Global| May 03 2005

Global| May 03 2005Confederation of British Industry's (CBI'S) Distributive Trades Survey: Retail and Motor Trades Slow Sharply, [...]

Summary

The Confederation of British Industries' (CBI's) Distributive Trades Survey released today, shows a weakening in current retail trade volume and in expected volumes. The percent balance between those who reported an increase in volume [...]

The Confederation of British Industries' (CBI's) Distributive Trades Survey released today, shows a weakening in current retail trade volume and in expected volumes. The percent balance between those who reported an increase in volume in April and those who report a decrease was -14%, compared with -9% in March and +30% in April, 2004.

In the March Survey, there were 3% more retailers who expected an increase in volume in April than those who expected a decrease. In the current survey, there are only 1% more retailers who expect an increase in volume than those who expect a decrease in May suggesting that retailers are almost equally balanced between those who expect May volume will increase and those who expect it to decrease.

Survey results for the wholesale trade sector were more positive. The balance of those reporting an increase in volume over those reporting a decrease rose to 2% from -17% in March in contrast to the expectations expressed in the March Survey when the balance in April was expected to be -7%. The current Survey expects that the balance of increases in wholesale volume over decreases will rise to16% in May.

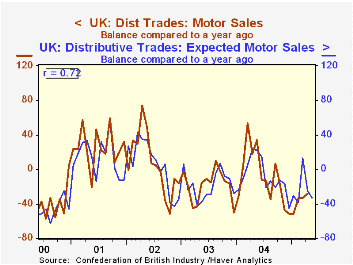

Reported current and expected volumes in the Motor Trades are bleak. Although the balance of those reporting a decrease in volume over those reporting an increase improved in April to -28%, from -33%, in March, it was 46 percentage points below the +18% of April, 2004. In the March Survey, the expectation for motor trade volume was for a balance of -25%, not too different from the actual figure reported for April. In the current survey, the expectation is that balance of those expecting an increase over those expecting a decrease will increase still further to -33%.

The ability of the expected series to forecast subsequently reported balances is not particularly robust as measured by the correlation coefficient. The best, shown in the attached chart, is that for the motor trades, which has a correlation coefficient of 0.72, compared with that for retail trade of .53 and for wholesale trade, .27. The fact that the motor trades sector is relatively homogeneous while those of the retail and wholesale sectors are heterogeneous may account for better ability of expectations in the motor trades to predict the subsequently reported volume.

| UK: Distributive Trade Survey | Apr 05 | Mar 05 | Apr 04 | M/M dif | Y/Y dif | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|---|---|

| Reported (Percent Balance) |

||||||||

| Retail Trade | -14 | -9 | 30 | -5 | -44 | 24 | 14 | 23 |

| Wholesale Trade | 2 | -17 | 38 | 19 | -36 | 27 | 4 | 6 |

| Motor Trade | -28 | -33 | 18 | 5 | -46 | -8 | -19 | 7 |

| May 05 | Apr 05 | May 04 | M/M dif | Y/Y dif | 2004 | 2003 | 2002 | |

| Expected (Percent Balance) |

||||||||

| Retail Trade | 1 | 3 | 34 | -2 | -34 | 25 | 18 | 29 |

| Wholesale Trade | 16 | -7 | 32 | 22 | -16 | 17 | -1 | 1 |

| Motor Trade | -33 | -25 | 22 | -8 | -55 | -8 | -18 | 5 |