Global| Jun 21 2010

Global| Jun 21 2010China Unpegs The Yuan

Summary

The Central Bank of China announced an end to its peg of the yuan to the dollar last Saturday. The announcement comes one week before the G20 meeting in Toronto where pressure was expected to be put on China to revalue its currency. [...]

The Central Bank of China announced an end to its peg of the yuan to the dollar last Saturday. The announcement comes one week before the G20 meeting in Toronto where pressure was expected to be put on China to revalue its currency. How much and how soon is the yuan likely to appreciate? And to what extent is the yuan undervalued?

To answer the first question, the Bank of China's subsequent comments that a substantial appreciation of the yuan was not in China's interest and that the exchange rate would remain basically stable suggest that any appreciation of the yuan will be slow and gradual. In addition, past experience supports this view.

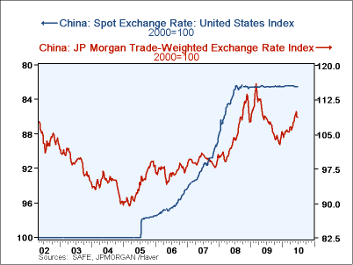

The last time the yuan was unpegged was the period from July 2005 to July 2008. During that period the yuan appreciated 21% from 8.3 yuan to the dollar to 6.8 yuan to the dollar or about 0.6 yuan a month. The trade weighted exchange rate which allows for changes in trade patterns is more volatile than the spot exchange rate as can be seen in the first chart. While it also appreciated in the July 2005 to July 2008 period, it depreciated following the world financial crisis but has appreciated again since early 2010. Data on China's spot exchange rate and it trade weighted exchange rate are available in several of the Haver data bases: Daily data are in INTDAILY, weekly data in INTWKLY and monthly in CHINA, EMERGEPR, and EMERGE.

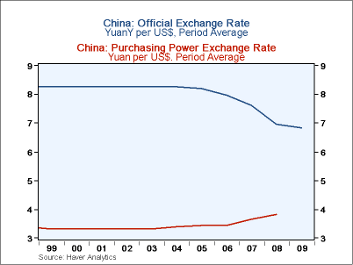

To answer the second question a rough estimate can be made comparing the spot rate with a purchasing power parity exchange rate. Haver's WDI (World Development Indicators) data base provides conversion factors to adjust spot exchange rates to purchasing power parity rates. The data are annual and are only through 2008. However, they suggest that the undervaluation of the yuan narrowed in the 2005-2008 period, but is still significant. In 2005 the difference between the PPP exchange rate and the spot rate was 4.8 yuan. By 2008, the difference was 3.1 yuan. The second chart show the spot rate and PPP rate.

| Jun 21 | Jun 14 | May 28 | 2009 | 2008 | 2007 | 2006 | 2005 | |

|---|---|---|---|---|---|---|---|---|

| Spot Rate (Yuan/Dollar) | 6.8282 | 6.8280 | 6.8279 | 6.83042 | 6.94865 | 7.60753 | 7.98344 | 8.18432 |

| PPP Rate (Yuan/Dollar) | -- | -- | -- | -- | 3.44161 | 3.42858 | 3.65161 | 3.44161 |

| JPMorgan Narrow Nominal Ex Rate (2000=100) | 108.7 | 109.2 | 110.3 | 108.4 | 105.0 | 99.4 | 96.9 | 94.0 |