Global| Oct 19 2009

Global| Oct 19 2009Actual Exchange Rates in the Developing World and Purchasing Power Parity

Summary

While purchasing power parity (PPP) is not a major factor in determining a country's actual exchange rate, it can be used as a rough guide in deciding whether a particular currency is under or over valued. Most developing countries [...]

While

purchasing power parity (PPP) is not a major factor in determining a

country's actual exchange rate, it can be used as a rough guide in

deciding whether a particular currency is under or over

valued. Most developing countries with growing

current account balances, have preferred to pile up foreign exchange

reserves rather than let their currencies appreciate.

Meanwhile, the purchasing power parity of their currencies has

generally increased slowly and steadily as their economies have

prospered. As a result their currencies have continued to be

undervalued.

While

purchasing power parity (PPP) is not a major factor in determining a

country's actual exchange rate, it can be used as a rough guide in

deciding whether a particular currency is under or over

valued. Most developing countries with growing

current account balances, have preferred to pile up foreign exchange

reserves rather than let their currencies appreciate.

Meanwhile, the purchasing power parity of their currencies has

generally increased slowly and steadily as their economies have

prospered. As a result their currencies have continued to be

undervalued.

Data on the purchasing power parity of currencies can be

derived from data in the Haver data base, The World

Development Indicators.  The data are annual so the

latest data point is 2008. PPP conversion factors for the

world countries are included in the section "Exchange Rates and

Prices". We chose four countries as examples:

China, Korea, Singapore and Brazil and the PPP Conversion

Factor (GDP) to market exchange rate ratio.

The data are annual so the

latest data point is 2008. PPP conversion factors for the

world countries are included in the section "Exchange Rates and

Prices". We chose four countries as examples:

China, Korea, Singapore and Brazil and the PPP Conversion

Factor (GDP) to market exchange rate ratio.

The conversion

factor is the ratio of PPP exchange rate to the actual exchange rate.

One minus the conversion factor, therefore is the percentage of under

or over valuation of the particular exchange rate relative to the

dollar. Thus for Korea, the conversion factor of

.684 in 2008 means that the Korea's actual exchange rate was 31.6%

undervalued relative to the dollar.  Since the actual exchange

rate is 1102.09 Won/$, a conversion factor of .684 means that the PPP

exchange rate is 753.98 Won/$ (.684 * 1102.09). The actual

exchange rates, the PPP exchange rates and the percent of

undervaluation of the currencies of the four countries are shown in the

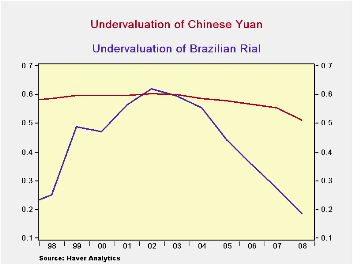

table below.· Brazil has allowed its currency to appreciate

considerably. From an undervaluation of 61.9 in 2002, the

Rial was only 18.4% undervalued in 2008, as shown in the first

chart. By contrast, China has permitted only moderate

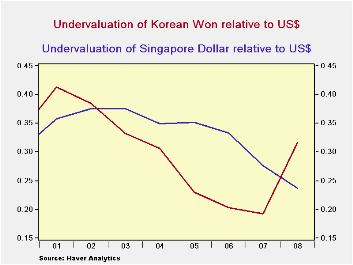

appreciation of the yuan as shown in the same chart. The Singapore

dollar has steadily reduced its undervaluation as can be seen in the

second chart. Korea, on the other hand experienced a sharp

increase in its undervaluation in 2008, also shown in the second

chart.

Since the actual exchange

rate is 1102.09 Won/$, a conversion factor of .684 means that the PPP

exchange rate is 753.98 Won/$ (.684 * 1102.09). The actual

exchange rates, the PPP exchange rates and the percent of

undervaluation of the currencies of the four countries are shown in the

table below.· Brazil has allowed its currency to appreciate

considerably. From an undervaluation of 61.9 in 2002, the

Rial was only 18.4% undervalued in 2008, as shown in the first

chart. By contrast, China has permitted only moderate

appreciation of the yuan as shown in the same chart. The Singapore

dollar has steadily reduced its undervaluation as can be seen in the

second chart. Korea, on the other hand experienced a sharp

increase in its undervaluation in 2008, also shown in the second

chart.

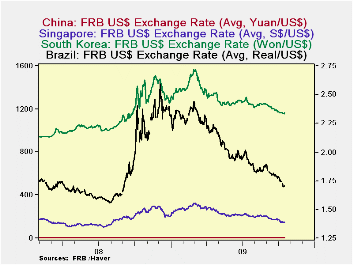

The third chart brings up to date the actual exchange

rates of the four countries. They have, to varying degrees,

appreciated in 2009. Again, the Chinese Yuan has appreciated

the least and the Brazilian Real, the most.

| 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | |

|---|---|---|---|---|---|---|---|

| China | |||||||

| Actual exchange rate (Yuan/$) | 6.95 | 7.61 | 7.97 | 8.19 | 8.28 | 8.28 | 8.28 |

| PPP exchange rate | 3.39 | 3.38 | 3.46 | 3.45 | 3.43 | 3.29 | 3.28 |

| Undervaluation (%) (1-Conversion factor) | 51.1 | 55.5 | 56.6 | 57.9 | 58.6 | 60.1 | 60.3 |

| Korea | |||||||

| Actual exchange rate (Won/$) | 1102.1 | 929.3 | 954.8 | 1024.1 | 1145.3 | 1191.1 | 1251.1 |

| PPP exchange rate | 754.0 | 747.9 | 760.7 | 788.9 | 794.3 | 795.7 | 769.8 |

| Undervaluation (%) (1-Conversion factor) | 31.5 | 19.3 | 20.3 | 23.0 | 30.7 | 32.2 | 38.5 |

| Singapore | |||||||

| Actual exchange rate (S$/US$) | 1.41 | 1.51 | 1.59 | 1.66 | 1.69 | 1.74 | 1.79 |

| PPP exchange rate | 1.08 | 1.09 | 1.06 | 1.08 | 1.10 | 1.09 | 1.12 |

| Undervaluation (%) (1-Conversion factor) | 23.7 | 27.7 | 33.3 | 35.7 | 34.9 | 37.6 | 37.5 |

| Brazil | |||||||

| Actual exchange rate (Rial/$) | 1.83 | 1.94 | 2.18 | 2.43 | 2.93 | 3.08 | 2.93 |

| PPP exchange rate | 1.50 | 1.41 | 1.40 | 1.36 | 1.31 | 1.22 | 1.11 |

| Undervaluation (%) (1Conversion factor) | 18.4 | 27.6 | 35.8 | 44.2 | 55.3 | 57.6 | 61.9 |