German Orders Stir in June But Are Still Quite Weak

Real German industrial orders rose 3.9% in June after falling 1.7% in May and 0.6% in April. The sharp rise in June has driven the three-month growth rate into positive territory to 6.4% at an annual rate. Orders in June were largely driven by domestic orders that rose by 9.1% in June after rising 0.4% in May and being flat in April. Foreign orders rose by 0.4% after falling 3% in May and 1% in April. June was a good month for German orders especially for domestic orders; however, the trend for German orders is still poor (see the year-on-year growth data-plot chart).

Sequential trends Sequential growth rates show that 12-month growth for real orders is -11.7%, over six months the annualized growth rate is -20.9%, and over three months that trend reverses to plus 6.4% at an annual rate. Foreign orders fall by 15.5% over 12 months, they drop at a 28.3% annual rate over six months, and that pace of decline is reduced to -14% at an annual rate over three months. Domestic orders fall 6.1% over 12 months, they drop at an annual rate of 9.4% over six months and then rebound strongly, growing at a 44% annual rate over three months. The progression of German orders is largely negative until the last 3 months when the negative paces reverses quite sharply in the case of domestic orders and in the case of foreign orders the pace of decline is simply diminished.

Manufacturing Overall manufacturing sales fell 0.9% in June after falling 0.3% in May and 1% in April. For manufacturing, there's a sequential decline that is getting progressively worse from -5.1% over 12 months to -6.2% at an annual rate over six months to -8.7% at an annual rate over three months.

Sector sales Sector results show consumer goods sales in June fell by 3.7%, consumer nondurables sales fell by 5.1% with durables sales rising by 4%. Capital goods sales fell by 1.7% and intermediate goods sales rose by 0.7%. That's rather a hodgepodge of pluses and minuses. However, taking a longer string of data, consumer goods sales are progressively contracting from a -4.9% decline over 12 months to a -6% rate of decline over six months to -12.7% rate of decline over three months. That progression is driven by nondurable goods that get sequentially worse, while consumer durable goods sales show the opposite trend, progressive acceleration from -6.4% over 12 months to a +5.3% pace of expansion over six months to a +13.3% pace of expansion over three months. Capital goods sales do not give us a clean reading on trend; sales are negative over 12 months; the negative growth rate worsens over six months but then it's trimmed back over three months. However, capital goods do show negative growth rates over each horizon. Intermediate goods are also confusing hodgepodge of growth rates with -4.5% growth over 12 months, 0.2% positive growth over six months and then -9.3% growth at an annual rate over three months.

Quarter-to-date The quarter-to-date calculations show that overall orders are falling in the recently completed second quarter by 5.3% at an annual rate, but this is the result of a nearly 12% annual rate decline in foreign orders tempered by an increase in domestic orders of about 5%. Across sectors, we find declines in the quarter for all sectors except for consumer durable goods but they post a significant growth rate of +8.9% at an annual rate in the quarter.

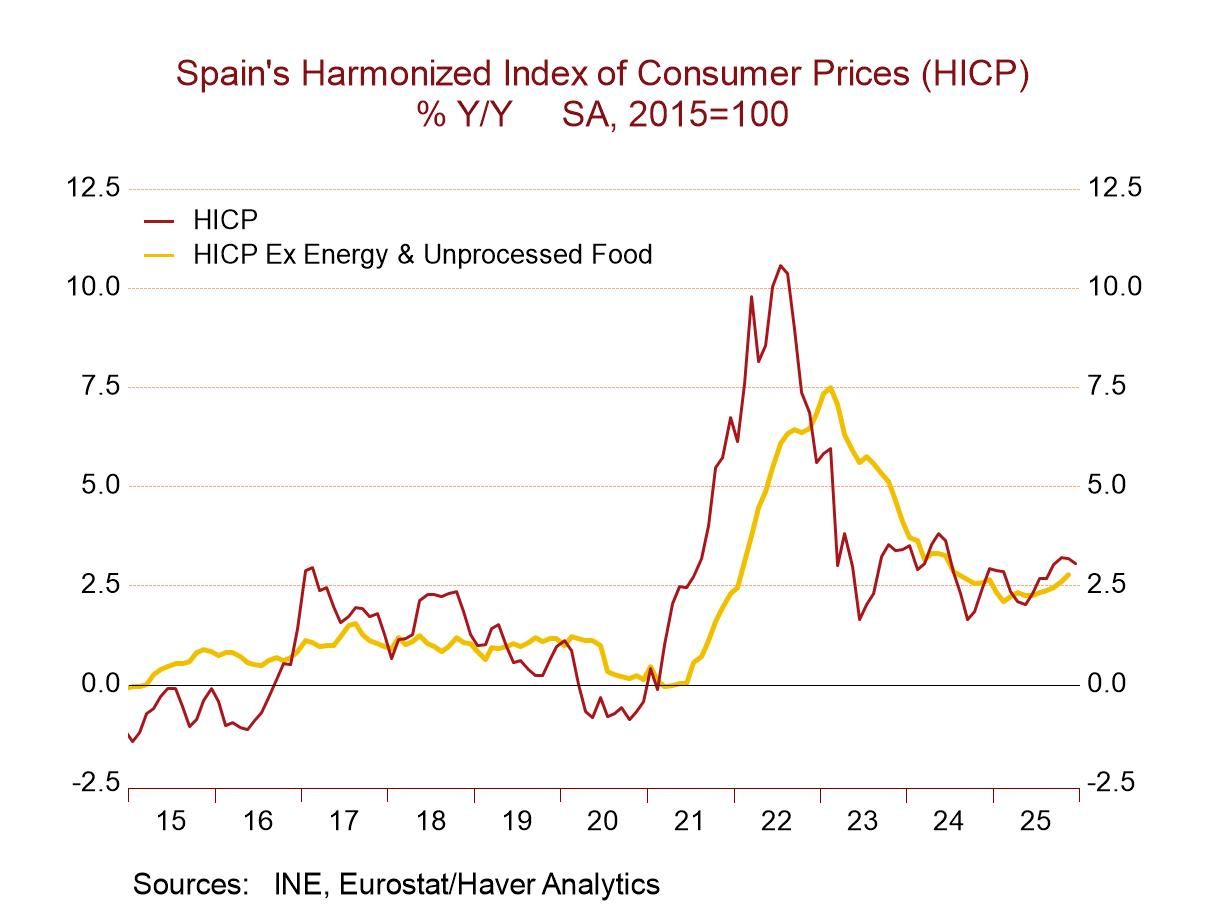

Industrial Europe Measures of industrial confidence for Germany and the three other largest economies in the European Monetary Union also give us a mixed picture; in the current month all three of them score a negative values for industrial confidence. However, over the last three months there's very little trend involved for either Germany, France, Italy, or Spain; they're all pretty much hugging a consistent negative growth rate on the period. And the same is true when we look for sequential growth rate patterns from 12-months to 6-months to 3-months. All four of these countries continue to present pretty much the same values without any clear trends over the period. Additionally, we create queue standings for these four countries and find that they are all in June below their mean values on data since 1990. The weakest standing is for Germany with a 16-percentile standing. The strongest is for Spain with a 42-percentile spending, with France at 37-percentile and in Italy at a 23.5 percentile standing.

Summing up There's very little in this report that's truly encouraging. The exception, of course, is domestic orders for Germany; they're absolutely strong in June and create a supercharged growth rate over three months if that can stand up. However, the trends for sales are all quite negative, except for consumer durable goods. In the context for German results within the European environment, we find that the industrial metrics for the large economies are weak and consistently weak without any clear trend.

Looking ahead: Good news/Bad news The good news is that inflation has abated substantially. The ECB, of course, started cutting rates a while ago. Inflation progress seems to have stopped in Europe as well as in the United Kingdom and as well as in the United States. And now on top of those complications, we've got a huge stock market sell-off emanating from the U.S. and hitting Japan very hard. It's really hard to tell what this sell-off is about since the economic data viewed in isolation from the financial markets behavior has actually been relatively solid despite having a clear slowing trend. Markets have been spooked by something and they've reacted very strongly and now this weakness in the markets could be the trigger that erodes economic confidence and feeds back into the economy and causes the economy to have the weakness that the markets seem to fear. This is the sort of self-fulfilling prophecy that markets are capable of creating. It's going to take some watching to tell when the markets will come to their senses or whether they're going to sell off senselessly and create adverse economic feedback. The policy scenario is already somewhat confused with central banks trying to figure out what to do with stubborn inflation. They were positioned to cut rates if they felt they could afford to do it. Now, because of that the market sell-off, the decision may have been made for them. Stay tuned.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.