Global| Aug 24 2007

Global| Aug 24 2007Borrowing at the Fed: Some Arithmetic

Summary

A further clarification on the borrowings data reported late yesterday by the Federal Reserve. There's some confusion over whether any banks borrowed earlier in the week or if it was just the four large banks who announced they were [...]

A further clarification on the borrowings data reported late yesterday by the Federal Reserve. There's some confusion over whether any banks borrowed earlier in the week or if it was just the four large banks who announced they were borrowing on Wednesday.

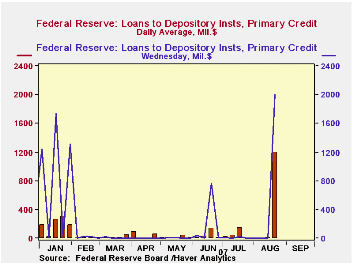

The Fed's "Factors Affecting Bank Reserves" H.4.1 release includes two measures for these factors, the daily average for the 7-day week ended each Wednesday and the amount outstanding on Wednesday at the close of business. The average amount of "Primary Credit" for the entire week ended August 22 was $1,200 million. The amount outstanding Wednesday night was $2,001 million. The Fed doesn't publish these figures for each day. We can, though, use the ones we have to address the general question, was there borrowing before Wednesday?

Take the $1,200 million average for the week. Multiply by 7 to obtain the aggregate amount of daily borrowing for the whole week; this is $8,400 million. Subtract the amount outstanding Wednesday night, $2,001 million, leaving $6,399 million. Divide this by the remaining days of the week, 6, and see that there indeed was an average $1,067 million every day before Wednesday. This is a not inconsiderable amount, given that there had been only $11 million of primary credit on average during the week before. We have no idea what days saw the most, who those borrowers might have been or even what Fed district they are in. But there was in fact noticeable borrowing prior to Wednesday and it looks to us that it was large enough that it probably came from a number of institutions.

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates