U.S. Unemployment Insurance Claims Rise Slightly

by:Sandy Batten

|in:Economy in Brief

Summary

- Initial claims edged up but remain below pre-pandemic level.

- Continued claims in regular state programs down 66% from a year ago.

- Insured jobless rate unchanged at 1.3%, lowest since 1.2% in March 2020.

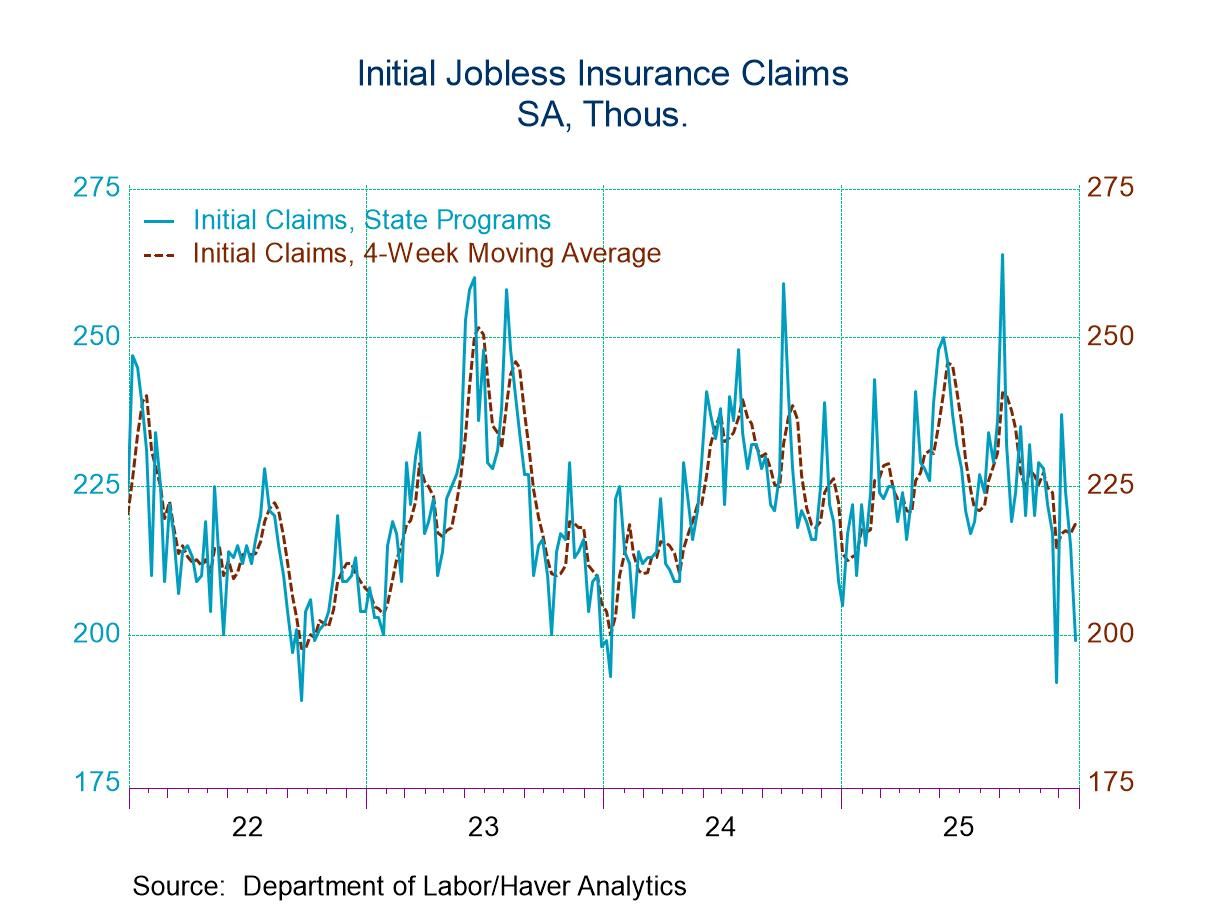

Initial claims for unemployment insurance increased 7,000 in the week ended January 1 to a seasonally adjusted 207,000 (-73.5% y/y); the prior week was marginally revised up from 198,000 to 200,000 reported initially. The Action Economics Forecast Survey expected 200,000 claims for the latest week. The 4-week moving average rose to 204,500 from 199,750 in the previous week.

Initial claims for the federal Pandemic Unemployment Assistance (PUA) program, which expired on September 6, 2020, are no longer included in this report. This program provided benefits to individuals who were not eligible for regular state unemployment insurance benefits, such as the self-employed.

In the week ended December 25, continued weeks claimed for regular state unemployment insurance were 1.754 million (-66.1% y/y), up from 1.718 million in the previous week (revised up slightly from 1.716 million). The insured unemployment rate was unchanged at to 1.3% in the December 25, the lowest since 1.2% in the week of March 14, 2020.

Continued claims for both the Pandemic Unemployment Assistance (PUA) program and for Pandemic Emergency Unemployment Compensation (a program for those unemployed who had exhausted their state benefits) are no longer included in this report as both programs have expired.

In the week ended December 18, the not seasonally adjusted total number of continuing weeks claimed in all programs plummeted 199,869 to 1.722 million, the lowest level since the week ended November 23, 2019.

The state insured rates of unemployment in regular programs vary widely. In the week ending December 18, the highest insured unemployment rates were in Alaska (3.05%), New Jersey (2.30%), Minnesota (2.25%), California (2.24%), Illinois (1.87%) and Massachusetts (1.87%). The lowest rates were in Virginia (0.14%), Alabama (0.30%), Kansas (0.40%), North Carolina (0.41%), Arizona (0.43%) and South Dakota (0.43%) Other state insured rates of unemployment in regular programs included Pennsylvania (1.53%), New York (1.76%), Texas (0.87%), and Florida (0.50%). These state rates are not seasonally adjusted.

Data on weekly unemployment claims going back to 1967 are contained in Haver's WEEKLY database, and they are summarized monthly in USECON. Data for individual states are in REGIONW. The expectations figure is from the Action Economics Forecast Survey and is in the AS1REPNA database.

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.