Global| Aug 22 2024

Global| Aug 22 2024Charts of the Week: Growth Alert

by:Andrew Cates

|in:Economy in Brief

Summary

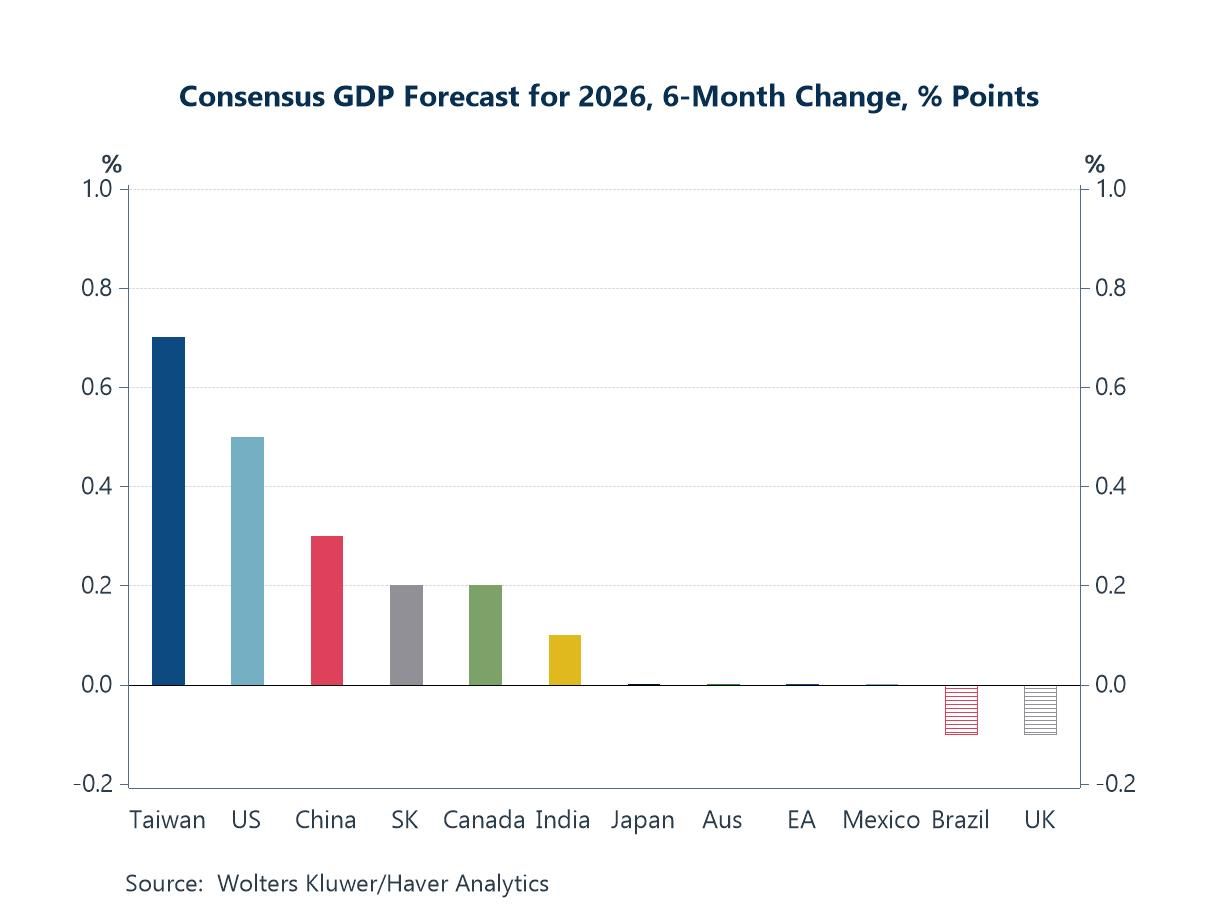

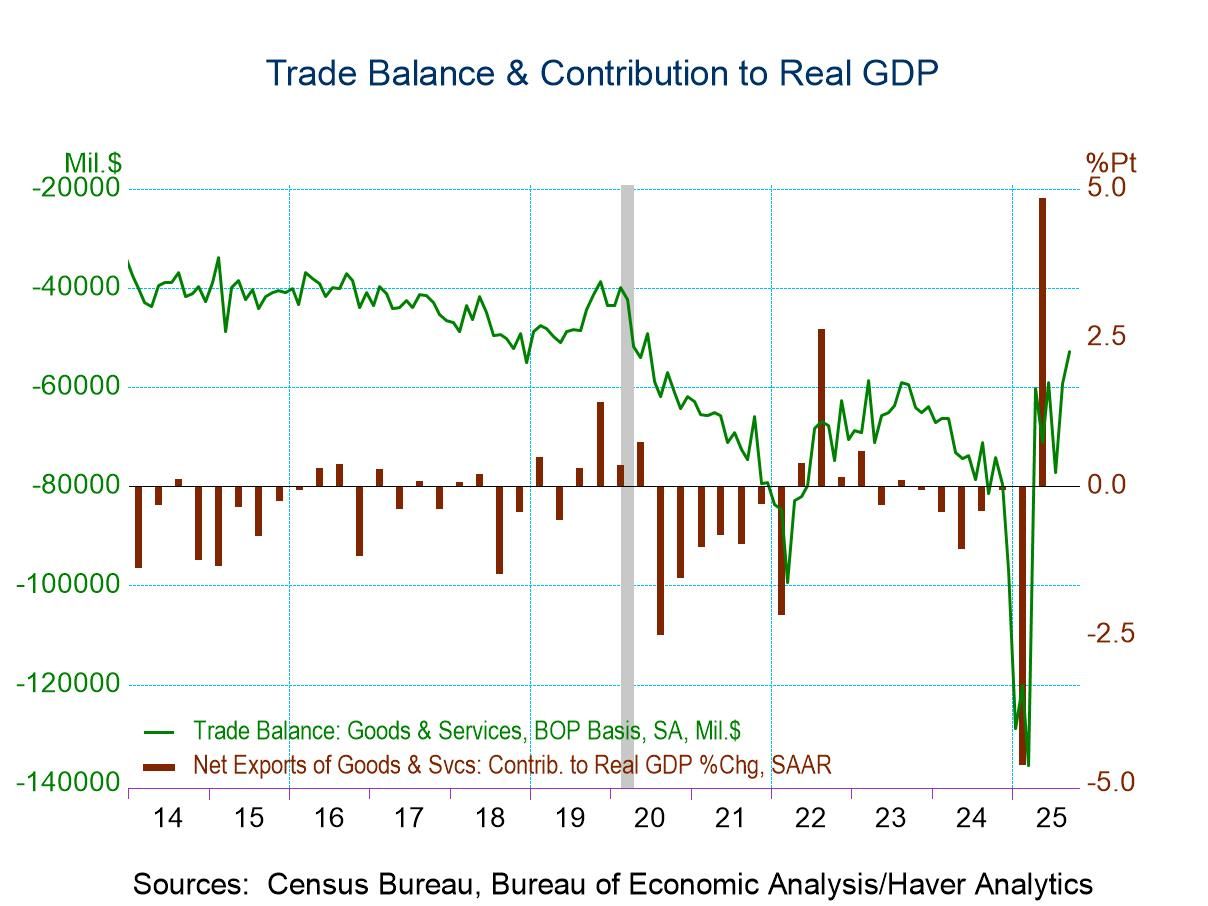

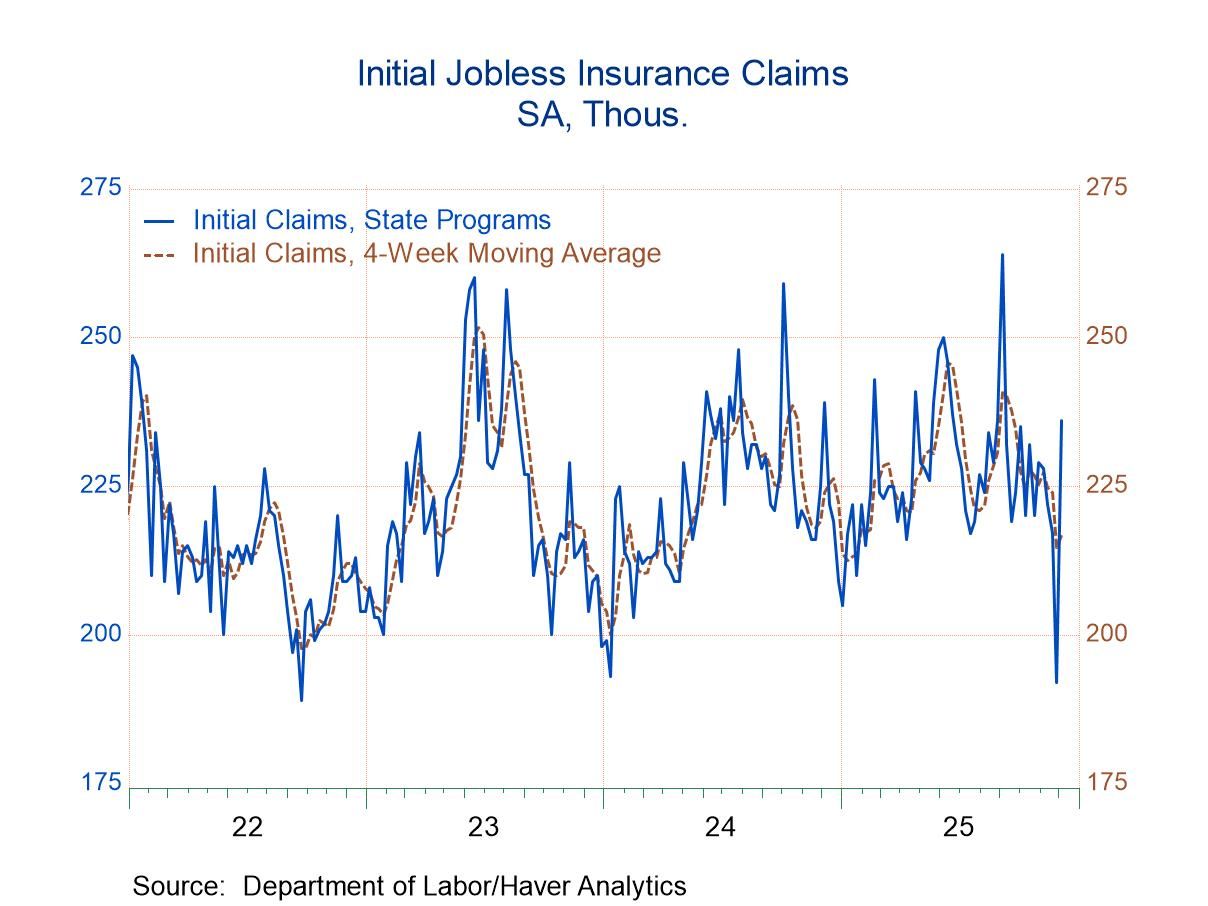

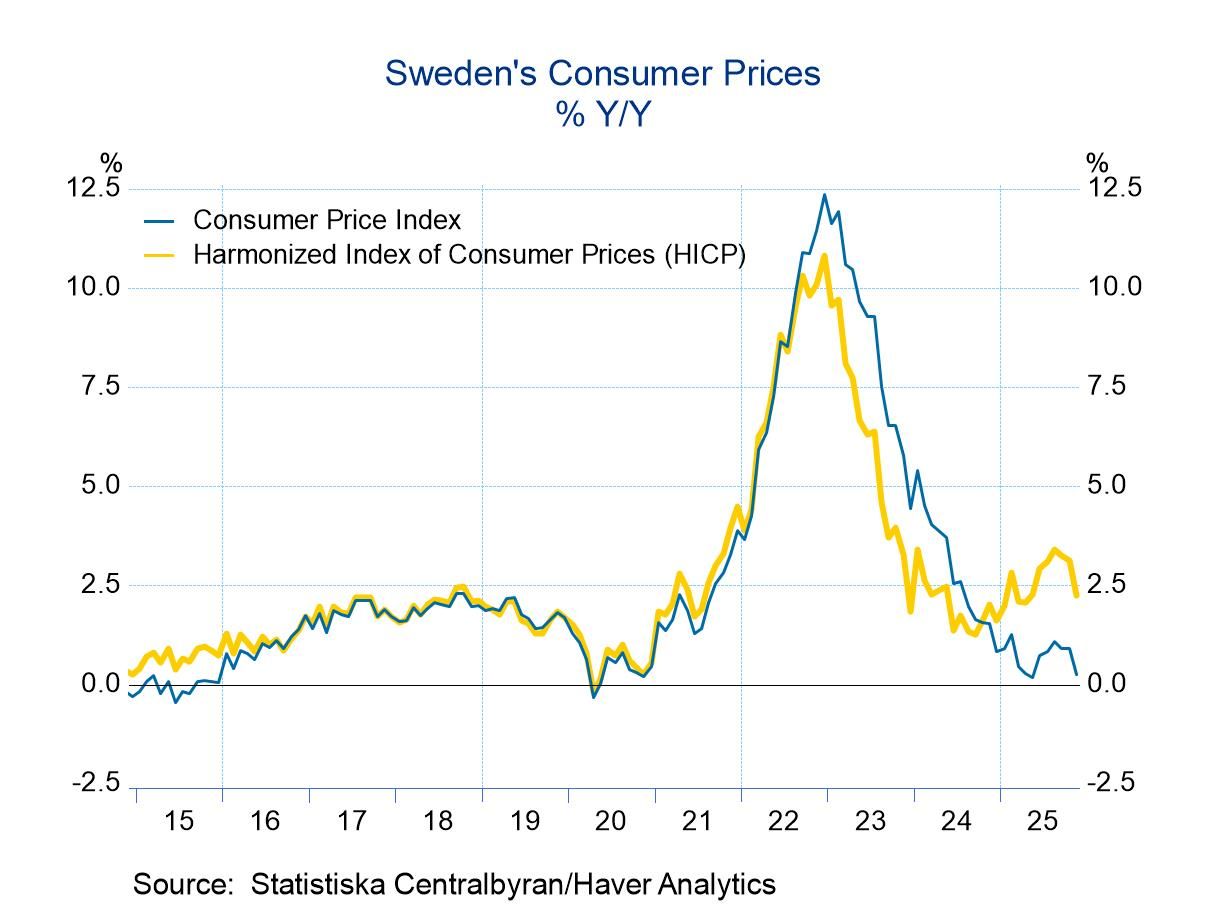

We will not be publishing ‘Charts of the Week’ and our accompanying podcast next week. Financial markets have remained in much calmer waters in recent weeks following the bout of volatility that earmarked the first week of August. That’s partly thanks to the release of some reassuring inflation data together with some dovish signals from several central banks. However, concerns about the global growth outlook persist. That’s partly because incoming growth data have continued to surprise forecasters on the downside (charts 1, 2 and 3). Lingering uncertainty about how a further unwinding of Japan’s carry trade might amplify financial instability in the period ahead could also be weighing on confidence (chart 4). In the meantime, while incoming inflation data have offered some reassurance that monetary policy will be loosened in the US and Europe in the coming months, still-sticky service sector inflation is generating some doubt about the scope and the scale (chart 5). Finally, and looking beyond these cyclical issues, there remain several structurally-rooted headwinds that could be knocking growth optimism off course, including ageing demographics (chart 6).

Copper prices and global growth Incoming data for global growth have been frequently missing forecasters’ expectations on the downside over the past few weeks. That’s why Citigroup’s global growth surprise index has lately declined to a near 3 year low (chart 1). Copper prices - often regarded as a good barometer of global growth conditions - have also lost some ground over the past couple of months notwithstanding some solid structural underpinning (e.g. from the global energy transition).

Chart 1: Citigroup global growth surprise index versus

Oil prices and interest rates Weaker-than-expected global demand may offer one explanation for why oil prices have also been softening over the past few weeks. But inasmuch as this has eased inflation fears and might leave more scope for looser monetary policy, this may have helped to drive US bond yields to lower levels as well (chart 2).

Chart 2: Oil prices versus US 10-year Treasury yields

China’s property market One of the more well-known pockets of global economic fragility concerns China’s property market. Last week’s data certainly suggested that a decline in house prices has continued unabated. Our nominal GDP-weighted index for China’s largest 70 cities, for example, revealed a 4.7% y/y drop in new property prices in July, and an 8.5% decrease in existing prices. This ongoing decline has persisted despite efforts by authorities to boost demand and address a supply glut.

Chart 3: China: property price inflation

Japan’s financial flows and the carry trade As noted, financial market conditions have stabilized in recent weeks in part because the unwinding of Japan’s carry trade – a key factor that had amplified the instability in early August - has subsided. Early August data specifically show that Japanese residents' net purchases of foreign assets has picked up, while non-residents' net sales of Japanese assets have declined. Although these flows are not directly tied to carry trade activity, they provide insights into investor sentiment regarding the yen’s underlying funding costs and the impact of changes in interest differentials.

Chart 4: Japan’s portfolio inflows versus the yen

The UK housing market and the BoE One of the key obstacles that has been hampering efforts to ease monetary policy in recent months is sticky service sector inflation. This has not been helped, at least in the UK, by the big feedback loops that exist between high levels of rental price inflation in the housing market, the wage demands of homeowners, landlords and tenants, and interest rates (chart 5). Still, with the Bank of England having reduced its policy rate in August and potentially now embarking on an easing cycle in the coming months, that vicious cycle between interest rates, wage inflation and services inflation could now move into reverse.

Chart 5: UK: Rental price inflation versus 2-year government bond yields

Demographic change Our final chart below this week illustrates the interplay between demographic factors such as the projected median age in 2025 and population growth (in the 10 years to 2025). The implications of these trends are arguably profound, affecting everything from economic growth and labour markets to social security systems and healthcare. Countries such as Japan and Italy, located at the far right of the chart, will likely experience significant demographic challenges, with ageing populations and shrinking workforces. But on the other end of the scale, Nigeria stands out with a very low median age and extremely high projected population growth. This underscores the demographic dividend that Nigeria ought to benefit from if it can effectively harness this demographic potential.

Chart 6: Projected population growth versus the median age in 2025 in selected economies

Andrew Cates

AuthorMore in Author Profile »Andy Cates joined Haver Analytics as a Senior Economist in 2020. Andy has more than 25 years of experience forecasting the global economic outlook and in assessing the implications for policy settings and financial markets. He has held various senior positions in London in a number of Investment Banks including as Head of Developed Markets Economics at Nomura and as Chief Eurozone Economist at RBS. These followed a spell of 21 years as Senior International Economist at UBS, 5 of which were spent in Singapore. Prior to his time in financial services Andy was a UK economist at HM Treasury in London holding positions in the domestic forecasting and macroeconomic modelling units. He has a BA in Economics from the University of York and an MSc in Economics and Econometrics from the University of Southampton.