Global| Oct 15 2010

Global| Oct 15 2010Business Inventories Expand, Continuing Realignment with Growing Sales

Summary

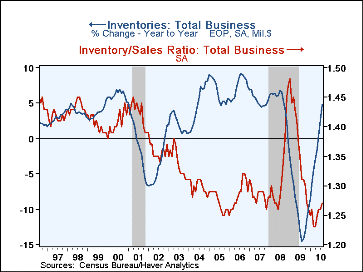

Businesses continued to add inventories in August, and the inventory/sales ratio made it to 1.27, the highest since November 2009. Total stocks were up 0.6% in August, following July's 1.1% gain. This sum of manufacturers, wholesalers [...]

Businesses continued to add inventories in August, and the inventory/sales ratio made it to 1.27, the highest since November 2009. Total stocks were up 0.6% in August, following July's 1.1% gain. This sum of manufacturers, wholesalers and retailers stocks was up 4.7% from a year ago. However, that perhaps can be seen as something of an exaggeration, since last August saw the "cash-for-clunkers" reductions in vehicle inventories. At the same time, excluding the motor vehicle inventories at both retail and wholesale, the total remainder shows stocks are still up 3.4% from their year-earlier level.

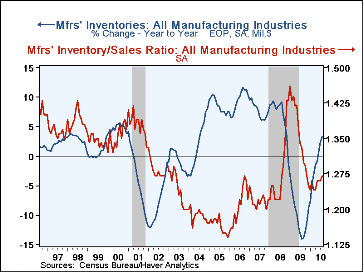

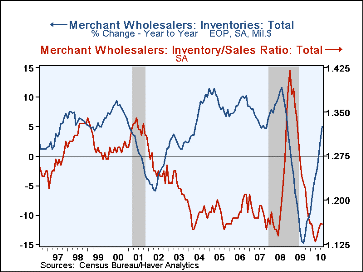

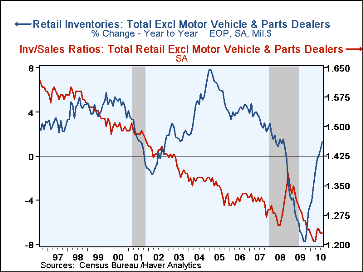

By stage of distribution, manufacturers' stocks were little changed in August, edging up just 0.1% after July's slightly revised 0.9% increase (originally 1.0%). Wholesalers, though, had an 0.8% gain in August after an upwardly revised 1.5% in July (originally 1.3%). Retailers added 1.0% to their stocks in August after 1.0% in July and 1.1% in June. Excluding motor vehicle dealers, other retailers' inventories were up just 0.2% as sales at those stores gained 1.0%, this restrained the growth of inventory perhaps to less than managers would intend. Thus, as Tom Moeller pointed out here last month, more inventory gains could be in prospect in subsequent reports, as merchants work to get the relationship of inventories to sales back up from its recent historic lows.

The business sales and inventory data are available in Haver's USECON database. Note that in a value-added feature, the database includes series calculated by Haver database managers showing sales, inventories and I/S ratios for total business less motor vehicle dealers and related wholesale operations.

| Business Inventories (%) | August | July | June | August Y/Y |

2009 | 2008 | 2007 |

|---|---|---|---|---|---|---|---|

| Total | 0.6 | 1.1 | 0.5 | 4.7 | -9.8 | 0.8 | 4.0 |

| Retail | 1.0 | 1.0 | 1.1 | 6.1 | -10.4 | -3.3 | 2.5 |

| Retail ex Motor Vehicles | 0.2 | 0.1 | 0.1 | 1.3 | -4.9 | -1.9 | 2.7 |

| Wholesale | 0.8 | 1.5 | 0.3 | 5.0 | -10.5 | 3.7 | 6.4 |

| Manufacturing | 0.1 | 0.9 | 0.1 | 3.3 | -8.8 | -0.8 | 7.6 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates