Global| Dec 08 2006

Global| Dec 08 2006Anomalous Behavior of Foreign Investment & Marked Reduction in Home Equity Withdrawal

Summary

The Federal Reserve's release yesterday of the quarterly Flow of Funds calls our attention once again to changing relationships highlighted in this enormous body of financial information. Here follow brief notes on two specific, but [...]

The Federal Reserve's release yesterday of the quarterly Flow of Funds calls our attention once again to changing relationships highlighted in this enormous body of financial information. Here follow brief notes on two specific, but widely diverse sectors. These are Q3 data, of course, and this is early December, so there are some lags.

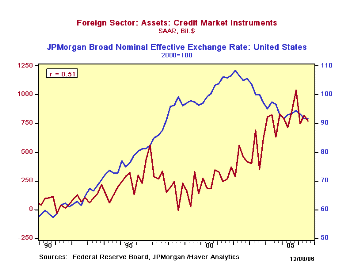

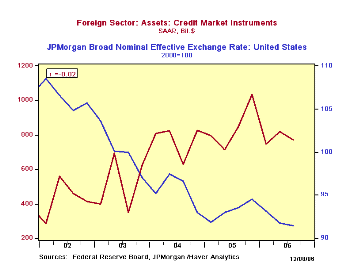

The general interpretation of foreign capital flows argues that foreign acquisition of US assets should be positively correlated with movements in the value of the dollar. Whichever way the causation goes, whether a rising dollar attracts foreign capital or larger foreign investment pushes up the dollar, one would think the relationship would show a positive correlation.

But since the dollar began to fall in 2002, this has not been the case. Foreign investment in the US has continued to increase anyway. See the table below and the accompanying graph. Overall correlation since 1990 is +51%; but from 2002 forward, the correlation shifts to -82%! The most recent three quarters of observations indicate some moderation in foreign acquisition of US assets, so perhaps this relationship is beginning to right itself. But it will be at least until the release of Q4 data in March before we know this.

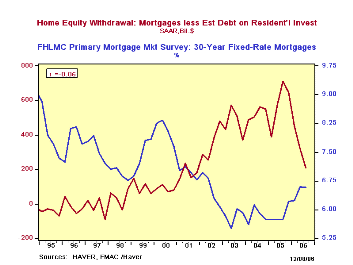

Another wide use of the Flow of Funds data has come to prominence quite recently, the analysis of mortgage data to gauge borrowing against home equity as a source of funds for consumer spending. Staff members in the Research Division of the Board of Governors calculate two measures of this, which they call Home Equity Extraction. Their figures, part of a full model on the intricate operation of the mortgage and mortgage securities markets, are not yet available for Q3. Haver Analytics has devised our own simpler series, which tend to follow the movements in the Fed's data. Our version, which we call Home Equity Withdrawal, was updated yesterday, soon after the release of the Flow of Funds data. All of these series reside in the USECON database.

Q3 shows a steep drop in this form of consumer borrowing: to "just" $209.3 billion, SAAR, from $319.6 billion in Q2 and $712.3 billion a year ago, which was the peak in our measure. This is closely related to the rise in mortgage rates, which has discouraged the refinancing associated with such equity withdrawal. Some forecasters had looked for a retreat in equity withdrawal to contribute to a significant slowdown in consumer spending this year. So far this doesn't seem to have taken place, at least to the extent feared by some. In the very most recent months falling energy costs have helped to cushion spending on other items, offsetting some of the shrinkage in debt financing.

| FLOW-OF-FUNDS SAAR, Bil.$ |

Q3 2006 | Q2 2006 | 2005 | 2004 | Average, 2000-2003 | Average, 1995-1999 |

|---|---|---|---|---|---|---|

| Foreign Acquisition, Credit Market Instruments | 769.5 | 818.6 | 847.8 | 772.9 | 373.9 | 243.3 |

| Broad Value of $* | 91.4 | 91.8 | 93.2 | 95.5 | 103.1 | 87.9 |

| Home Equity Withdrawal** | 209.3 | 319.6 | 578.5 | 525.6 | 271.8 | 10.7 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates