

and industrial production, shown in the second chart, are significantly

greater than those of the last recession.

The reduction from 2% to 1.5% in its key interest rate by the European Central Bank on March 5 may have played a role in the slight improvement in the participants expectations of the outlook six months ahead. And the stock market stopped declining. From March 2 to March 16, the Frankfurt Xetra Dax Index rose 9%.

| GERMANY | Mar 09 | Feb 09 | Jan 09 | Dec 08 | Nov 08 | Oct O8 | Sep 08 |

|---|---|---|---|---|---|---|---|

| ZEW SURVEY (% balance) | |||||||

| Current Conditions | -89.4 | -86.2 | -77.1 | -64.5 | -50.4 | -35.9 | -1.0 |

| Expectations 6 months ahead | -3.5 | -5.8 | -31.0 | -45.2 | -53.5 | -63.0 | -41.1 |

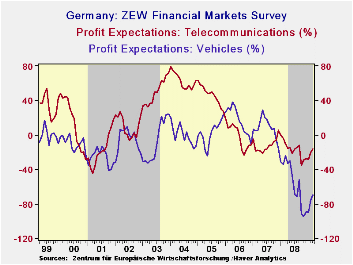

| Profit Expectations Telecommunications | -16.1 | -20.2 | -28.3 | -27.7 | -29.7 | -35.7 | -12.1 |

| Profit Expectations Vehicle/Car | -70.2 | -75.3 | -90.3 | -89.3 | -94.6 | -91.7 | -51.7 |

| Industrial Production (Y/Y %) | N. A. | N. A. | -19.24 | -11.58 | -7.25 | -3.53 | -1.50 |

| New Orders Manufacturing (Y/Y %) | N. A. | N. A. | -35.11 | -30.5 | -26.07 | -18.80 | -9.80 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates