Global| Feb 07 2005

Global| Feb 07 2005Chile's Monthly Economic Indicator Predicts 5.9% Growth in GDP in 2004

Summary

Chile's monthly seasonally unadjusted economic indicator, IMACEC (Indicator Mensual de Activeda Economica)was 134.2 (1996=100) in December, 7.70% above December, 2003. On a quarterly basis the fourth quarter value of the indicator was [...]

Chile's monthly seasonally unadjusted economic indicator, IMACEC (Indicator Mensual de Activeda Economica)was 134.2 (1996=100) in December, 7.70% above December, 2003. On a quarterly basis the fourth quarter value of the indicator was 133.1 or 6.83% above the fourth quarter of 2003.

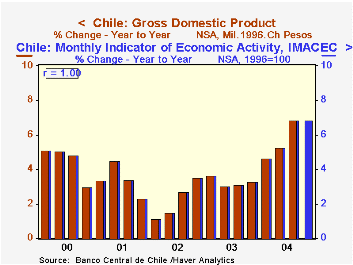

The seasonally unadjusted monthly indicator is an excellent indicator of monthly values of the seasonally unadjusted real gross domestic product. As the first chart and the following table show, the year over year change in real GDP is equal to the year over year change in the monthly indicator, aggregated on a quarterly basis. The two series are perfectly correlated. As a result, we are safe to assume that Chile's real economy grew 6.83% in the fourth quarter from the fourth quarter of 2003 and will show a 5.89% growth for the year 2004, up from 3.27% in 2003 and 2.21% in 2002.

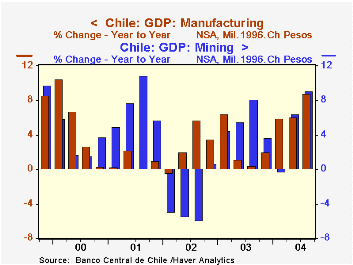

The acceleration in Chile's growth has been due in large part to the rising demand for copper, which has led to increased employment and incomes within the mining industry and through secondary effects stimulated the general economy. The second chart shows the growth in the mining industry and in manufacturing.

| Chile | Dec 05 | Nov 04 | Dec 04 | M/M % | Y/Y % |

2004 % | 2003 % | 2002 % | 2001 % |

|---|---|---|---|---|---|---|---|---|---|

| Economic Indicator (NSA 1996=100) |

134.2 | 132.5 | 124.6 | 1.30 | 7.70 | 5.89 | 3.27 | 2.21 | 3.39 |

| Q4 04 | Q3 04 | Q2 04 | Q1 04 | 2004 | 2003 | 2002 | 2001 | ||

| Economic Indicator (NSA 1996=100) |

133.1 | 130.9 | 132.7 | 130.8 | 131.9 | 124.5 | 120.6 | 118.0 | |

| Y/Y Percent Change | 6.83 | 6.84 | 5.26 | 4.65 | 5.89 | 3.27 | 2.21 | 3.39 | |

| Real GDP (NSA Billions 1996 Pesos) |

10.231 | 10.359 | 10.217 | 38.900 | 37.670 | 36.855 | |||

| Y/Y Percent Change | 6.84 | 5.26 | 4.65 | 3.27 | 2.21 | 3.32 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates