Global| Jan 17 2006

Global| Jan 17 2006Canadian Business Expects Further Increases in Sales, but Sees More Difficulty in Meeting Demand

Summary

Canadian firms remain optimistic regarding the business outlook according to the latest Business Outlook Survey of the Bank of Canada that was released today. The Bank conducts interviews with the senior management of about 100 [...]

Canadian firms remain optimistic regarding the business outlook according to the latest Business Outlook Survey of the Bank of Canada that was released today. The Bank conducts interviews with the senior management of about 100 companies, selected in accordance with the composition of Canada's gross domestic product. Topics discussed include the companies' views on such factors as the outlooks for the economy and inflation, plans for investments and pressures on production capacity and labor shortages. According to the Bank, "The method of sample selection ensures a good cross-section of opinion. Nevertheless, the statistical reliability of the survey is limited, given the small sample size."

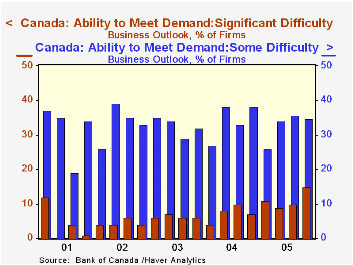

The excess of those who think future sales will be higher over those who think they will be lower rose to 15.84% in the fourth quarter of 2005 from 13.86% in the third quarter and was 7.92 percentage points above the excess in the fourth quarter of 2004. Along with a higher balance of opinion on the sales outlook, there has been and increase in the proportion of respondents who expect to incur difficulties in meeting demand. Those expecting some difficulty declined slightly to 34.70% in the fourth quarter from 35.60% in the third and was 3.30 percentage points below the fourth quarter of 2004. However, those expecting significant difficulty rose to 14.90% in the fourth quarter from 9.90% in the third quarter and from 7.00% in the fourth quarter of 2004. The increases in those expecting some, and those expecting significant, difficulty in meeting demand are shown in the first chart.

In spite of the increase in those expecting significant difficulty in meeting demand, the balance of opinion regarding for investment in machinery and equipment declined slightly in the fourth quarter and was 2.78 percentage points below the fourth quarter of 2004. The balance of opinion regarding future employment also declined slightly in the fourth quarter from the third, but was almost 12 percentage points above the fourth quarter of 2004.

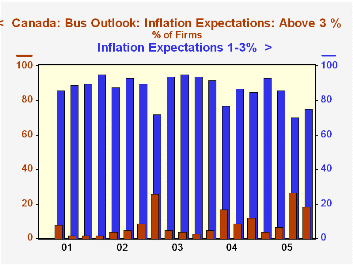

According to the survey, inflationary expectations have moderated. The number of firms expecting consumer price inflation to exceed 3% over the next two years declined to 18.80% in the fourth quarter from 26.70% in the third quarter but was 6.80 percentage points above the fourth quarter of 2004. The second chart shows the percent of firms expecting inflation to range between 1-3% and those expecting inflation to exceed 3%.

| The Business Outlook Survey of the Bank of Canada | Q4 05 % | Q3 05 % | Q4 04 % | Q/Q % pt | Y/Y % pt | 2005 % | 2004 % | 2003 % |

|---|---|---|---|---|---|---|---|---|

| Percent Balance | ||||||||

| Future Sales Growth | 15.84 | 13.86 | 7.92 | 1.98 | 7.92 | 17.43 | 17.91 | 21.38 |

| Plans for Investment | 19.00 | 19.80 | 21.78 | -0.80 | -2.78 | 19.20 | 16.95 | 2.99 |

| Future Employment | 49.50 | 50.50 | 37.62 | -1.00 | 11.88 | 42.75 | 33.42 | 27.96 |

| Percent of Respondents | ||||||||

| Inflation Expectations | ||||||||

| <1% | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.25 | 0.00 | 0.50 |

| 1-2% | 13.90 | 9.90 | 29.00 | 4.00 | 15.10 | 18.70 | 32.25 | 34.25 |

| 2-3% | 61.40 | 60.40 | 56.00 | 1.00 | 5.40 | 62.45 | 53.00 | 54.50 |

| >3% | 18.80 | 26.70 | 12.00 | -7.90 | 6.80 | 14.13 | 10.75 | 9.50 |

| Ability to Meet Demand | ||||||||

| Some Difficulty | 34.70 | 35.60 | 38.00 | -0.90 | -3.30 | 32.58 | 34.00 | 32.50 |

| Significant Difficulty | 14.90 | 9.90 | 7.00 | 5.00 | 7.90 | 11.20 | 7.25 | 6.25 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates