Global| Nov 07 2024

Global| Nov 07 2024Charts of the Week: Uncertainty Is the Easy Part

by:Andrew Cates

|in:Economy in Brief

Summary

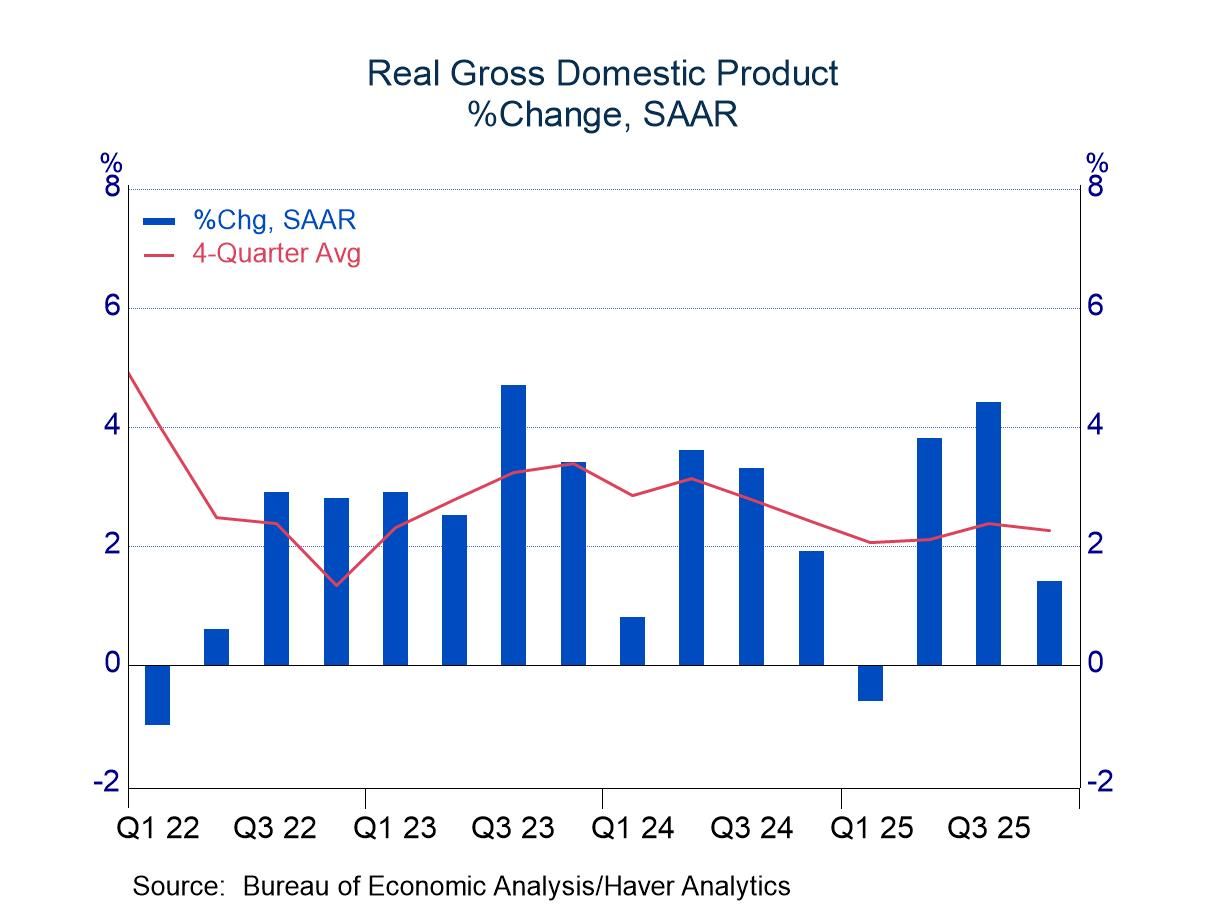

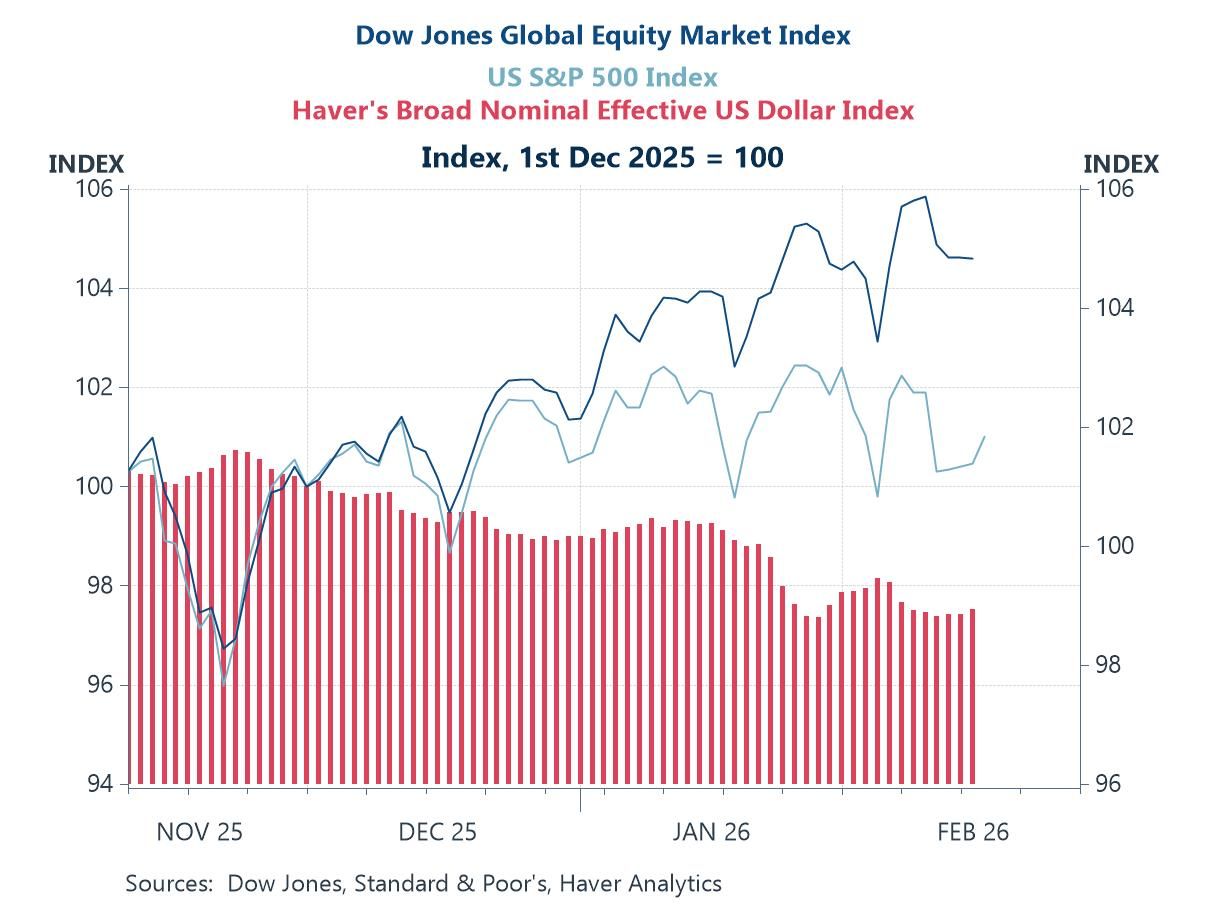

The policy decisions of a new US administration could potentially impact the global economy in a number of ways. Key areas that might be affected include trade and tariffs, geopolitical stability, fiscal policy (US tax cuts), deregulation, and immigration policy. And possibly in anticipation of some economic instability, sentiment toward global equity markets (excluding the US) has soured over the past few weeks (see chart 1). Gauges of global policy uncertainty, in the meantime, have remained relatively high (see chart 2). There remains a strong consensus, nevertheless, that most major central banks will continue to loosen monetary policy over the next 12 months (chart 3). That consensus view, however, might be challenged if prospective US policy decisions prove to be more inflationary (chart 4). One economy that will of course be an immediate area of focus will be China (chart 5). Japan is also in the spotlight at present though that’s more because of some uncertainty surrounding its domestic politics and prospective policy choices in the period ahead (chart 6).

Global equity markets The resilience of its economy in recent months and the dominance of its technology sector in particular have been key to the outperformance of the US equity market so far this year. The degree to which sentiment toward broader global equity markets has soured over the past few weeks compared with sentiment toward the US has, nevertheless, been striking (see chart 1). Uncertainty about the potential policy choices of a new US administration is likely a key factor behind this shift.

Chart 1: Global Equity Market Performance

Global uncertainty This message from equity markets chimes too with gauges of economic policy uncertainty. As chart 2 below suggests, this gauge has remained relatively low over the past few months in the US compared with the norms of the past 10 years. A gauge of global policy uncertainty, in contrast, has remained relatively high.

Chart 2: The global and US economic policy uncertainty index

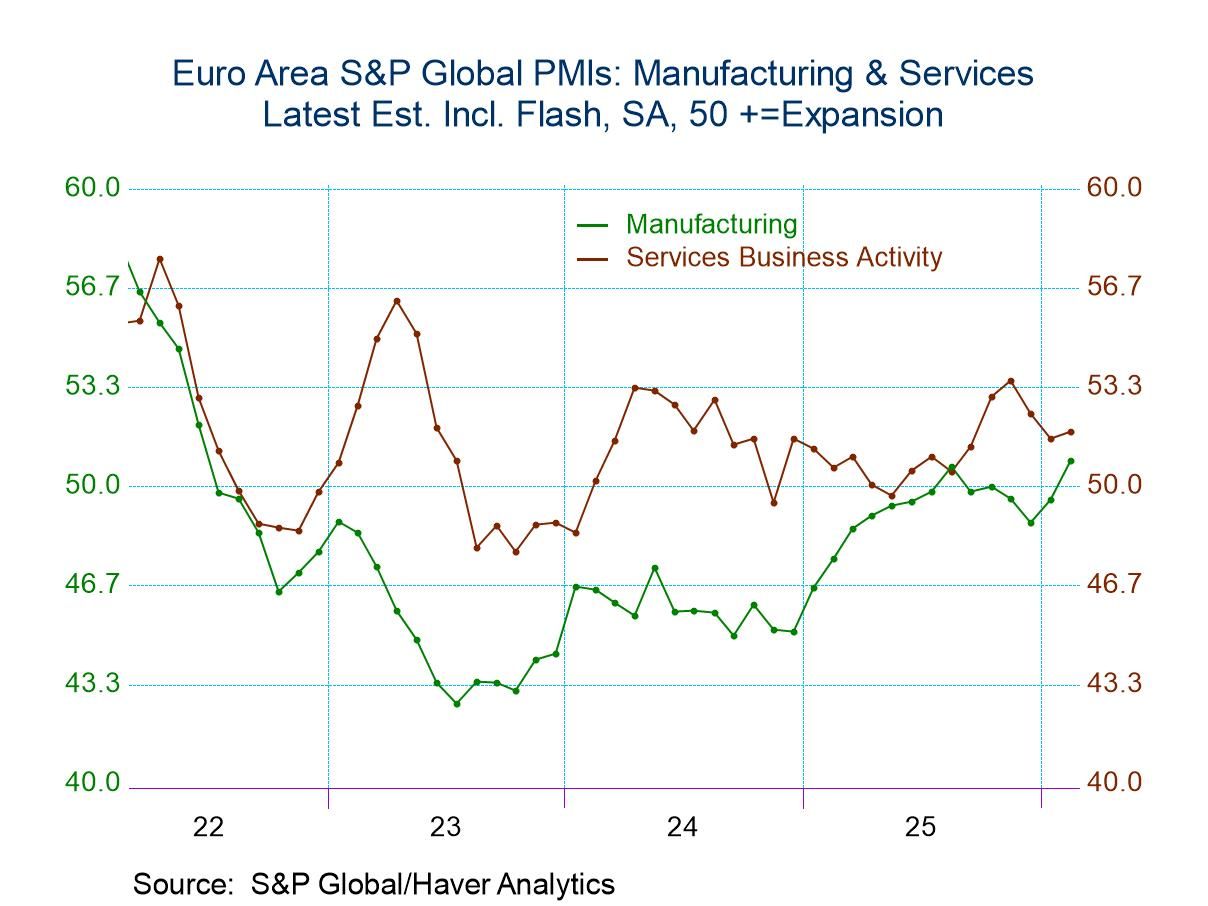

The consensus view on monetary policy Against that backdrop there remains a firm consensus nevertheless that monetary policy in most major economies will continue to be loosened over the next 12 months. The ECB, for example, is expected to lower its key policy rates by 106 basis points over the next 12 months with a next cut in the cycle universally expected in December. Meanwhile, the BoE is expected to lower its Bank rate by 133 bps over the same time frame, with a clear majority having expected a 25bps cut on November 7th. These forecasts contrast with the US where the fed funds rate is expected to be lowered by 132 basis point between now and this time next year.

Chart 3: Blue Chip Financial Forecasts: Expected changes in policy rates over the next 12 months

Oil and yields Those aforementioned interest rate forecasts are subject to some upside risks if forthcoming policy shifts turn out to be more inflationary. One area to watch will be the energy sector and oil prices in particular. Oil prices have remained relatively low in recent weeks even though market-based gauges of US inflation expectations have shifted higher. A previously tight correlation between oil prices and US Treasury yields has broken down as a result.

Chart 4: Oil prices and US 10-year Treasury yields

China’s economy Another focal point in the weeks ahead will be the Asian region and China in particular. The latter’s fortunes have, however, improved a little recently, thanks in part to a series of easing measures by the authorities. This is reflected in chart 5 below, which shows stronger composite PMI readings for October, based on both official and private sector indicators. Additionally, recent data surprises—captured by Citigroup’s economic surprise index—suggest positive momentum. Despite this, the Chinese economy may not be out of the woods just yet, not least if this week’s election news signals renewed tensions between China and the US.

Chart 5: China’s Purchasing Managers’ Index versus Citigroup’s China surprise index

Japan’s politics Japan’s politics has also been grabbing headlines in recent days as the country is now set to elect a new Prime Minister on November 11th. That has led markets to scale back their expectations for further policy easing by the Bank of Japan in the near term. As it stands, market-implied probabilities indicate reduced expectations for a Bank of Japan rate hike in December, with the timing now pushed to January. Furthermore, the result of the US election has also generated a ripple effect across Asia’s financial markets, with the yen, along with several other Asian currencies, having weakened against the US dollar.

Chart 6: Japan: The USD/JPY exchange rate versus 2 month swap spreads

Andrew Cates

AuthorMore in Author Profile »Andy Cates joined Haver Analytics as a Senior Economist in 2020. Andy has more than 25 years of experience forecasting the global economic outlook and in assessing the implications for policy settings and financial markets. He has held various senior positions in London in a number of Investment Banks including as Head of Developed Markets Economics at Nomura and as Chief Eurozone Economist at RBS. These followed a spell of 21 years as Senior International Economist at UBS, 5 of which were spent in Singapore. Prior to his time in financial services Andy was a UK economist at HM Treasury in London holding positions in the domestic forecasting and macroeconomic modelling units. He has a BA in Economics from the University of York and an MSc in Economics and Econometrics from the University of Southampton.