INSEE Household Confidence Makes January Gain Three-Month High

The INSEE household confidence indicator in January 2025 rose to 91.7 from 88.6 in December; the index sits now at a three-month high; it's still below its October level of 93.5.

• Living standards over the next 12 months are expected to show improvement as the reading moves to -47 in January from -58 in December.

• Unemployment expected over the next 12 months is lower with a net diffusion reading of 47 in January compared to 54 in December.

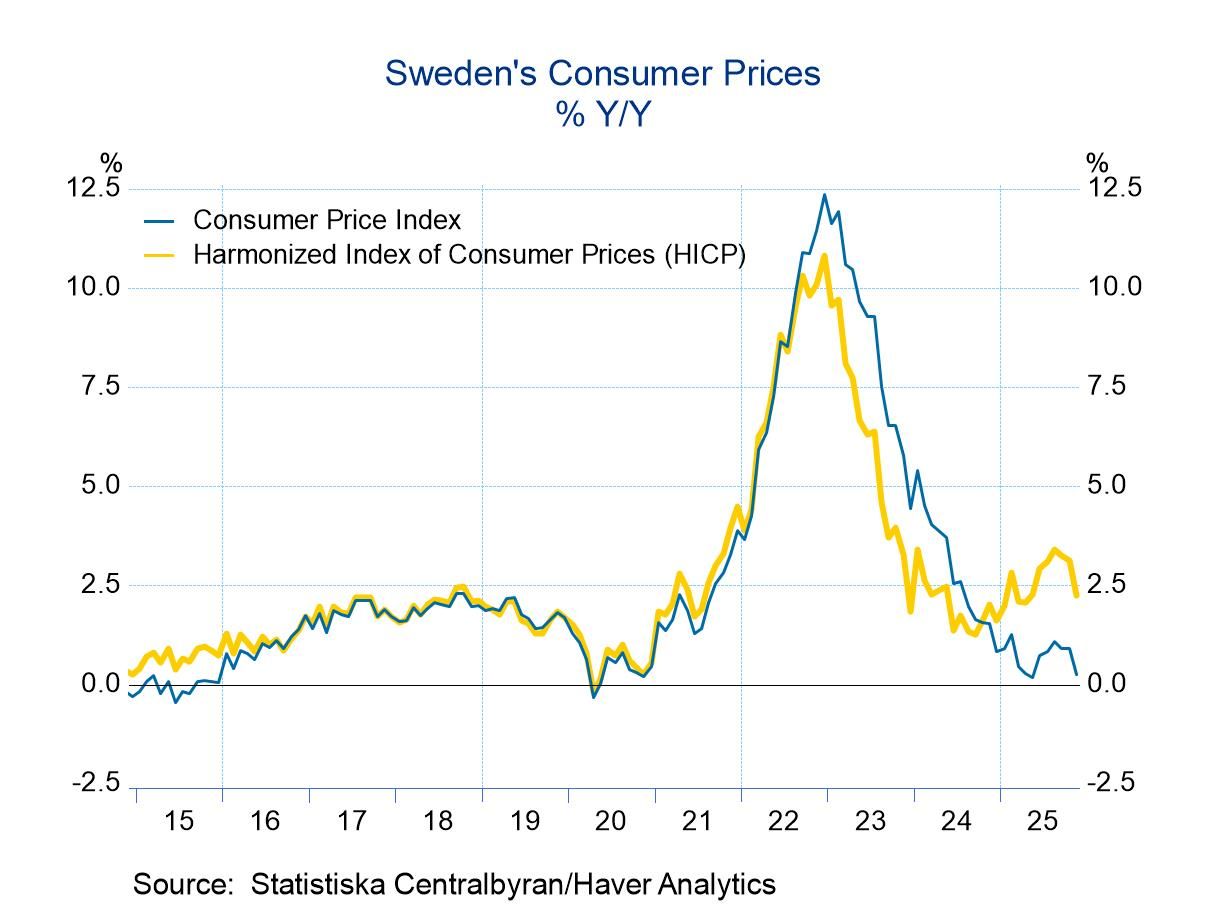

• Price developments show expectations for weaker inflation ahead over the last 12 months. Past price developments move from a reading of three in December to two in January. Looking ahead to the next 12 months, the reading falls to -43 from -33, a significantly weaker outlook for inflation.

• The ability to save over the next 12 months is unchanged in January compared to December. The favorability of the savings environment is slightly better at 38 in January compared to 34 in December.

• The favorability of the environment for making a major purchase is slightly better but little change, with a reading of -28 in January, up from -29 one month ago.

• And the financial situation over the past 12 months as well as the next 12 months is improved slightly from what it was in December. Over the past 12 months, conditions were assessed at -22 compared to -23 a month ago; over the forward-looking next 12 months, the outlook has a reading of -10 in January, an improvement from -14 in December.

Some monthly improvement but still a weak report On balance, however, the household confidence index is weak. We rank it among its various values since January 2001 (Rank % column); the ranking is in its 36th percentile, barely above the lower one-third of its historic queue of data. Living standards over the next 12 months mark a 27.6 percentile standing while the expectation for unemployment over the next 12 months is a relatively high 67-percentile, leaving it in the top one-third of its historic rankings – an uncomfortable level for ‘expected’ unemployment. Note that it does not mean that two-thirds of the respondents expect unemployment. The ranking just means that whatever the level of unemployment that is expected that expectation is higher only about one-third of the time.

Price developments showed that over the past 12 months, the inflation expectation stood in its 52.5 percentile. However, looking ahead, that has dropped-down to its 18.6 percentile; a significant improvement in the outlook for inflation.

The favorability and ability to save over the next 12 months are both high readings and their high, 97th percentile responses to this question, often indicate economic impairment. When the rankings are high for savings, conditions are often under stress. The favorability to spend to execute a major purchase improved slightly month-to-month, as we saw above, but has only a 20-percentile standing, a lower one-fifth reading for the favorability to spend.

The financial situation over the last 12 months had a 54-percentile standing; looking ahead to the next 12 months, it seemed to be slightly weaker with a 48-percentile standard, slightly below its historic median.

Summing up The survey continues to show weakness in the household sector although there's month-to-month improvement in January. The levels of the readings in January are still quite weak by historical comparison and we know that the entire European economy remains weak with Germany struggling terrifically. The ECB is still apparently dedicated to reducing interest rates even though inflation has become stubborn and has appeared to be stuck somewhat above its target range. Political stresses continue to play out in Europe as well. At the conditions for consumers in France are not worsening. To see them improving in this environment is heartening.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

Global

Global