Global| Oct 30 2020

Global| Oct 30 2020Business Activity Slips in October

Summary

• Employment remains weak. The Chicago Purchasing Managers Business Barometer eased to 61.1 during October from 62.4 in September, but the sharp improvement from the May low of 32.3 is largely intact. Note that a reading above 50 [...]

• Employment remains weak.

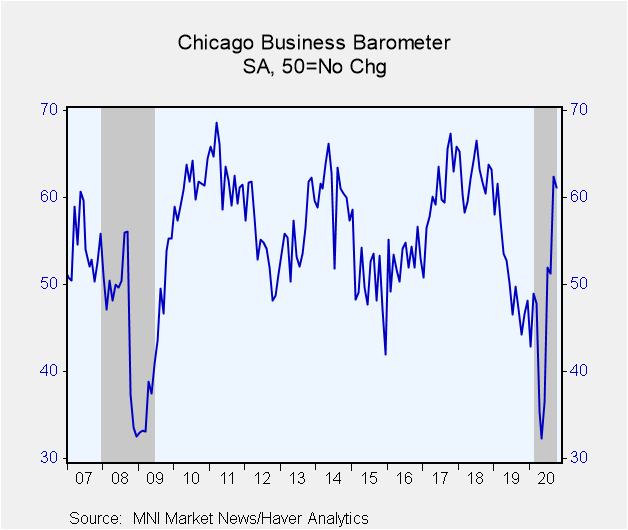

The Chicago Purchasing Managers Business Barometer eased to 61.1 during October from 62.4 in September, but the sharp improvement from the May low of 32.3 is largely intact. Note that a reading above 50 suggests rising activity in the Chicago area.

Haver Analytics constructs an ISM-Adjusted Chicago Business Barometer with similar methodology to the ISM Composite Index. This measure dropped to 56.7 from 58.7 in September.

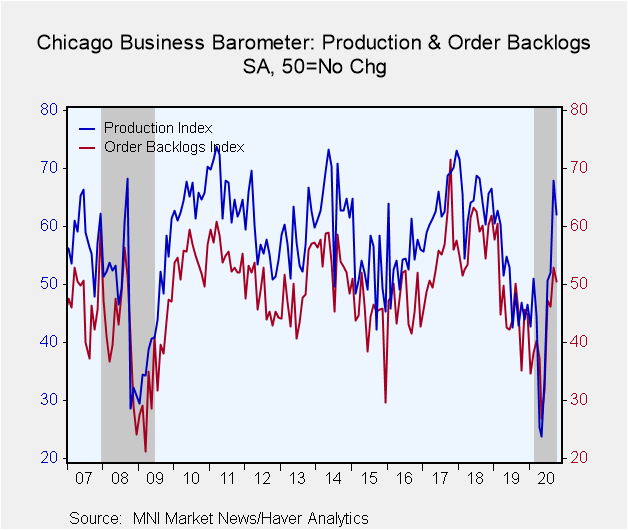

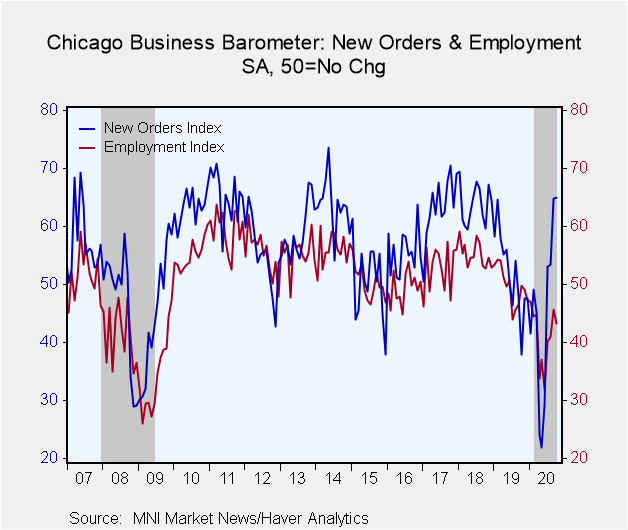

New Orders was the only category showing an uptick, albeit small, to 65 in October compared to 64.9 in September, while the production measure slipped to 62.1 from 67.9 in September. The report noted mixed signals from firms, with some describing a drop in demand while others seeing a stable level of orders and production.

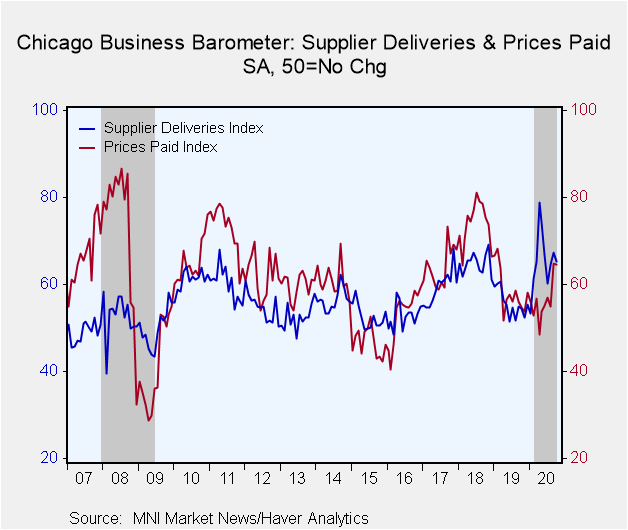

Orders backlogs eased to 50.5 during October, down from 52.9 in September, and inventories were little changed at 47.7 from the 47.8 in September. Supplier deliveries declined to 65.3 from 67.4 in September, but remain elevated reflecting the current crisis.

Employment remains weak, with a reading of 43.2 down from 45.7 in September and well below the 50 level. Firms reported staff reductions related to the pandemic.

Factory prices kept largely stable in October, easing only slightly to 64.6 from 64.7 in September.

The MNI Chicago Report is produced by MNI in partnership with ISM-Chicago. The survey is collected online each month from manufacturing and non-manufacturing firms in the Chicago area. Summary data are contained in Haver's USECON database, with detail including the ISM-style index in the SURVEYS database.

| Chicago Purchasing Managers Index (%, SA) | Oct | Sep | Aug | Oct '19 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| General Business Barometer | 61.1 | 62.4 | 51.2 | 44.3 | 51.3 | 62.4 | 60.8 |

| ISM-Adjusted General Business Barometer | 56.7 | 58.7 | 49.7 | 47.1 | 51.4 | 60.8 | 59.0 |

| Production | 62.1 | 67.9 | 52.0 | 46.9 | 51.2 | 64.5 | 64.2 |

| New Orders | 65.0 | 64.9 | 53.5 | 37.9 | 52.0 | 63.8 | 63.4 |

| Order Backlogs | 50.5 | 52.9 | 46.2 | 35.2 | 46.9 | 58.0 | 55.2 |

| Inventories | 47.7 | 47.8 | 37.3 | 46.3 | 48.7 | 55.4 | 54.9 |

| Employment | 43.2 | 45.7 | 41.1 | 49.8 | 49.6 | 55.3 | 52.9 |

| Supplier Deliveries | 65.3 | 67.4 | 64.5 | 54.5 | 55.6 | 64.8 | 59.4 |

| Prices Paid | 64.6 | 64.7 | 55.0 | 54.8 | 58.5 | 73.9 | 64.0 |

Kathleen Stephansen, CBE

AuthorMore in Author Profile »Kathleen Stephansen is a Senior Economist for Haver Analytics and an Independent Trustee for the EQAT/VIP/1290 Trust Funds, encompassing the US mutual funds sponsored by the Equitable Life Insurance Company. She is a former Chief Economist of Huawei Technologies USA, Senior Economic Advisor to the Boston Consulting Group, Chief Economist of the American International Group (AIG) and AIG Asset Management’s Senior Strategist and Global Head of Sovereign Research. Prior to joining AIG in 2010, Kathleen held various positions as Chief Economist or Head of Global Research at Aladdin Capital Holdings, Credit Suisse and Donaldson, Lufkin and Jenrette Securities Corporation.

Kathleen serves on the boards of the Global Interdependence Center (GIC), as Vice-Chair of the GIC College of Central Bankers, is the Treasurer for Economists for Peace and Security (EPS) and is a former board member of the National Association of Business Economics (NABE). She is a member of Chatham House and the Economic Club of New York. She holds an undergraduate degree in economics from the Universite Catholique de Louvain and graduate degrees in economics from the University of New Hampshire (MA) and the London School of Economics (PhD abd).

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates