Global| Feb 15 2011

Global| Feb 15 2011ZEW Survey: Germans See Improvement In The Economy But Are Beginning To Worry About Profits

Summary

The February results of the ZEW survey of some 267 analysts and institutional investor in Germany show small improvements in their appraisal of current conditions and their expectations for the next six months. Their expectations for [...]

The February results of the ZEW survey of some 267 analysts and institutional investor in Germany show small improvements in their appraisal of current conditions and their expectations for the next six months. Their expectations for profits over the next six months, however, have weakened.

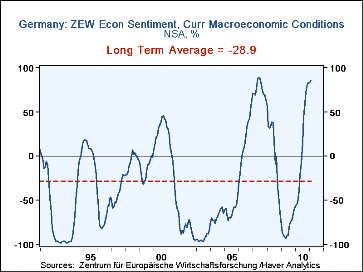

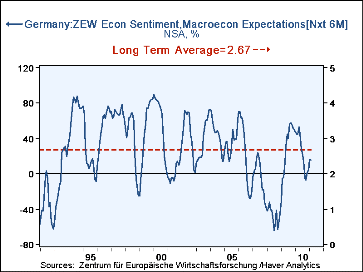

The excess of German institutional investors and analysts who expect economic conditions to improve over the next six months over those who expect economic conditions to deteriorate rose only 0.3 points in February to 15.7% from 15.4% in January. Although encouraging, this is 29.4 percentage points below February of a year ago and 15 percentage points below the long term average of 26.7%. The first chart shows the history of the Economic Expectations data from December 1991 to date and its long term average.

The financial community's appraisal of current conditions rose slightly more. The excess of those who believe current conditions are good versus those who believe they are bad rose 2.4 points to 85.2% in February from 82.8% in January. This is a dramatic improvement of 140 points from the year ago figure of -54.8% and is well above the long term average of -28.9%. The second chart show the history of the Current Economic data from December 1991 to date and its long term average.

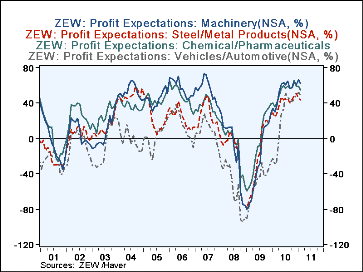

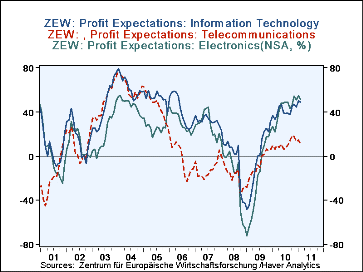

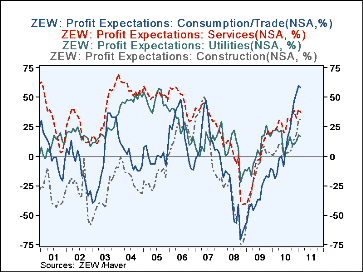

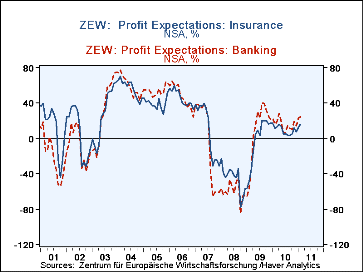

Except for the Banking and Insurance Industries, profit expectations in every other industry were lower in February than in January. However, profit expectations in most industries were well above the year ago figures. Only the expectations for profits in the Utility Industry were lower in February 2011 than they were in February 2010. Attached are three charts where profit expectations have declined in February and one where profit expectations have improved. Data on profit expectations in January and February of this year and February of last year are shown in the following table.

| ZEW SURVEY (% Balance) | Feb 11 | Jan 11 | Feb 10 | M/M Chg | Y/Y Chg |

|---|---|---|---|---|---|

| Economic Expectations 6 Months Ahead | 15.7 | 15.4 | 45.1 | 0.3 | -29.4 |

| Current Economic Conditions | 85.2 | 82.8 | -54.8 | 2.4 | 140.0 |

| Profit Expectations | |||||

| Vehicles/Automotive | 49.6 | 31.9 | -29.7 | -2.9 | 79.3 |

| Chemical/Pharmaceutical | 54.6 | 59.0 | 35.8 | -4.4 | 18.8 |

| Steel/Metal | 43.2 | 45.7 | 23.8 | -2.5 | 19.4 |

| Machinery | 62.0 | 66.1 | 29.6 | -4.1 | 32.4 |

| Information Technology | 48.8 | 50.4 | 33.5 | -1.6 | 15.3 |

| Telecommunications | 10.8 | 14.3 | 13.6 | -3.5 | 4.4 |

| Electronics | 51.7 | 54.8 | 22.0 | -3.1 | 29.7 |

| Consumption/Trade | 57.9 | 59.9 | -18.9 | -2.0 | 76.8 |

| Services | 37.5 | 39.8 | 22.1 | -2.3 | 15.4 |

| Utilities | 16.5 | 17.8 | 21.4 | -1.2 | -4.9 |

| Construction | 31.0 | 31.3 | 4.2 | -0.3 | 26.8 |

| Banking | 23.9 | 23.6 | 15.8 | 0.3 | 8.1 |

| Insurance | 15.9 | 12.7 | 11.0 | 3.2 | 4.9 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates