Global| Jul 02 2012

Global| Jul 02 2012China's Manufacturing PMIs

Summary

There are two diffusion indexes that track China's purchasing managers' views of the manufacturing outlook. One is China's official Purchasing Managers Index compiled by the China Federation of Logistics and Purchasing and the other [...]

There are two diffusion indexes that track China's purchasing managers'

views of the manufacturing outlook. One is China's official

Purchasing Managers Index compiled by the China Federation of Logistics

and Purchasing and the other is the HSBC manufacturing PMI published by

Markit Economics. In HAVER'S data bases, the former can be found at

S924VM@ EMERGEPR, and the latter at S924M@ PMI. The series differ, among

other things, in the size of their samples--the official series is

based on a sample of 727 and the Markit PMI on a sample of 429. The

two series also differ in their seasonal adjustment

procedures.

There are two diffusion indexes that track China's purchasing managers'

views of the manufacturing outlook. One is China's official

Purchasing Managers Index compiled by the China Federation of Logistics

and Purchasing and the other is the HSBC manufacturing PMI published by

Markit Economics. In HAVER'S data bases, the former can be found at

S924VM@ EMERGEPR, and the latter at S924M@ PMI. The series differ, among

other things, in the size of their samples--the official series is

based on a sample of 727 and the Markit PMI on a sample of 429. The

two series also differ in their seasonal adjustment

procedures.

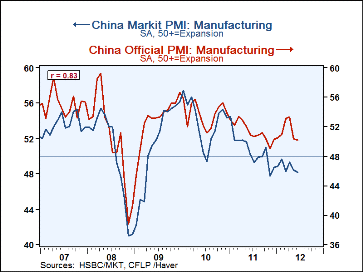

The two series are shown in the attached chart. The official series has generally been above the Markit series, but the two series have shown the same general trend. The correlation between the two series is fairly high at .83. Both indicators are currently forecasting a slowdown in China's manufacturing activity. The Official diffusion index for June at 50.2 was just slightly above the 50 mark which represents the dividing line between expansion and contraction. The Markit PMI for June was 48.2 continuing to be in the contractionary area. It has remained in a rather narrow band just below the 50 mark for most of the past year, suggesting that while a slowdown in manufacturing in China is likely, a sharp drop is not imminent.

| China's Manufacturing PMIs | Jun | May | Apr | Mar | Official PMI | 50.2 | 50.4 | -- | -- |

|---|---|---|---|---|

| Markit PMI | 48.2 | 48.4 | -- | -- |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates