U.S. JOLTS: April Job Openings Ease Slightly from All-Time High

Summary

- The number of job openings falls 455,000 in April, but still historically very large.

- New hires also ease, but remain sizable.

- Quits and layoffs decrease.

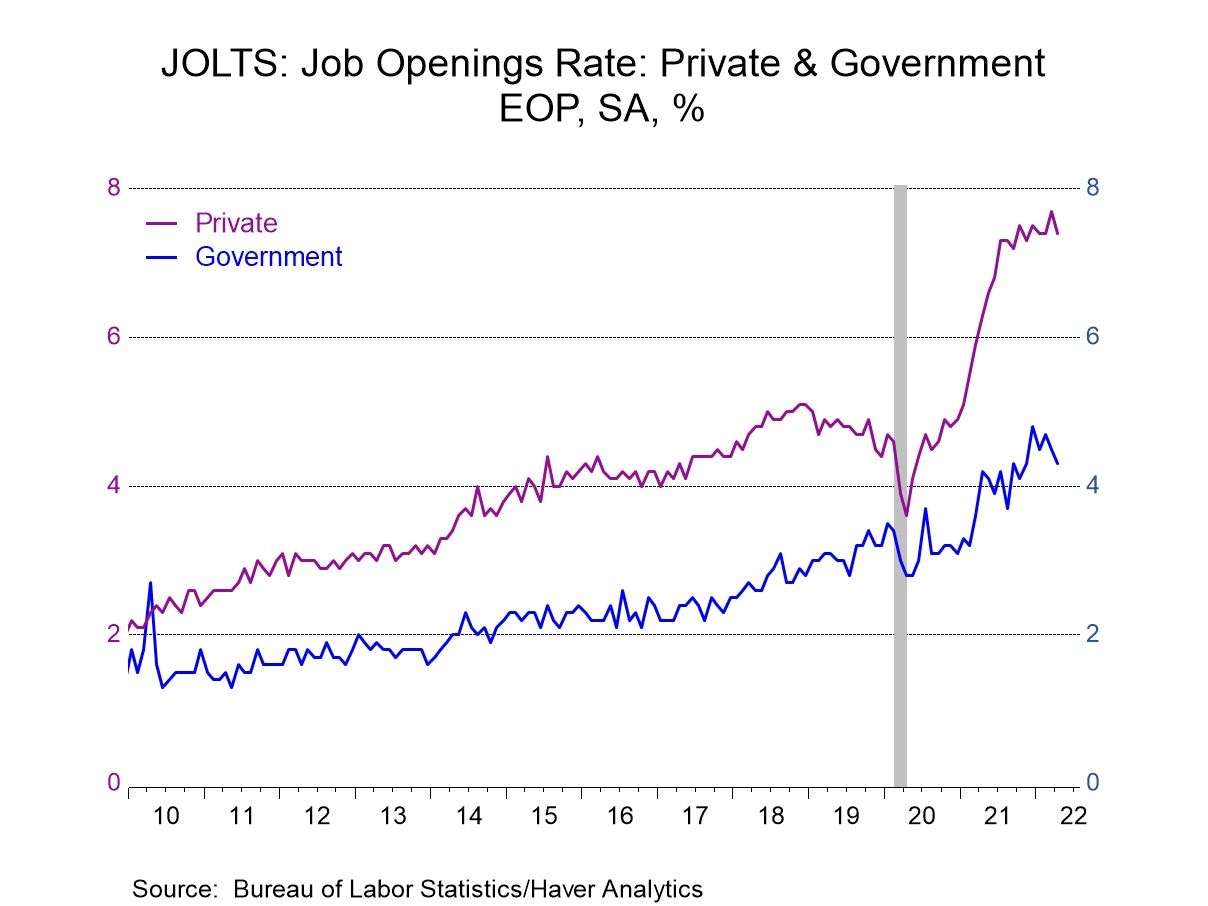

Job openings fell 455,000 in April to 11.400 million (-3.8% m/m, +23.0% y/y), but that followed an increase of 511,000 in March which produced an all-time high of 11.855 million. These data, collected and published by the Bureau of Labor Statistics, begin in December 2000. The job openings rate, 7.0% in April, is calculated as job openings as a percentage of the sum of establishment employment plus openings. Its highest value ever was 7.3% in March; the rate first reached 7.0% in October 2021, so this shows that the labor market has been quite strong in recent months.

New hires decreased 59,000 in April (-0.9% m/m, +7.6% y/y) after declining 187,000 (-2.7% m/m in March. The March and April declines follow a surge of 406,000 in February, +6.3% m/m. The hiring rate was 4.4% in April, the same as in March and down from 4.5% in February.

The total number of job separations was 6.033 million in April (-3.4% m/m, +4.9% y/y). There were 4.424 million quits (-0.6% m/m and +10.2% y/y), following 4.449 million in March. The quits rate was 2.9% in April, the same as in March and February. Layoffs and discharges were 1.246 million in April (-12.0% m/m and -10.0% y/y), down from 1.416 in March and the smallest amount ever in these data, which began in December 2000. "Other separations" were 363,000 in April (-5.5% m/m and +2.5% y/y); the April amount is down from 384,000 in March and close to the historical average for this category, 347,000.

Private-sector job openings fell 3.9% m/m (+25.1% y/y) in April, to 10.392 million, with the private-sector job openings rate at 7.0%, down from 7.3% in March.

Among select industries, openings in manufacturing had the biggest increase in April, 119,000 (+13.6% m/m and 15.1% y/y). Construction job openings also increased, reaching 449,000 (+5.4% m/m and +36.5% y/y) in April after 426,000 in March. The April amount was a record number of openings for the construction sector. Professional and business services had 2.181 million job openings at the end of April, down 6.4% m/m but up 31.4% y/y. Government sector job openings were 1.008 million at the end of April, down 3.4% m/m and up 5.4% y/y.

Total separations in the private sector were 5.658 million in April, down 3.2% m/m but up 4.1% y/y. The private sector quits rate was 3.2%, down slightly from 3.3% in March.

Layoffs and discharges are involuntary separations initiated by the employer. In the private sector, these were 1.178 million in April, down from 1.333 million in March. The layoff and discharge rate in April was 0.9%, down from 1.0% in March and the lowest ever. Among various industries, layoffs and discharges were 295,000 in professional and business services, less that the 428,000 in March; the April amount was a rate of 1.3%, lower than the 1.9% in March. In leisure and hospitality, they were 186,000, a rate of 1.2%. In manufacturing, there were 105,000 layoffs and discharges, a rate of 0.8%, the same as both February and March. In construction, there were 115,000 layoffs and discharges, representing a rate of 1.5%.

The Job Openings and Labor Turnover Survey (JOLTS) are available in Haver's USECON database.

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.

Global

Global