Global| Jun 26 2007

Global| Jun 26 2007Business and Consumer Confidence in Italy and the Netherlands

Summary

The Netherlands released June data on consumer and business confidence today and Italy released data on business confidence, having released data on consumer confidence last week. In Italy confidence is expressed as an index with [...]

The Netherlands released June data on consumer and business confidence today and Italy released data on business confidence, having released data on consumer confidence last week. In Italy confidence is expressed as an index with 2000=100 while in the Netherlands it is measured by the percent of optimists over the percent of pessimists.

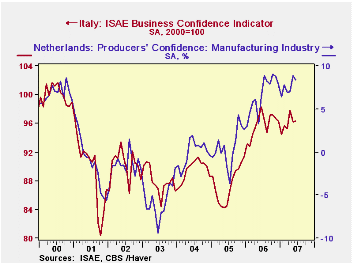

Business confidence in both countries showed little change in the month of June. In Italy it was a little stronger--96.3 vs. 96.2--and in the Netherlands, a little weaker--8.5% vs. 8.9%. However, it appears that the level of business confidence is higher in the Netherlands than in Italy. The first chart compares the two measures of business confidence since 2000 when both measures were at historical highs. Business confidence in the Netherlands is above its 2000 highs while business confidence in Italy is still below its 2000 highs.

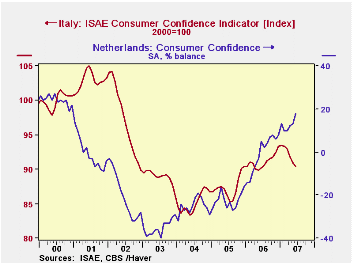

A different picture emerges when consumer confidence is compared between the two countries. Dutch consumer confidence rose by five percentage points in June while Italian consumer confidence fell by 2.1%. Over the longer period, however, until early 2006, Italian consumers were more optimistic than their Dutch counterparts. It has only been since then that Dutch consumers have become more confident than Italian consumers as can be seen in the second chart.

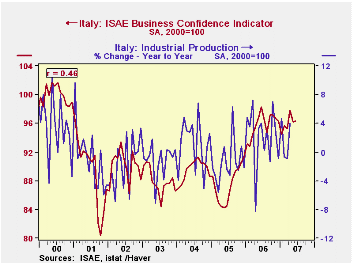

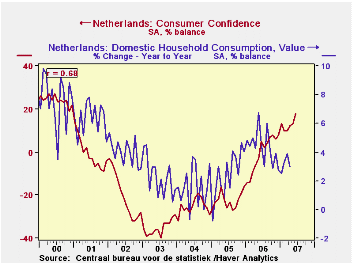

Confidence measures do have an impact on consumer and business behavior, however, the connection is tentative at best. To illustrate the point we plot the year to year changes in the series, Monthly Household Consumption for the Netherlands and the consumer confidence measure in the third chart. The correlation (R) between the two series is 68%. The R-square is 46%, which means that the confidence measure explains about 46% of the variations in the two series. We also plot the year to year change in Italian industrial production and the Italian business confidence indicator in the fourth. In this case, the correlation and R-square are even lower, 46% and 21%.

| CONFIDENCE MEASURES | Jun 07 | May 07 | Jun 06 | M/M | Y/Y | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|---|

| Italy (2000=100) | ||||||||

| Business Confidence | 96.3 | 96.2 | 98.3 | 0.10 | -2.03 | 65.8 | 87.5 | 89.5 |

| Consumer Confidence | 107.2 | 109.4 | 107.0 | -2.10 | 0.19 | 108.7 | 104.2 | 101.5 |

| Netherlands (% Balance) | ||||||||

| Business Confidence | 8.4 | 8.9 | 6.4 | -0.5 | 2 | 6.7 | 0.6 | -0.1 |

| Consumer Confidence | 18 | 13 | 5 | 5 | 13 | -1 | -22 | -25 |

by Robert Brusca June 26, 2007

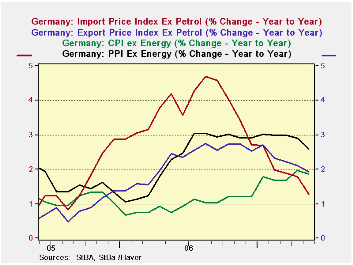

German export and import inflation is less more subdued than are domestic trends.

German export and import prices excluding energy flared to peaks in the second half of 2006. But now as they subside, it is Germany domestic excluding energy inflation that has flared.

German PPI prices excluding energy has flared in early 2007 then showed some sign of settling down. It is the German CPI where prices look to be still building. By May nonpetroleum import prices were rising at the same pace as CPI ex energy prices. The CPI ex-energy seems to have peaked in May but not yet declined.

| % m/m | % SAAR | ||||||

| SA | May-07 | Apr-07 | Mar-07 | 3-Mo | 6-Mo | 12-Mo | Yr-Ago |

| Export Prices | 0.3% | 0.2% | 0.0% | 1.9% | 1.5% | 1.8% | 2.7% |

| Import Prices | 0.3% | 0.8% | -0.1% | 4.2% | 1.5% | 0.6% | 7.5% |

| NSA | |||||||

| Exports excl Petroleum | 0.1% | 0.3% | 0.1% | 1.9% | 1.5% | 1.9% | 2.5% |

| Imports excl Petroleum | 0.0% | 0.3% | 0.1% | 1.6% | 0.6% | 1.3% | 4.2% |

| Memo: SA | |||||||

| CPI | 0.2% | 0.4% | 0.3% | 3.6% | 2.7% | 1.9% | 1.9% |

| CPI excl Energy | 0.1% | 0.4% | 0.1% | 2.2% | 1.9% | 1.9% | 0.7% |

| PPI | 0.3% | 0.1% | 0.2% | 2.4% | 1.5% | 1.9% | 6.2% |

| PPI excl Energy | 0.2% | 0.4% | 0.1% | 2.6% | 2.2% | 2.6% | 2.3% |

by Robert Brusca June 26, 2007

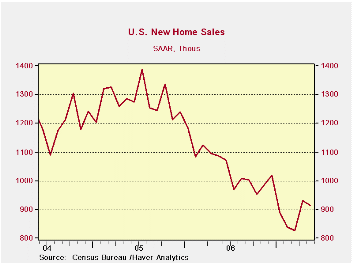

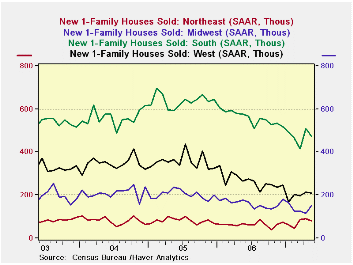

Housing is still in the grip of a downtrend but prices are not plunging or even weakening further nor are sales trends worsening; in fact, they are showing some signs of stability. Housing rebounded in April and maintained most of its gain in May - a good sign for the sector. Question: How bad is this??

A tale of two suburbs? Maybe it’s not of two cities but definitely a tale of two suburbs – one affluent and one not. Average house prices are up and strongly at 6.5% year/year. Yes, some of that owes to a weak result a year ago, but not all of it. And year/year price declines for new homes are not very common. Median prices are off for two months running and the last year/year decline was in September of 2006. For average prices, they fell year/year in April 2007; they last fell year/year in November 2006. Obviously high-priced homes are faring better in this housing cycle.

Stability in sales by region is shown in the table below.

| Momentum: Annualized Rates Of Change | Prices | ||||||

| As of: | Total | Northeast | Midwest | South | West | Median | Average |

| May.07 | Month-to-month percent change | ||||||

| May.07 | -1.6% | -11.0% | 30.8% | -7.3% | -1.9% | 1.5% | 4.5% |

| Apr.07 | 12.5% | 3.4% | -7.9% | 22.7% | 8.1% | -9.9% | -7.9% |

| Mar.07 | -1.5% | 91.3% | 0.0% | -10.2% | -3.9% | 3.0% | 1.2% |

| Annualized Rates | |||||||

| Total | Northeast | Midwest | South | West | Median | Average | |

| 3-Mo | 35.7% | 304.3% | 81.9% | 8.7% | 7.8% | -21.5% | -10.2% |

| 6-Mo | -14.6% | 53.1% | 4.0% | -23.9% | -23.6% | -3.3% | 15.1% |

| 1-Yr | -15.8% | 19.1% | -14.5% | -17.9% | -21.1% | -0.9% | 6.5% |

by Robert Brusca June 26, 2007

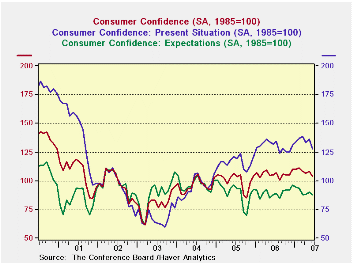

The present situation index is doing its leap frog advance thing and this month is one of its landing hops not an advancing hop. Expectations have moved to a weak flat-lining mode as they often do at mature stages of an expansion. If we did not have HIGH gas prices to blame we might be worried about this…

But what we do have is improving regional MFG surveys and evidence of still strong job growth. We do not have the accompanying signs that would make us really worried. My take on housing is that its declines are less severe; some regions are showing erratic advances and new home prices even rose 6% Yr/Yr. It hardly seems like all the news is bad. But then I’m not on anti-depressants and I don’t work at a firm that is up to its eyeballs in sub-prime paper. OK the high gas prices were a bummer. But the economic news is generally improving.

Still, many regions of the country are just having a real tough time – see table below.

The East North Central region is in bad shape AKA the rust belt. Old industry and auto sector troubles are raging in these states where current conditions, the strong reading of the trio, is some 20% lower than its level at end of the last recession. New England and the West North Central states are also laggards. But most regions are 20% above those lows with the Western Mountain States and the Pacific States considerably better off. Moreover, this month took all the regional readings down hard except New England.

While the regional reports look pretty glum, the responses arrayed by category do not. The confidence index is still in the top 15% of its post- recession range, as is the present situation. Expectations are weaker, in the 54th percentile of their range (see below).

As for survey components, business conditions in the present situation are in the top 20% of their range as is employment. For expectations, the percentiles are obviously lower: 48th percentile for business conditions expected, 49th percentile for employment conditions expected and 43rd percentile for income expected. Buying plans are low especially for houses, the bottom 10 percentile of their range. However, nearly everybody is planning to buy an appliance as that gauge stands in the 95th percentile of its range.

What we have is a weak month for confidence. The weakness still has not driven the levels of the index to a depressing state, it was just a large monthly decline. Now we look to the future to see if the weakness unwinds and how rapidly.

| Regional Confidence from Oct-03 to Jan-07 | % Above | % Below | ||||||

| Jun-07 | May-07 | Yr Ago | % Y/Y | Recsn-End | Pre-Recsn | Recsn-End | Pre-Recsn | |

| New England | 116.9 | 113.8 | 114.8 | 1.8% | 112.3 | 207.1 | 4.1% | -43.6% |

| MidAtlantic | 106.9 | 117.0 | 101.8 | 5.0% | 88.7 | 150.7 | 20.5% | -29.1% |

| East North Central | 73.9 | 86.3 | 81.0 | -8.8% | 92.8 | 175.6 | -20.4% | -57.9% |

| West North Central | 131.5 | 136.0 | 130.2 | 1.0% | 126.9 | 172.8 | 3.6% | -23.9% |

| South Atlantic | 129.5 | 144.3 | 134.5 | -3.7% | 106.1 | 178.9 | 22.1% | -27.6% |

| East South Central | 113.6 | 130.5 | 122.7 | -7.4% | 92.5 | 146.9 | 22.8% | -22.7% |

| West South Central | 138.0 | 167.4 | 146.4 | -5.7% | 113.2 | 177.2 | 21.9% | -22.1% |

| Mountain | 151.8 | 177.4 | 156.7 | -3.1% | 108.7 | 178.9 | 39.7% | -15.1% |

| Pacific | 145.9 | 167.4 | 149.9 | -2.7% | 87.9 | 169.7 | 66.0% | -14.0% |

| Pre-recession is 1998-2000 | ||||||||

| Percentage of Regions with confidence improving | ||||||||

| CurrCond improving | Jun-07 | May-07 | Apr-07 | Mar-07 | Nov-06 | Oct-06 | Sep-06 | Aug-06 |

| MO/MO or as noted | 11.1% | 66.7% | 11.1% | 55.6% | 88.9% | 22.2% | 55.6% | 33.3% |

| Current | Max/Oct'03 | Min/Oct'03 | Year Ago | Percentile | |

| Confidence Index | 103.9 | 111.2 | 61.4 | 105.4 | 85.3% |

| Present Situation | 127.9 | 138.5 | 59.7 | 132.2 | 86.5% |

| Expectations | 87.9 | 110.2 | 61.4 | 87.5 | 54.3% |

| Jun-07 | Percentile standing | ||||

| Diffusion | Overall | Good | Bad | Normal | |

| Present Situation | -- | 86.5% | -- | -- | -- |

| Business Conditions | 55.5 | 80.5% | 85.7% | 11.5% | 36.9% |

| Employment | 53.0 | 79.3% | 83.8% | 12.6% | 18.6% |

| Expectations | -- | 54.3% | -- | -- | -- |

| Business Conditions | 52.6 | 38.8% | 20.7% | 34.8% | 68.7% |

| Employment | 48.5 | 49.2% | 20.7% | 34.8% | 68.7% |

| Income | 55.0 | 43.8% | 42.0% | 23.0% | 71.6% |

| Buying plans | |||||

| Automobile | -- | 34.1% | -- | -- | -- |

| House | -- | 10.5% | -- | -- | -- |

| Major Appliance | -- | 96.9% | -- | -- | -- |

| Percentile of range since Oct 2003 to date. 100% is High; 0% is Low | |||||