Global| Dec 13 2005

Global| Dec 13 2005Confidence among German Investors and Analysts Rises Sharply: The ZEW Survey

Summary

The ZEW survey of institutional investors and analysts showed a 22.9 point increase in expectations for improvement in the German economy six months ahead. This was the second largest month-to-month increase recorded since the series [...]

The ZEW survey of institutional investors and analysts showed a 22.9 point increase in expectations for improvement in the German economy six months ahead. This was the second largest month-to-month increase recorded since the series began in January 1992. The largest increase, 31.5, occurred in July 1993. Relief that the much of the uncertainty arising out of the recent election has abated may have been part of the reason for the increased confidence. But, the strength in exports and increased business investment in the third quarter may also have played a role in the increased confidence. Aided by a weaker Euro--the Euro has declined some 13% since early this year--goods export growth in the third quarter rose to 5.2% compared with 1.0% and 1.8% increases in the second and first quarters of this year. Expenditures on business equipment rose 3.8% in the third quarter compared to increases of 0.6% in the second quarter and 1.6% in the first.

The respondents to the survey were somewhat less pessimistic about the current economic conditions. Pessimists outweighed optimists by 44.6% in December, down from 55.2% in November and 64.2% in December of a year ago. The continued dissatisfaction with current conditions may be due to the continued sluggishness in the consumer related areas of consumer spending and residential construction. The quarterly increases in consumer spending have been -0.27%, 0.18% and -0.03% in the first, second and third quarters of this year while the corresponding figures for residential construction have been -2.56%, 0.59% and 0.89%.

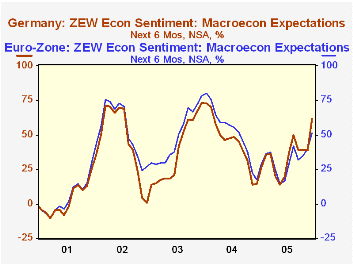

The ZEW survey also queries its respondents on current conditions and expectations for improvement in the next six months in the economy of the Euro Zone as a whole. Expectations for improvement in the economy six moths ahead in Germany and in the Euro Zone are show in the first chart. Over the past five years expectations for all of the Euro Zone, including Germany, have generally been greater than those for Germany alone. This year expectations for the German economy appear to be improving relative to the Euro Zone as a whole.

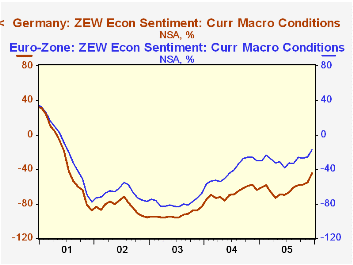

In terms of opinions on current conditions in the Euro Zone and Germany, shown in the second chart, the respondents to the ZEW survey are generally more pessimistic about the German economy than for the Euro Zone economy as a whole.

| ZEW Financial Market Survey | Dec 05 % bal |

Nov 05 % bal |

Dec 04 % bal |

M/M Dif | Y/Y Dif | 2005 % bal |

2004 % bal |

2003 % bal |

|---|---|---|---|---|---|---|---|---|

| Germany | ||||||||

| Current Conditions | -44.4 | -55.2 | -64.2 | 10.8 | 19.8 | -61.8 | -67.7 | -92.6 |

| Expectations 6 Months Ahead | 61.6 | 38.7 | 14.4 | 22.9 | 49.2 | 34.8 | 44.6 | 38.4 |

| Euro Zone | ||||||||

| Current Conditions | -16.8 | -2.55 | -30.2 | 8.7 | 13.4 | -28.7 | -41.4 | -78.5 |

| Expectations 6 Months Ahead | 51.2 | 40.0 | 17.7 | 11.2 | 33.5 | 32.3 | 57.1 | 48.9 |