Global| Jun 12 2012

Global| Jun 12 2012Australia Prepares for a Slowdown in Activity

Summary

On Tuesday of last week, the Reserve Bank of Australia lowered its cash target rate twenty-five basis points to 3.5% after having reduced the rate fifty basis points just the month before. On the next day, Australia reported that its [...]

On Tuesday of last week, the Reserve Bank of Australia

lowered its cash target rate twenty-five basis points to 3.5% after having

reduced the rate fifty basis points just the month before. On the

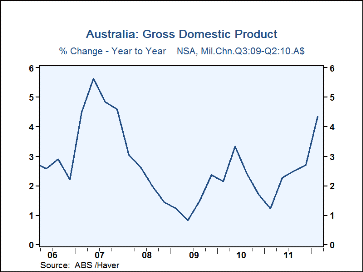

next day, Australia reported that its first quarter GDP had

increased 4.34% over the first quarter of 2011, the highest year to year

increase since the fourth quarter of 2007, as seen in the attached

chart. Reducing interest rates in the face of strong growth is

hardly the usual policy of a central bank. But Governor Stevens of the

Reserve Bank noted that concern over in the troubles of the Euro

Area that had the potential to disrupt the world economy played a

significant role in the bank's seemingly paradoxical decision.

On Tuesday of last week, the Reserve Bank of Australia

lowered its cash target rate twenty-five basis points to 3.5% after having

reduced the rate fifty basis points just the month before. On the

next day, Australia reported that its first quarter GDP had

increased 4.34% over the first quarter of 2011, the highest year to year

increase since the fourth quarter of 2007, as seen in the attached

chart. Reducing interest rates in the face of strong growth is

hardly the usual policy of a central bank. But Governor Stevens of the

Reserve Bank noted that concern over in the troubles of the Euro

Area that had the potential to disrupt the world economy played a

significant role in the bank's seemingly paradoxical decision.

The May Business Survey of the National Bank of Australia that was released today shows that the Australian economy has weakened considerably from the first quarter and that an easier monetary policy is not inapprorpriate. The naysayers now out weigh the optimists. The May percent balances of opinion on confidence, business and trading conditions, profitability, employment, export sales, forward orders and inventories are all negative as can be seen in the table below. The survey results shows little expected change in costs and prices, but an expected decline in capacity utilization.

Australia has managed to avoid even one quarter of negative growth since the financial crisis and it looks as if the monetary authorities would like to maintain that record.

| Business Survey of National Bank of Australia | |||||

|---|---|---|---|---|---|

| May'12 | Apr'12 | Mar'12 | Feb'12 | Jan'12 | |

| Business Confidence (% Balance) | -2.2 | 4.1 | 2.7 | 0.7 | 4.0 |

| Business Conditions (% Balance) | -3.5 | 0.1 | 2.6 | 2.4 | 2.4 |

| Trading Conditions (% Balance) | -0.2 | 2.1 | 7.4 | 7.6 | 4.1 |

| Profitability (% Balance) | -6.4 | -4.1 | 2.3 | 0.5 | -0.7 |

| Employment (% Balance) | -3.7 | 2.0 | 0.3 | -0.6 | 0.8 |

| Export Sales(% Balance) | -2.2 | -3.8 | 0.5 | -3.3 | -4.5 |

| Forward Orders (% Balance) | -4.1 | -1.6 | -11 | -2.6 | -1.0 |

| Stocks (% Balance) | -0.9 | 1.3 | 1.8 | 4.1 | 3.7 |

| Labor Costs (% Change) | 0.7 | 1.0 | 1.0 | 1.0 | 0.8 |

| Purchase Costs (% Change) | 0.7 | 0.7 | 0.5 | 0.7 | 0.1 |

| Final Product Price (% Change) | 0.2 | 0.1 | 0.2 | 0.2 | 0.0 |

| Capacity Utilization (%) | 79.8 | 79.5 | 81.0 | 80.5 | 81.2 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates