Global| Jun 26 2012

Global| Jun 26 2012Comparing Consumer Confidence in Germany and France

Summary

Indicators of Consumer Confidence for France and Germany were released today. In Germany, GfK's Consumer Climate indicator declined from the March high of 6.0 points to 5.7 points in May and June but is now forecasting an improvement [...]

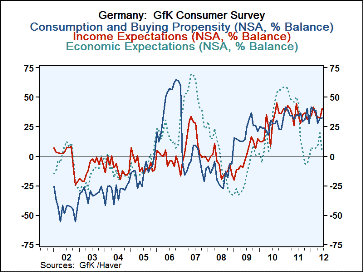

Indicators of Consumer Confidence for France and Germany were released today. In Germany, GfK's Consumer Climate indicator declined from the March high of 6.0 points to 5.7 points in May and June but is now forecasting an improvement to 5.8 for July. In spite of a sharp decline in the balance of opinion regarding the general economic scene from 19.6% in May to 3.0% in June, there was a significant rise in the number of German consumers who viewed their income prospects more favorably. The balance of opinion on income expectations rose from 32.0% in May to 40.1% in June as a result of the low level of unemployment and the prospect of increased wages. The latter two factors are probably responsible for the slight increase in the balance of opinion on consumption and buying propensities from 32.0% to 32.7%. The components of the GfK survey are shown in the first chart.

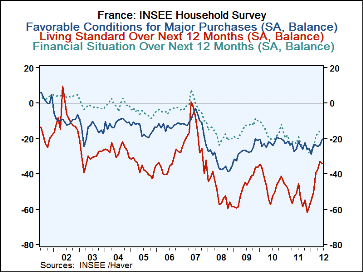

In France, INSEE's Indicator of consumer confidence, which had been rising in each month of this year, declined from 90.4 in May to 89.6 in June. Although the balances of opinion regarding living standards and the financial situation worsened, there was a less pessimistic appraisal of conditions for major purchases. The balance of opinion on living standards over the next 12 months declined from -32.9% in May to -34.1% in June, and that for the financial situation from -15.9% to -16.9% while the balance of opinion on favorable conditions for major purchases rose from -23.7% to -20.6%. These components of the INSEE survey are shown in the second chart.

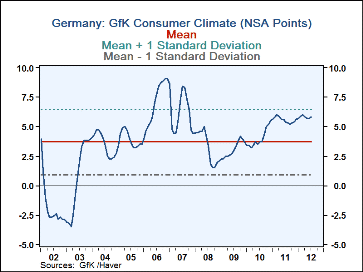

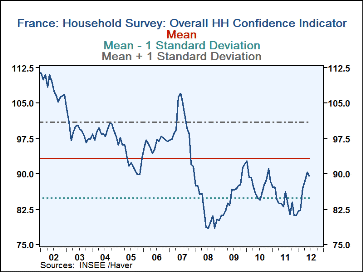

A comparison of the first two charts shows that, in general, some of the main factors affecting consumer confidence have been improving in Germany and falling in France over the past three years. A comparison of the overall indicators, however, doesn't seem to reveal much. One is measured in "points" and the other, "relative to its long term average." One way getting around this problem is to show the data with its mean and standard deviation (The means and standard deviations are shown at the bottom of the Haver graph presentations.) In the third and fourth charts, we plotted the overall indexes relative to their means and standard deviations.b The chart showing Germany's GfK Consumer Climate shows that the indicator has generally been almost one standard deviation above its mean over the past three years while the French INSEE overall Household Confidence Indicator has generally been one or more standard deviations below its mean. suggesting that confidence among German consumers has, as a comparison of the components suggested, been improving while confidence in France has been declining.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates