Global| Feb 22 2007

Global| Feb 22 2007Bank of Japan Raises Call Rate Target to 0.50%; Cites Demand Growth & High Industry Operating Rate

Summary

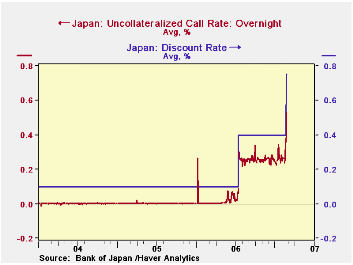

The Bank of Japan raised short-term interest rates by 25 basis points yesterday "effective immediately". As seen in the first graph here, money markets began to factor this change into their trading last Friday, when the key policy [...]

The Bank of Japan raised short-term interest rates by 25 basis points yesterday "effective immediately". As seen in the first graph here, money markets began to factor this change into their trading last Friday, when the key policy target rate, the uncollateralized overnight call rate, moved up about 10 basis points from 0.260% to 0.362%. It stayed near there through the close of markets yesterday. Today, it moved on up, reaching 0.528% on a provisional basis; the Bank wants it to hover around 0.50%.

The BoJ decision is based on two main forward-looking criteria: the Bank sees a reduction in uncertainty over the outlook for Japan's economy, and it is concerned that markets not get complacent about accommodative monetary policy.

As mentioned specifically in the Bank's policy statement, consumer spending in Japan had weakened last summer, but the reports last week of Q4 data show a distinct rebound. As we described here a week ago, total GDP was up 1.2% in Q4 (4.8% annual rate) following a mere 0.3% in Q3. Household consumption had fallen at a 4.3% rate in Q3 and came back at a 4.5% pace in Q4. All four major types of expenditure participated in the gain: durables, semi-durables, nondurables and services. The Bank was also  reassured, it said, by reduced uncertainty abroad, especially in the US. Further, today, more evidence of rising demand abroad and its favorable impact for Japan came in the January trade data. Exports were up 3.3% from December, the largest monthly increase since the Spring of 2004. Sales to China were strongest on a year-over-year basis, but shipments to other Asian and Middle Eastern trading partners also showed notable growth.

reassured, it said, by reduced uncertainty abroad, especially in the US. Further, today, more evidence of rising demand abroad and its favorable impact for Japan came in the January trade data. Exports were up 3.3% from December, the largest monthly increase since the Spring of 2004. Sales to China were strongest on a year-over-year basis, but shipments to other Asian and Middle Eastern trading partners also showed notable growth.

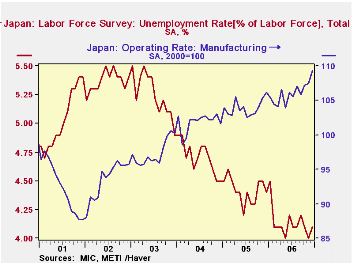

These favorable demand developments are promoting gains in usage of resources in Japan, noted by the Bank as sources of price pressure "over the longer term", precisely what concerns it most. As seen in the final graph, industrial capacity utilization in manufacturing reached 109.3 in December (2000=100), the highest since late 1991. Unemployment has steadied, hovering just above 4%. All of 2006 averaged 4.1%, the lowest yearly figure since 1998.

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates