Global| Mar 01 2019

Global| Mar 01 2019Complicated U.S. Personal Income and Spending Report

Summary

As a result of the government shutdown the Bureau of Economic Analysis released the delayed December personal income, personal consumption and related prices measures as well as the January personal income data, without outlays and [...]

As a result of the government shutdown the Bureau of Economic Analysis released the delayed December personal income, personal consumption and related prices measures as well as the January personal income data, without outlays and prices.

In January, personal income edged down 0.1% (+4.3% year-on-year) after a 1.0% gain in December. November's gain was revised slightly higher to 0.3% from 0.2%. The Action Economics Forecast Survey expected gains of 0.3% in January and 0.4% in December. Wages & salaries grew 0.3% (4.2% y/y) after a 0.5% rise. Benefits were up 0.3% (3.0% y/y) in January, while transfers jumped 2.6% (6.4% y/y), driven by a 3.1% cost-of-living related spurt in social security payments (6.7% y/y). These gains were more than offset by the 3.4% drop in receipts from assets (+2.8% y/y), some of which was related to a special dividend payment made by VMware Incorporated in December. In addition, proprietors' income slumped 1.6% (+5.3% y/y).

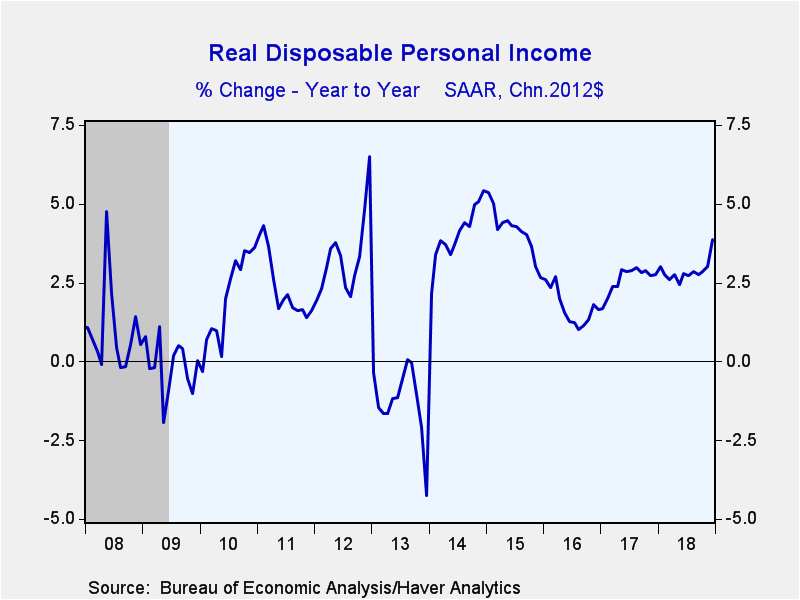

Disposable personal income declined 0.2% (+4.4% y/y) in January following a 1.1% increase. When adjusted for inflation, real disposable income rose 1.0% (3.9% y/y) in December.

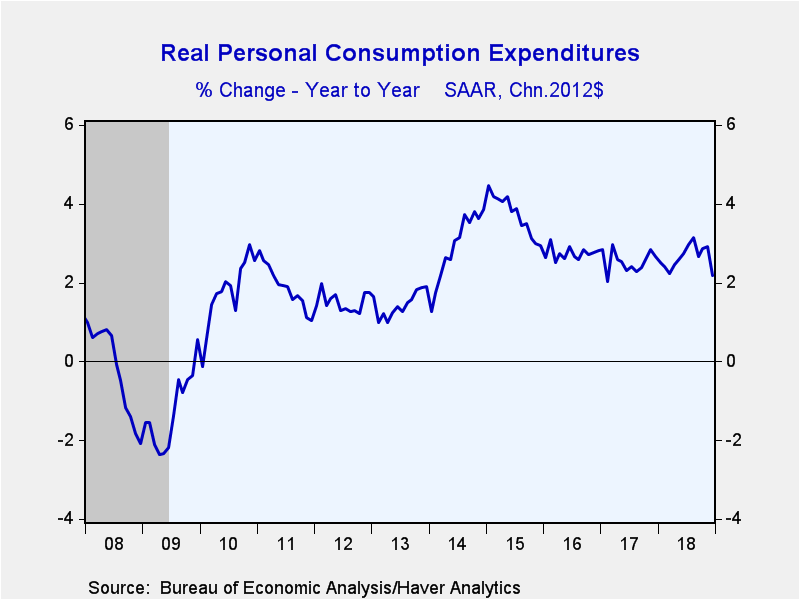

Personal consumption expenditures fell a greater than expected 0.5% in December. A 0.1% decline had been anticipated by the Action Economics Forecast Survey. Inflation-adjusted consumption dropped 0.6% (+2.2% y/y) as both goods and services spending decreased 1.4% (+2.4% y/y) and 0.2% (+2.1% y/y) respectively. Spending on goods was weak across the board, while the decline in services reflected a 1.0% drop in housing related expenditures (+0.6% y/y) as well as eating out and hotel stays (-0.9%; +2.5% y/y).

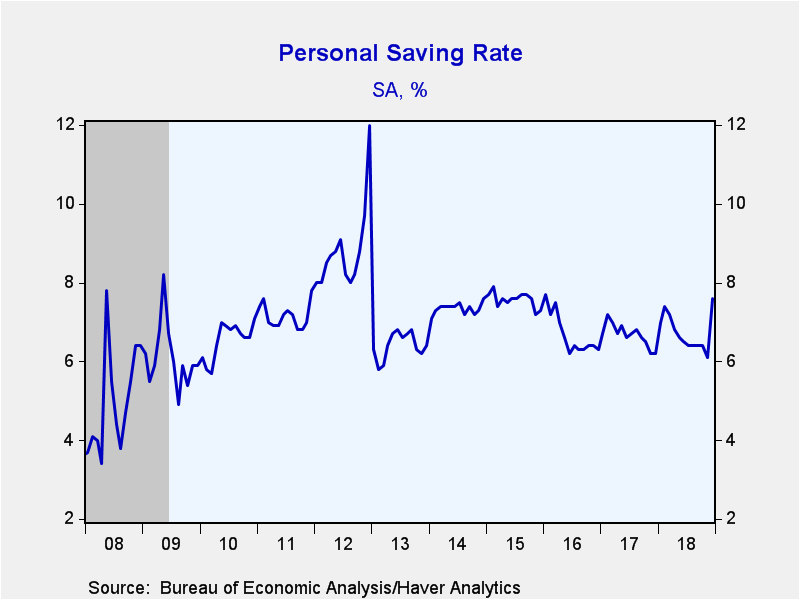

The personal savings rate rebounded to 7.6% in December's from November's five-and-a-half year low of 6.1%. The level of personal savings jumped 28.2% y/y, the fastest growth since early 2014.

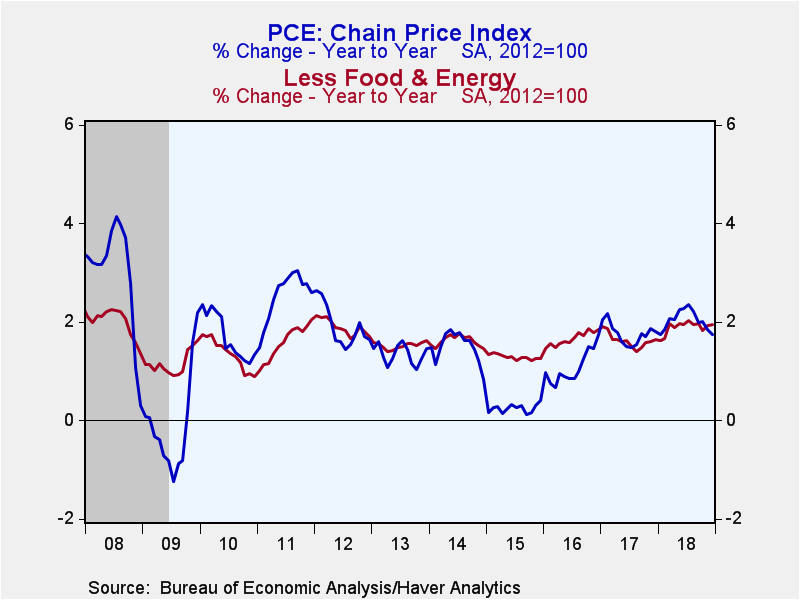

The personal consumption chain price index edged up 0.1% (1.7% y/y) in December after an unchanged reading in November (was 0.1%). The index excluding food & energy also rose 0.2% (1.9% y/y) for a second month.

The personal income and consumption figures are available in Haver's USECON database with detail in the USNA database. The Action Economics figures are in the AS1REPNA database.

| Personal Income & Outlays (%) | Jan | Dec | Nov | Jan Y/Y | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| Personal Income | -0.1 | 1.0 | 0.3 | 4.3 | 4.5 | 4.4 | 2.6 |

| Wages & Salaries | 0.3 | 0.5 | 0.2 | 4.2 | 4.5 | 4.6 | 2.9 |

| Disposable Personal Income | -0.2 | 1.1 | 0.3 | 4.4 | 5.0 | 4.4 | 2.8 |

| Jan | Dec | Nov | Dec Y/Y | 2018 | 2017 | 2016 | |

| Personal Consumption Expenditures | -- | -0.5 | 0.6 | 4.0 | 4.7 | 4.3 | 3.8 |

| Personal Saving Rate | -- | 7.6 | 6.1 | 6.2 (Dec '18) | 6.7 | 6.7 | 6.7 |

| PCE Chain Price Index | -- | 0.1 | 0.0 | 1.7 | 2.0 | 1.8 | 1.1 |

| Less Food & Energy | -- | 0.2 | 0.2 | 1.9 | 1.9 | 1.6 | 1.7 |

| Real Disposable Income | -- | 1.0 | 0.2 | 3.9 | 2.9 | 2.6 | 1.7 |

| Real Personal Consumption Expenditures | -- | -0.6 | 0.5 | 2.2 | 2.6 | 2.5 | 2.7 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.