Global| Oct 13 2017

Global| Oct 13 2017British Chamber of Commerce Survey Shows Manufacturing/Service Sector Divide

Summary

The British Chamber of Commerce quarterly survey features separate readings on the manufacturing and service sectors. We feature the manufacturing and services data in the table but the chart only the manufacturing data. If I use [...]

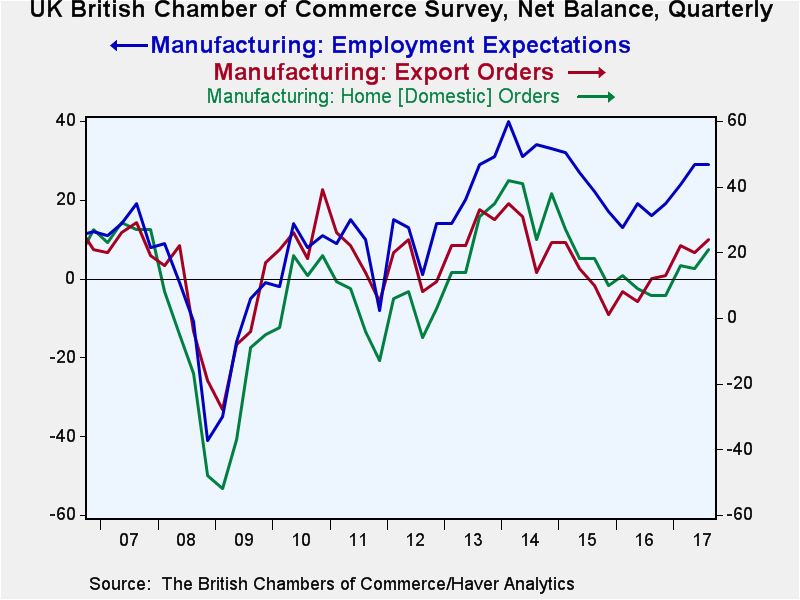

The British Chamber of Commerce quarterly survey features separate readings on the manufacturing and service sectors. We feature the manufacturing and services data in the table but the chart only the manufacturing data.

The British Chamber of Commerce quarterly survey features separate readings on the manufacturing and service sectors. We feature the manufacturing and services data in the table but the chart only the manufacturing data.

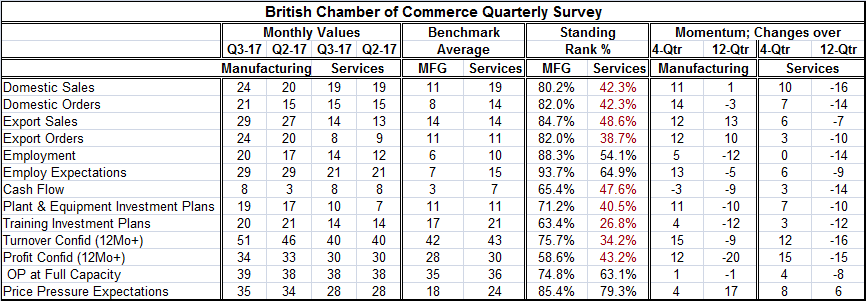

If I use sales as the overarching summary measure of a sector, manufacturing is doing pretty well. Manufacturing sales edged up to a net diffusion reading of 24 in Q3 from 20 in Q2 to stand at the 80th percentile of its historic ranking of such net readings at more than double its average. That is a reasonably strong and quite solid standing. The reading on sales is 11 net points higher over four quarters, but it is only one point higher than it was 12 quarters ago.

Compared to services, manufacturing looks stunningly strong. Service sector sales have a net reading in Q3 of 19, unchanged from Q2. The services sales reading standing is below its historic median at a percentile rank standing in its 42nd percentile, but is still right on top of its historic average. Over the last four quarters, service sector sales are up by 10 net points, about the same gain as for manufacturing. But the services sector is 17 net points lower than it was two years ago and 16 net points lower than it was three years ago. The services sector may have some short-term momentum that is reasonably good, but its standing is still poor. The level of activity in the services sector is weak. And on the same metrics offered up for the manufacturing sector, services are below their respective component medians for 9 of those 13 measures. Only the employment measures, capacity and price pressure components have readings above their historic medians in services.

The British economy is not doing anywhere near as well as the manufacturing data portray. Neither is the economy as stagnant as the services sector data say. Still, the services sector is the jobs sector and its influence on the entire economy will carry more weight for that reason alone. Fortunately, the employment readings are one of the 'high points' in the services sector. What 'sticks out' in both surveys is that the standing of the labor market is among the strongest readings in both the manufacturing and services surveys. There is no clear reason why that component should be strongest since we would generally expect the industries' treatment of labor would be in line with their economic performance. Of course, we know that in a downturn labor tends to be more protected than other economic variables. Sales and orders will fall more than employment will in a downturn as firms are reluctant to let labor go so readily.

However, as to momentum, there is more 4-quarter momentum in both manufacturing and service sector sales and orders than in employment although expected employment generally tracks better with orders and sales.

Neither sector sees much tension in their full capacity assessments. Still both manufacturing and services have relatively elevated assessments of price pressures. The U.K. has some excess inflation currently, but it is mostly from import prices as wages have continued to lag behind price gains. On balance, the survey does not give the Bank of England much guidance for policy. It seems to show a divided economy in terms of performance in its goods and services sectors. And while the last four quarters show strong momentum for sales and orders in both sectors, the comparison of the sales and orders to eight and twelve quarters ago shows a much less favorable view of the economy underlining the weak standings within the services sector.

The U.K. still faces the unknown of Brexit and the negotiations are really having a hard time making progress. The EU seems to be dogmatically serious about the U.K. paying and while the U.K. has always contended it would pay its fair share, what this seemingly agreeable rhetoric obscures is what each side views as fair and equitable. The EU wants to nail down the amount first and EU officials act as though the number is set in stone while the British side clearly views it and other things as matters for negotiation. The amount that the U.K. owes is not separate from the negotiations and it is not a cut of meat from a sacred cow. So Brexit continues to hang in the balance and to obscure the future. While there has been some momentum in plant and equipment investment in both manufacturing and in the services sector, the service sector standing for this activity is in its 40th percentile while in manufacturing it is in its low 70th percentile. And investment as well in training is not going to take hold until the future gets cleared up and on that front the Brexit negotiations seem to swirl around and around without making much progress. The European leaders can say as much as they want that they are not trying to torture Britain, but clearly they are.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.