Global| Jul 15 2016

Global| Jul 15 2016Business Inventories Rise Further in May; Sales Slow

by:Sandy Batten

|in:Economy in Brief

Summary

Total business inventories edged up 0.2% m/m (1.0% y/y) following an unrevised 0.1% m/m increase in April. Total business sales slowed to a 0.2% m/m rise (-1.4% y/y) in May after a 0.8% m/m jump in April (revised down slightly from [...]

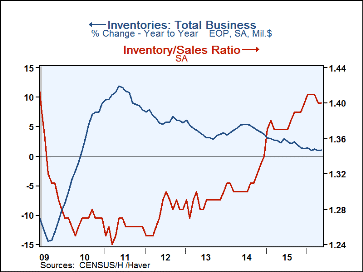

Total business inventories edged up 0.2% m/m (1.0% y/y) following an unrevised 0.1% m/m increase in April. Total business sales slowed to a 0.2% m/m rise (-1.4% y/y) in May after a 0.8% m/m jump in April (revised down slightly from the initially reported 0.9% m/m gain).

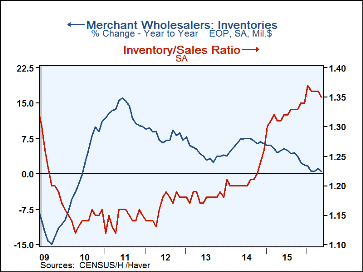

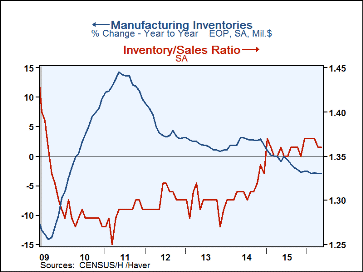

The new information in today's release was for retail inventories. Manufacturing and wholesale inventories had already been reported. Manufacturing inventories were down 0.1% in May (their eleventh consecutive monthly decline) while wholesale inventories edged up 0.1% m/m, their third consecutive monthly increase following five consecutive monthly declines.

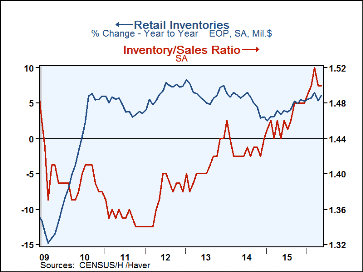

Retail inventories rose 0.5% m/m in May (6.0% y/y) after an unexpected 0.1% m/m decline in April. Before the April decline, retail inventories had risen for ten consecutive months. In May, retail inventories excluding motor vehicles and parts rose 0.4% m/m (3.4% y/y) with increases across all major categories. Inventories of motor vehicles and parts jumped 0.7% m/m in May after having been unchanged in April.

Sales were generally up across sectors in May. Retail sales added a 0.2%m/m gain in May (revised down from the initially reported 0.4% m/m increase) to the 1.4% m/m jump recorded in April. Adding the June figure for retail sales (a 0.6% m/m increase reported today separately from this release), retail sales in the second quarter were up 6.2% at an annual rate from the first quarter, pointing to a sharp rebound in household consumption in 2Q from the weak performance in 1Q. Wholesale sales rose a solid 0.5% m/m in May after a downwardly revised 0.8% m/m gain in April, their third consecutive significant increase after four straight monthly declines. Manufacturing sales were essentially unchanged in May from April, after solid gains in March (+0.3% m/m) and April (+0.4% m/m).

The inventory-to-sales ratio in the business sector remained at 1.40 in May. In April, it had edged down from 1.41, the highest since the economy exited recession in 2009. Inventory-to-sales ratios were also unchanged in May from April for retailers (1.50) and manufacturers (1.36)-but again down from February/March levels that were the highest in the current economic expansion. The inventory-to-sales ratio for wholesalers edged down to 1.35 in May from 1.36 in April, its fourth consecutive unchanged or lower monthly reading.

The manufacturing and trade data are in Haver's USECON database.

| Manufacturing & Trade | May | Apr | Mar | May Y/Y | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|---|---|

| Business Inventories (% chg) | 0.2 | 0.1 | 0.3 | 1.0 | 1.3 | 3.7 | 3.9 |

| Retail | 0.5 | -0.1 | 0.9 | 6.0 | 5.3 | 3.1 | 7.4 |

| Retail excl. Motor Vehicles | 0.4 | -0.2 | 0.1 | 3.4 | 4.1 | 2.6 | 4.8 |

| Merchant Wholesalers | 0.1 | 0.7 | 0.2 | 0.5 | 1.9 | 6.5 | 4.0 |

| Manufacturing | -0.1 | -0.1 | -0.1 | -3.0 | -2.6 | 1.8 | 1.0 |

| Business Sales (% chg) | |||||||

| Total | 0.2 | 0.8 | 0.2 | -1.4 | -2.6 | 2.8 | 2.9 |

| Retail | 0.2 | 1.4 | -0.3 | 1.8 | 1.6 | 3.9 | 3.8 |

| Retail excl. Motor Vehicles | 0.4 | 0.9 | 0.5 | 2.1 | 0.2 | 3.2 | 2.6 |

| Merchant Wholesalers | 0.5 | 0.8 | 0.6 | -2.5 | -4.3 | 3.6 | 3.1 |

| Manufacturing | 0.0 | 0.4 | 0.3 | -3.2 | -4.4 | 1.2 | 2.1 |

| I/S Ratio | |||||||

| Total | 1.40 | 1.40 | 1.41 | 1.37 | 1.38 | 1.31 | 1.29 |

| Retail | 1.50 | 1.50 | 1.52 | 1.44 | 1.46 | 1.43 | 1.41 |

| Retail excl. Motor Vehicles | 1.28 | 1.28 | 1.29 | 1.26 | 1.27 | 1.24 | 1.23 |

| Merchant Wholesalers | 1.35 | 1.36 | 1.36 | 1.31 | 1.32 | 1.21 | 1.18 |

| Manufacturing | 1.36 | 1.36 | 1.37 | 1.36 | 1.36 | 1.31 | 1.30 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates