NABE Lowers GDP Growth Forecast for 2024 After a Stronger-than-Expected 2023

by:Tom Moeller

|in:Economy in Brief

Summary

- Consumer spending & business investment are projected to slow in 2024.

- Housing activity recovers modestly next year after 2023 decline.

- Price inflation is forecasted to cool next year.

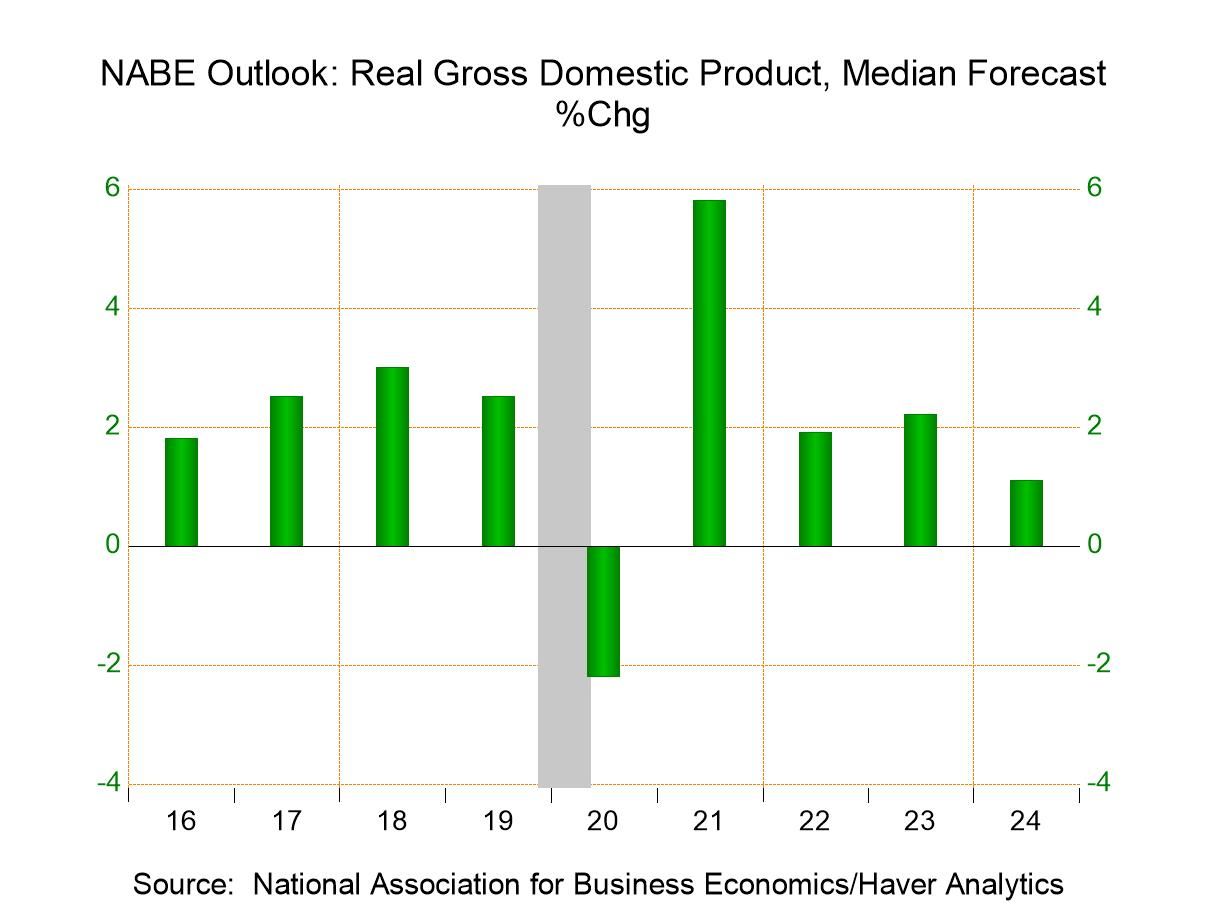

The National Association for Business Economics is forecasting real GDP growth (Q4/Q4) in 2024 of 1.1%, revised from 1.8%, and 2.0% in 2023, lifted from 0.4%. These gains follow 0.7% growth in 2022. Quarterly GDP in 2024 is expected to rise 0.5% in Q1 followed by a 1.0% gain in Q2, 1.3% in Q3 and 1.7% in Q4.

Growth in personal consumption expenditures is forecast to decelerate to 1.3% in 2024 from 2.4% in 2023. These gains are revised from 1.2% for next year and 1.6% this year. Forecasts for business fixed investment growth of 1.4% in 2024 and 3.0% in 2023 were revised from 0.7% and 1.5%, respectively. An expected 1.1% gain in residential investment in 2024 compares to 1.3% expected earlier, following an 11.3% decline in 2023, revised from -12.7% and a 10.6% decline in 2022. Government spending shou1d rise 1.3% next year after a 3.2% 2023 gain, revised from 1.0% and 2.3% respectively.

The net export deficit is expected to shrink to a smaller $1.212 trillion in 2023 then rise again to $1.229 trillion in 2024, revised from $1.213 trillion. Exports should rise roughly 2.0% both this year and next, revised from 3.6% and 3.0% in 2024. Imports are expected to rise 1.8% in 2024 and recover this year’s 2.0% decline. Imports had been expected to decline 0.7% this year then rise 1.3% in 2024. Following $128.1 accumulation in 2022, inventories are expected to increase a little-changed $15 billion in 2023 and $26 in 2014.

Housing starts are expected to be marginally lower in 2024 at 1.38 million, but they have been trending lower since the 2021 peak of 1.60 million. Light vehicle sales should hold at an unchanged estimate of 15.5 million next year; the figure for 2023 was revised up to 15.4 million from 14.9 million. The average monthly gain payroll employment next year should approach 42,000, revised from 87,000. The expected 192,000 payroll gain for this year compares to 125,000 expected before. The expected unemployment rate next year of 4.2% compares to the earlier estimate of 4.4%, and this year’s estimate was slightly changed at 3.6%.

Inflation pressures should ease. After rising 7.1% (Q4/Q4) in 2022, the gain in the Consumer Price Index should slow to 3.2% this year and to 2.4% in 2024, revised from 3.0%. Price inflation, as measured by the PCE price index, is expected to slow from 5.9% last year to 3.1% in 2023, revised from 2.8%, then to an unchanged estimate of 2.2% in 2024. After rising 5.1% in 2022, the gain in the chain PCE price index excluding food & energy is projected to slow to a marginally changed 3.5% in 2023 and 2.3% in 2024, revised from 2.2%. The cost of crude oil is expected to be $85 per barrel at the end of this year and $80 per barrel by the end of 2024, revised from $78 per barrel.

Interest rates are expected to decline. The forecasted 3.80% on ten-year Treasury notes at yearend 2024 compares to 4.14% at the end of this year. These figures were little changed from earlier estimates. The Federal funds rate is forecasted to decline to 4.4% at the end of 2024.

After-tax corporate profits are predicted to decline 3.7% this year, revised from -2.1%, after rising an upwardly revised 4.8% in 2022. Profits should improve 1.5% next year. The expected Federal government budget deficit should narrow to $1.604 trillion next year from $1.700 trillion this year, revised from $1.354 trillion. The deficit hit a peak of $3.132 trillion in 2020.

The figures from the latest NABE report can be found in Haver's SURVEYS database.

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

Global

Global