Global| Nov 27 2007

Global| Nov 27 2007Business Climate Perks up in France

Summary

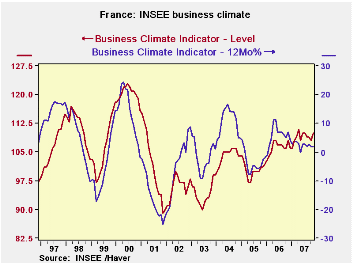

Frances business climate improved to an index reading of 110 in November from 108 in October. The gain, like the rise in the German IFO index was unexpected. Still the index has moderated as the level reading has flattened out and [...]

France’s business climate improved to an index reading of 110 in November from 108 in October. The gain, like the rise in the German IFO index was unexpected. Still the index has moderated as the level reading has flattened out and the percentage gain reading shows a slowdown is still in effect. The climate index sits firmly at the 74th percentile mark of its range. The production trends and likely trend readings are also firm in their ranges in their 59th and 79th range percentiles, respectively. Orders are in about the same relative standing in the 74th percentile of their range and foreign orders are in the 69th percentile of their range..

The bounce in the French and German industrial sentiment gauges in November is curious especially as the euro moves higher and there have been concerns voiced of what a strong euro might do to growth. Still the rises in these two industrial gauges were small and they have not reversed the trends to weaker readings that had been in force. A stronger exchange rate is a good thing in many respects since it increases purchasing power and helps to fight off inflation. But so far in EMU the inflation numbers have stayed troublesome and even gotten worse, at least they have for Germany.

| Since Jan 1990 | Since Jan 1990 | |||||||||

| Nov-07 | Oct-07 | Sep-07 | Aug-07 | Percentile | Rank | Max | Min | Range | Mean | |

| Climate | 110 | 108 | 109 | 109 | 74.0 | 40 | 123 | 73 | 50 | 101 |

| Production | ||||||||||

| Recent Trend | 3 | 10 | 6 | 11 | 59.8 | 78 | 44 | -58 | 102 | -6 |

| Likely trend | 43 | 34 | 32 | 33 | 79.2 | 6 | 63 | -33 | 96 | 7 |

| Orders/Demand | ||||||||||

| Orders & Demand | 3 | -1 | 1 | 1 | 74.7 | 30 | 25 | -62 | 87 | -15 |

| Foreign Orders & Demand | 4 | 3 | 10 | 8 | 69.7 | 51 | 31 | -58 | 89 | -11 |

| Prices | ||||||||||

| Likely Sales Prices Trend | 9 | 9 | 13 | 11 | 68.1 | 29 | 24 | -23 | 47 | 0 |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates