Global| Mar 07 2007

Global| Mar 07 2007ADP Report Points to 57K Private Payroll Growth for February; Survey Revised, Series Added on Sector and Firm-Size

Summary

The ADP National Employment Report for February points to a 57,000 increase in private nonfarm payrolls. This measure is intended as a leading indicator for the "official" BLS data to be reported Friday, March 9. For January, the ADP [...]

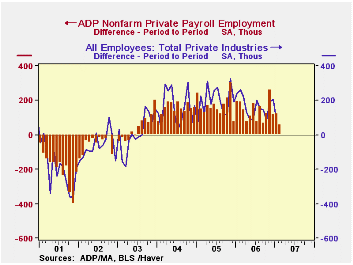

The ADP National Employment Report for February points to a 57,000 increase in private nonfarm payrolls. This measure is intended as a leading indicator for the "official" BLS data to be reported Friday, March 9. For January, the ADP figure was 121,000, with the actual coming at 97,000.

With the annual revision of the BLS data, ADP has also revised its figures and made methodological changes in the calculations. ADP, you perhaps know, processes payrolls for millions of American workers; indeed, their annual report says they cover 1 in 6 private sector workers. Initially their calculation was based on a sample of their own clients covering about 7 million workers. They have expanded this to a substantial portion of their entire base, with data collection weekly not just once a month. New efforts are being made to align both the totals and a broad industry breakdown every month. The seasonal adjustment process was shifted from X-11 to X-12 ARIMA, and closer examination is being made for outliers. These changes are aimed at minimizing the production of false signals in the report: for example, in December, the original series pointed to a decline in private sector jobs of 40,000, but the BLS figure showed an increase of 150,000.

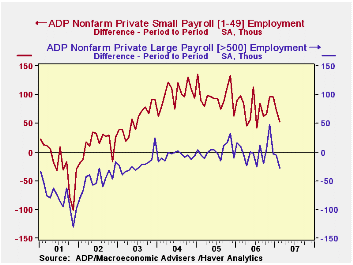

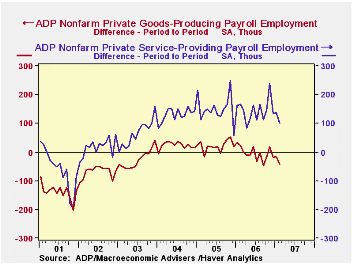

The Report also contains new information. It shows a breakdown for goods-producing and service-producing sectors, with employment in goods industries presently seen declining 43,000 in February and services going up 100,000. Brand-new series are available on the size of payroll units. Since most business growth has occurred in small- and medium-sized firms, this would be useful in assessing the breadth of payroll changes. So for February, the ADP data show a 53,000 gain at small businesses (49 or fewer employees), 33,000 at medium-sized companies (50-499) and a decline of 29,000 at large firms (500 and over). It's easy to focus on large businesses because they get more public attention, but in fact, it's the smaller ones where there is more dynamism.

| Private Nonfarm Payrolls (000s) | Feb 2007 | Jan 2007 | Dec 2006 | Nov 2006 | Monthly Averages|||

|---|---|---|---|---|---|---|---|

| 2006 | 2005 | 2004 | |||||

| ADP Total | 115,111 | 115,054 | 114,933 | 114,815 | 114,165 | 112,288 | 110,290 |

| Change | 57 | 121 | 118 | 258 | 142 | 171 | 153 |

| BLS Total | -- | 115137 | 115040 | 114835 | 114186 | 111890 | 109804 |

| Change | -- | 97 | 205 | 190 | 167 | 198 | 159 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates