Global| Jun 06 2007

Global| Jun 06 2007Australia GDP Up 1.6% in Q1; Best Quarter in 3 Years

Summary

Australian GDP grew 1.6% in Q1, up from 1.1% in Q4 and the strongest quarter since Q4 2003. This compared with 1.3% expected in one major forecast survey. Year-to-year growth was 4.0%. Data for Australia are contained in Haver's ANZ [...]

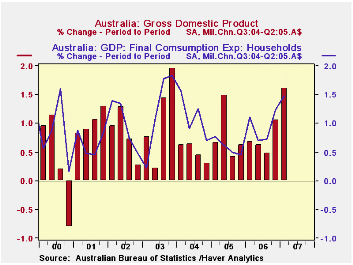

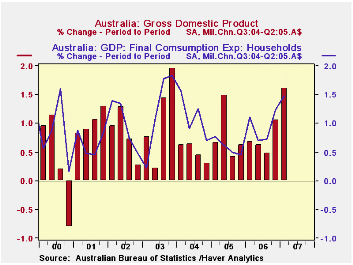

Australian GDP grew 1.6% in Q1, up from 1.1% in Q4 and the strongest quarter since Q4 2003. This compared with 1.3% expected in one major forecast survey. Year-to-year growth was 4.0%. Data for Australia are contained in Haver's ANZ database and in G10+ as well as numerous international databases from the OECD, IMF and others.

The pick-up resulted from positive inputs in several demand areas. Private consumption was up 1.5% compared to 1.2% the quarter before. Exports expanded 1.4%, up from 1.0%, while growth in imports was lower, 2.1% from 6.5%. This latter, of course, helps raise the total growth rate since imports enter the GDP calculation negatively.

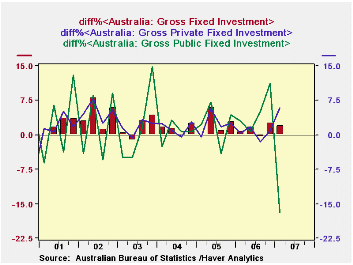

Fixed capital formation grew nicely as well, although the Q1 rise of 2.0% was less than Q4's 2.6%. It is important to note here the impact of the privatization of the telephone and telecommunications utility in Australia, Telstra. The government sold this company to private owners in November and it enters the GDP accounts in the private investment category for the first time in this report. Thus, the 5.8% surge in private fixed investment and the 16.9% plunge in public investment exaggerate the underlying movements. The Australian Bureau of Statistics reports that private investment would still have looked pretty good, at 4.8% growth in Q1, if the telephone company had been in the private sector all during Q4 as well. Public investment would still have fallen in Q1, but by "only" 7.5%. These latter growth rates are recorded in a footnote in our ANZ menu.

Interestingly, among the various industrial sectors, manufacturing output declined, despite the gain in overall GDP. Gross value added in manufacturing eased by 0.5%, although that did follow two very good quarters of 1.7% and 2.0%. Agricultural output also declined, but only 0.3% and far less than in the prior two quarters. So agriculture actually contributed to the increase in GDP growth by subtracting less. Construction activity gained 2.5%, a reputable figure, but less than Q4's 3.9%. The best performances came in retail trade, up 2.4%, and finance, up 2.3%, with both at least a percentage point stronger than the quarter before.

| AUSTRALIA, % Chg, Chn A$, Q3/2004-Q2/2005 |

Q1 2007* | Q4 2006* | Q3 2006* | Year Ago | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Real GDP | 1.6 | 1.1 | 0.5 | 4.0 | 2.7 | 2.7 | 3.7 |

| Private Consumption | 1.5 | 1.2 | 0.7 | 4.2 | 3.1 | 3.0 | 5.7 |

| Gross Fixed Capital Formation | 2.0 | 2.6 | -0.5 | 5.8 | 6.3 | 7.8 | 7.5 |

| Private | 5.8** | 0.9 | -1.5 | 7.1 | 5.4 | 7.6 | 7.1 |

| Public | -16.9** | -11.3 | 5.2 | -2.1 | 11.9 | 8.7 | 9.9 |

| Exports | 1.4 | 1.0 | 0.2 | 4.6 | 3.4 | 2.4 | 4.6 |

| Imports | 2.1 | 6.5 | -0.5 | 11.4 | 7.7 | 8.5 | 15.3 |

| Manufacturing | -0.5 | 2.0 | 1.8 | 3.3 | -1.3 | 0.2 | 0.0 |

| Finance & Insurance | 2.3 | 1.0 | 0.9 | 5.9 | 6.1 | 2.5 | 3.7 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates