- Initial claims increase 1,000 to 203,000.

- Continued weeks claimed fell again to a new 52-year low.

- Insured unemployment rate remained at record low of 1.0%.

Introducing

Carol Stone, CBE

in:Our Authors

Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

Publications by Carol Stone, CBE

- USA| May 12 2022

U.S. Unemployment Claims Edge Upward

- USA| May 04 2022

U.S. Mortgage Applications Turn Upward After 7 Weekly Declines

- Total applications up 2.5%.

- Loans to purchase a house rise 4.1%, refinance loans manage 0.2% increase.

- Mortgage interest rates ease slightly.

- Crude oil price up $2.31 per barrel.

- Gasoline prices edge lower again after mid-March record high.

- Natural gas prices continue to rise.

- Fuel prices, up 14.6% in March, again drive import prices.

- Import prices ex fuels increase 1.2%.

- Export prices surge 4.5%, a second monthly record; food and industrial goods both very strong.

- USA| Mar 29 2022

U.S. JOLTS: Job Openings Nearly Steady in February

- Job openings rate unchanged at 7.0%.

- Hirings increase enough that rate rose.

- Quits rose while layoffs & discharged eased.

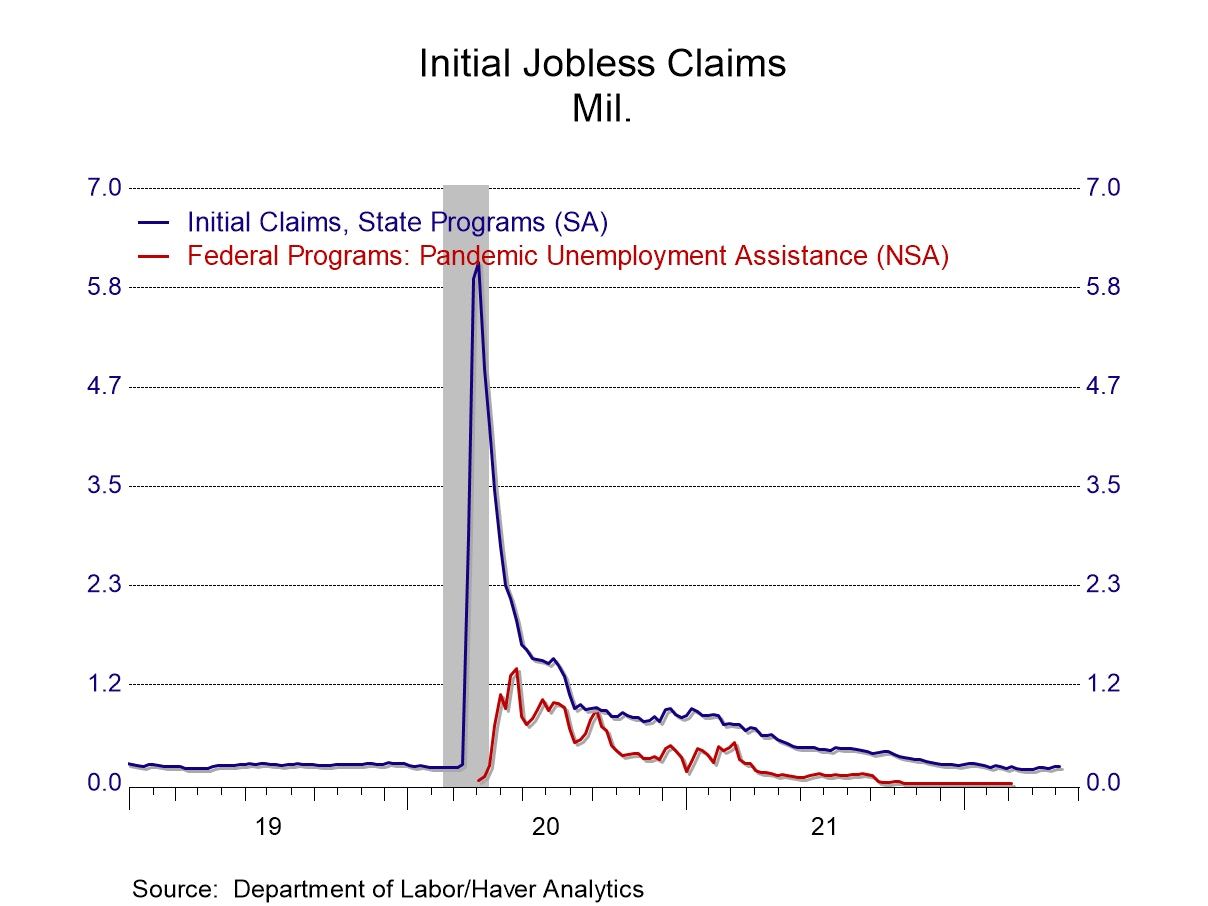

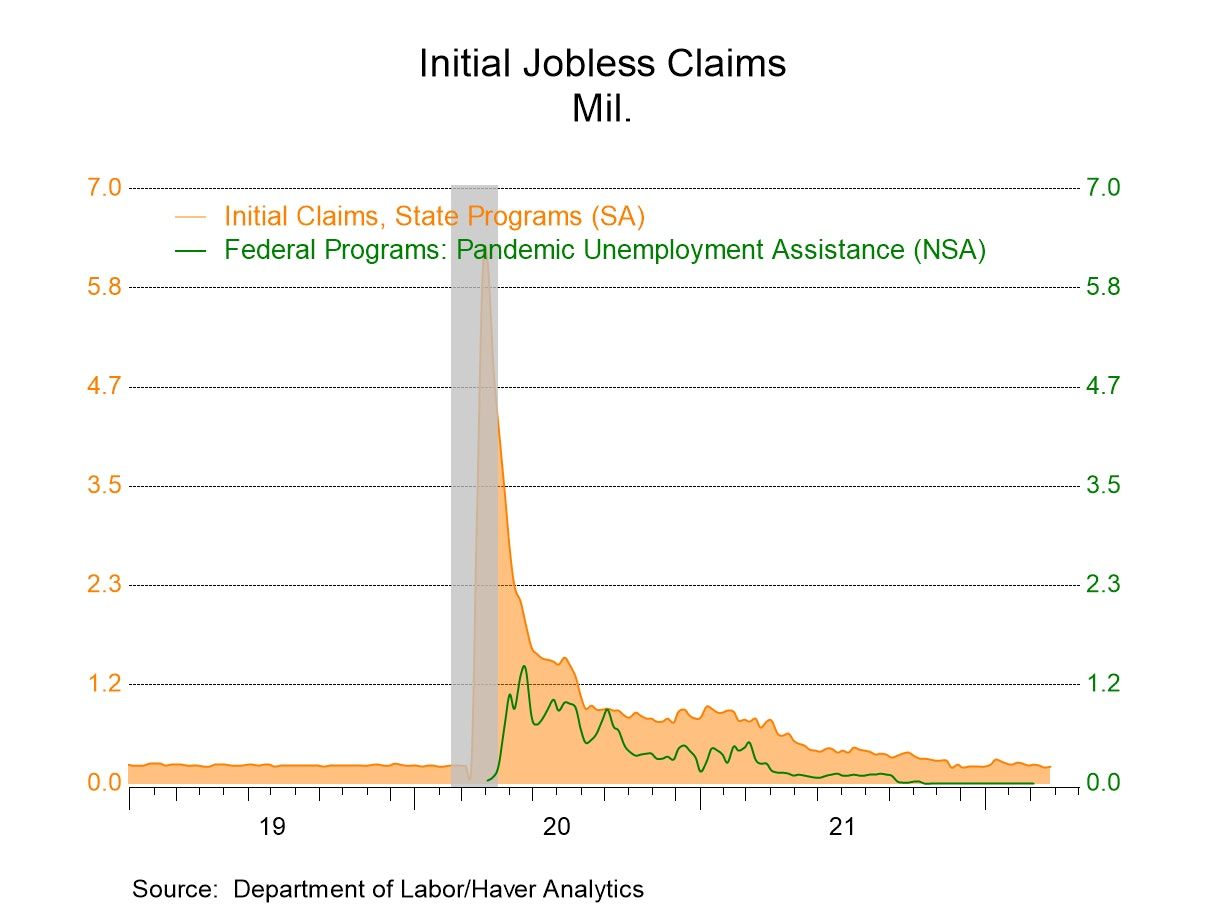

- Initial claims noticeably lower than forecast.

- Continued claims below pre-pandemic amounts.

- USA| Mar 17 2022

U.S. Unemployment Claims Decrease; Rate Hits Record Low

- Initial claims decrease somewhat more than expected.

- Continued claims rose slightly but remain well below pre-pandemic levels.

- Insured unemployment rate = 1.0%, lowest ever.

- USA| Mar 16 2022

U.S. Mortgage Application Volume Eases, Rates Rise

- March 11 week decrease follows sizable advance the week before.

- Applications to purchase edge higher as refinance activity declines.

- Mortgage interest rates advance 20 basis points.

- USA| Mar 11 2022

U.S. Financial Accounts Show Expanded Borrowing in Q4

- Federal government resumes sizable borrowing in Q4 after net paydown in Q3.

- Household borrowing largest relative to income since before the Great Recession.

- Business corporations take on new loans and pay down bonds in Q4.

- USA| Mar 03 2022

U.S. Factory Orders and Shipments Advance in January

- New orders for manufactured goods gained in January; December’s decline is revised to an increase.

- Durable and nondurable goods shipments have notable increases.

- Unfilled orders and inventories also grow.

- USA| Mar 02 2022

U.S. Mortgage Application Volume Steadies After Sizable Decrease

- Total applications down 25% in latest four weeks.

- Applications for purchase down, refinancing application edge upward.

- Mortgage interest rates increase slightly.

- Decrease in jobless claims suggests firm labor market conditions.

- Continued claims were up in January 15 week.

- Insured unemployment rate remains in historically low range.

- of114Go to 15 page