Global| Jun 27 2006

Global| Jun 27 2006Business Confidence in Europe Still Strong in Spite of Euro Strength, High Oil Prices and Rising Interest Rates

Summary

Germany, Italy and the Netherlands reported increased business confidence today. We noted yesterday that confidence in Belgium had also increased. France is the only Euro Zone country that, so far, has seen a decline in business [...]

Germany, Italy and the Netherlands reported increased business confidence today. We noted yesterday that confidence in Belgium had also increased. France is the only Euro Zone country that, so far, has seen a decline in business confidence.

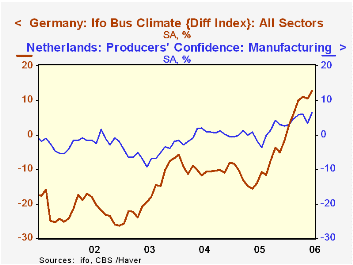

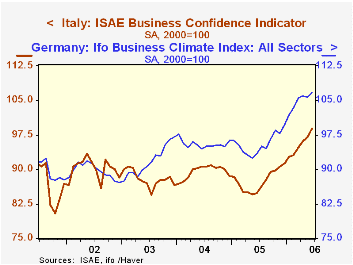

The German IFO measure of business confidence rose 1.0% from 105.7 to 106.8 (2000=100) in June, the highest level since February, 1991. In terms of the diffusion index the excess of optimists over pessimists rose 2.3 percentage points from 10.4% in May to 12.7% in June. In the Netherlands, where business confidence is measured by the excess of optimists over pessimists, the percent balance rose 3.1 percentage points from 3.3% to 6.4%. The first chart compares the percent balances indicators for Germany and the Netherlands. Business confidence in Italy, which has been lower than that in Germany, rose by almost 2% in June from May to reach 98.9 (2000=100), the highest level since December, 2000. The second chart compares the indexes of business confidence in Germany and Italy.

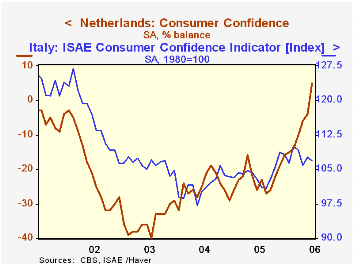

Italy and the Netherlands also reported on consumer confidence. The Italian consumer lost some confidence as the indicator of consumer confidence fell 0.7% from 107.1 (2000=100) in May to 106.8 in June. The Dutch consumer, on the contrary, became more optimistic in June as the optimists exceeded the pessimist by 5% in contrast to May when the pessimists exceeded the optimists by 4%. The third chart compares consumer confidence in Italy and in the Netherlands.

The rise in business confidence in these countries has occurred in spite of strength in the euro, continued high oil prices and the likelihood of a rise in the European Central Bank's main lending interest rate. It may be that the biggest threat to confidence is the possibility of greater than expected increases in ECB's lending rate. The rate is currently 2.75%, having risen by from the low 2% in three increments of 25 basis points in December of last year and in March and June of this year. In the past week six council members of the ECB have hinted that the bank may accelerate interest rate increases to combat inflationary pressures. And just today, in its Annual Report the Bank of International Settlements (BIS) called on central bankers to raise interest rates to combat these same global inflationary pressures.

| Confidence Measures | Jun 06 | May 06 | Jun 05 | M/M % | Y/Y % | 2005 | 2004 | 2003 |

|---|---|---|---|---|---|---|---|---|

| Germany Business Confidence | ||||||||

| Index (2000=100) | 106.8 | 105.7 | 93.3 | 1.04 | 14.47 | 95.5 | 95.5 | 91.8 |

| % Balance | 12.7 | 10.4 | -14.1 | 2.3* | 24.5* | -9.7 | -9.9 | -17.2 |

| Italy Business Confidence (2000=100) | 98.9 | 92.0 | 84.8 | 1.96 | 16.62 | 87.5 | 89.5 | 87.9 |

| Italy Consumer Confidence (2000=100) | 106.8 | 107.6 | 102.9 | -0.74 | 3.79 | 104.2 | 101.4 | 106.1 |

| Netherlands Business Confidence (% Balance | 6.4 | 3.3 | -1.7 | 3.1* | 8.1* | 0.6 | -0.1 | -5.6 |

| Netherlands Consumer Confidence (% Balance) | 5 | -4 | -26 | 9* | 31* | -22 | -25 | -35 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates