U.S. Leading Indicators Continue to Decline in October

by:Tom Moeller

|in:Economy in Brief

Summary

- Component movement in leading index is mixed.

- Coincident indicators hold steady again.

- Lagging indicators are little changed.

The Conference Board's Leading Economic Index fell 0.4% (-4.1% y/y) during October, following two months of 0.3% weakening. A 0.3% decline in the October index had been expected in the Action Economics Forecast Survey. The Leading Index is comprised of 10 components which tend to precede changes in overall economic activity.

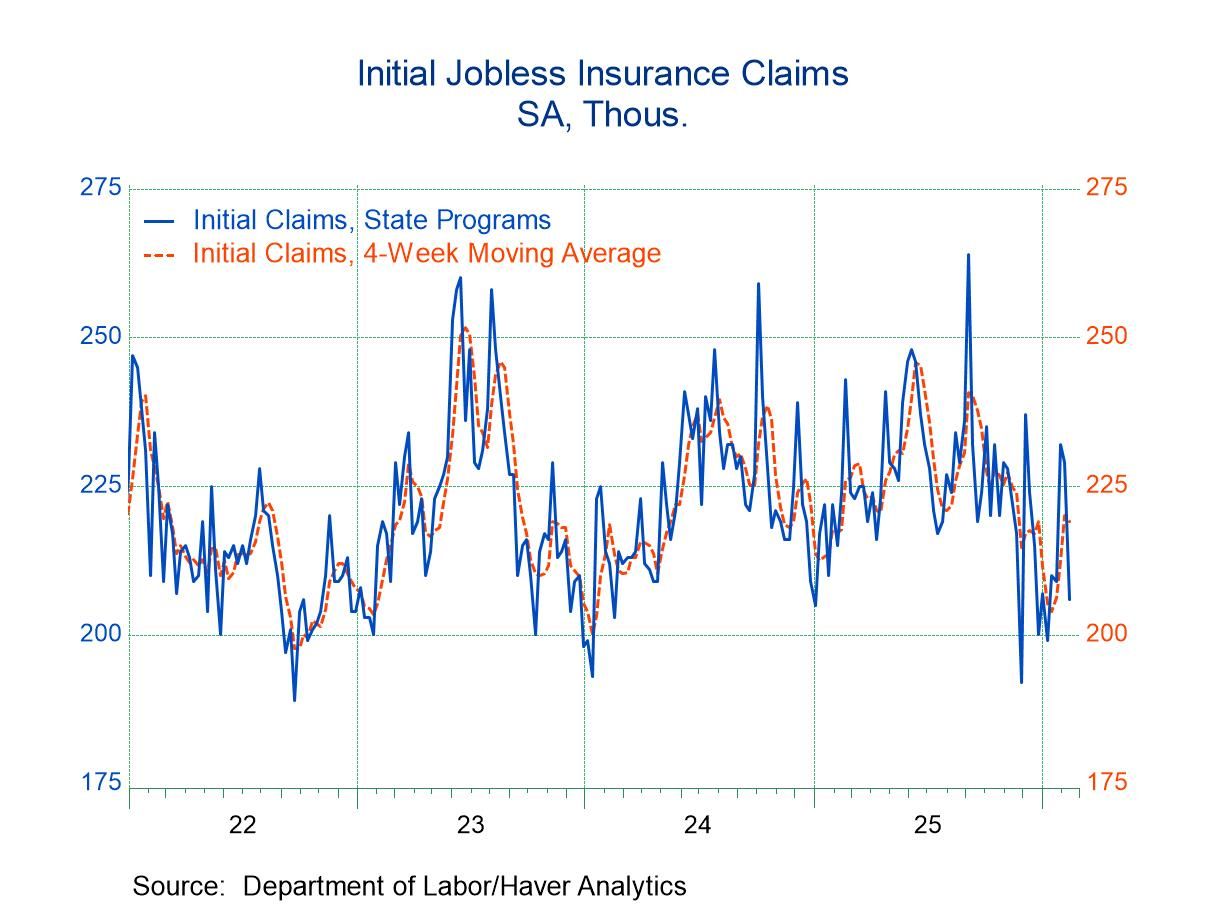

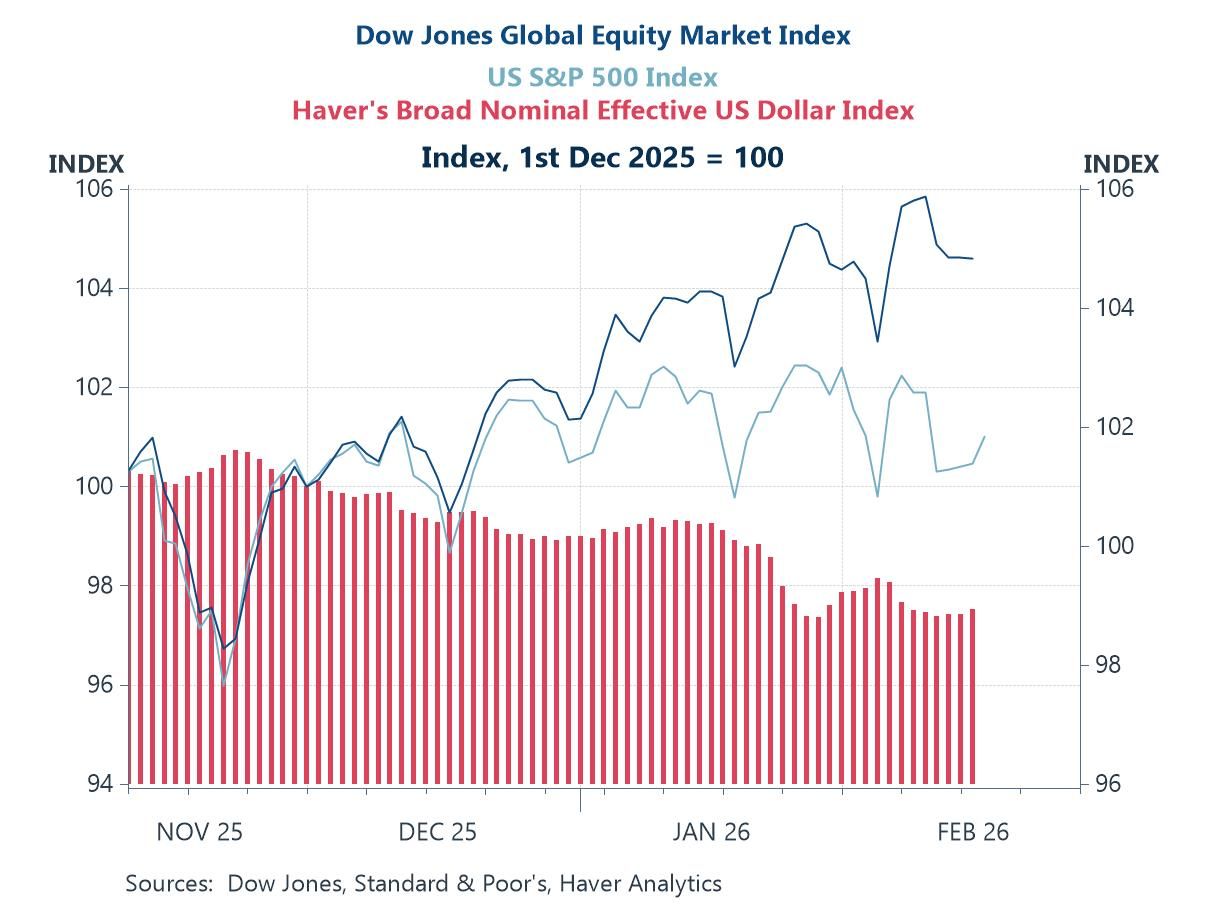

Component increases in the leading indicators index which contributed positively to the index change included improved factory orders for consumer goods, higher stock prices in the S&P 500 index and the leading credit index. Series contributing negatively were the factory sector workweek, higher unemployment insurance claims, the ISM new orders index, building permits, the interest rate yield curve and consumer expectations for business/economic conditions. Holding steady was new orders for nondefense capital goods.

The Coincident Economic Index was unchanged last month (1.3% y/y) after holding steady in September. Movement amongst the four components was mixed in October. Industrial production fell, but real personal income and real manufacturing & trade sales rose. Payroll employment held steady.

The Lagging Economic Index eased 0.1% last month (+0.4% y/y) after rising 0.3% in September. The duration of unemployment, the six-month change in factory unit labor costs, the prime rate charged by banks and C&I loans outstanding contributed negatively to the index change. The 6-month change in the services CPI and the ratio of consumer installment credit-to-personal income contributed positively. The business inventory-to-sales ratio contributed zero to the index change.

The ratio of coincident-to-lagging indicators, considered another leading indicator, rose slightly last month following three straight months of increase.

The Conference Board figures are available in Haver's BCI database; the components are available there, and most are also in USECON. The expectations are in the AS1REPNA database. Visit the Conference Board's website for coverage of leading indicator series from around the world.

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

Global

Global