Global| Aug 29 2007

Global| Aug 29 2007Confidence Measures in Sweden Hover Near All-Time Highs

Summary

Swedish consumers and business leaders are maintaining extraordinary levels of confidence this summer, although the National Institute for Economic Research monthly survey results did ease a bit for August, reported today. The total [...]

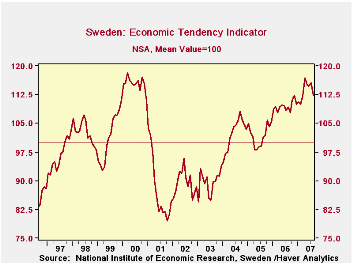

Swedish consumers and business leaders are maintaining extraordinary levels of confidence this summer, although the National Institute for Economic Research monthly survey results did ease a bit for August, reported today. The total "economic tendency" measure stands at 112.3, where the long-run average since 1996 equals 100. The August figure is 3.4 points less than July's 115.7. A recent high is 116.9 in April, and the all-time high was 118.2 in March 2000, at the peak of the tech boom.

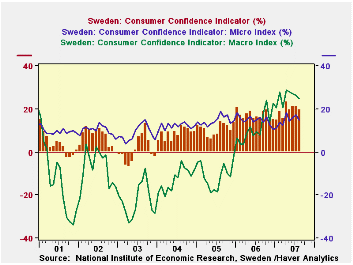

Both the consumer and the business surveys have shared in the recent strength. Consumer confidence had a positive balance in August of 19.7%. It was 21.3% in July and its recent high was 23% in April. There are two divisions of this index, the "macro" and the "micro". The questions in the macro set include opinions on the overall economy for the coming year and on the unemployment rate. The micro questions ask about the current condition and prospects for personal finances and about whether respondents believe this is a good time to make major purchases and if they plan to increase major purchases in coming months. As we see, people's views of the macro economy swing widely, but they see their personal situation in a pretty steady light. So the currently less buoyant readings on the "micro" indicator don't suggest a weak consumer outlook, but one instead that sees the wider economy as relatively strong.

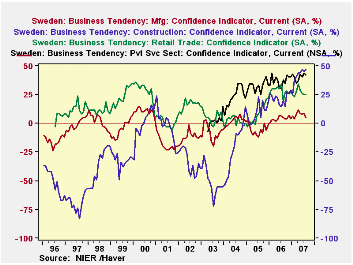

The industry survey also sees much of the economy doing well. Traditional manufacturing looks at first to be an exception with a mere +5 reading, but the industry detail shows strength in key products Sweden is known for: machinery, electrical equipment and transportation equipment. Other European producers of these items have also seen good demand recently. Swedish retailing and service industries have been steady at a high level. The real standout is construction. Its August reading of 47% ties with June as the all-time high. No individual industry gauge is a record, but all show favorable results simultaneously, producing the strength in the overall indicator: order books are expanding, the volume of construction produced and anticipated is large and the number of employees is increasing at almost the largest number of firms ever.

So participants in the Swedish economy appear optimistic presently. Its stock market reflects this, with stock prices up 30% in the last few weeks from a year ago. This is similar to German stocks, which have gains of 33%. Both stock markets are less ebullient than they were back in July, but given the upheaval in other nations' stock markets, such backtracking is hardly surprising. What is impressive is the sustained and widespread favorable outlook for Sweden.

Data on Sweden are in Haver's NORDIC database. The share prices come from the MSCI databases, which consist of the Morgan Stanley Capital International indexes.

| SWEDEN (% Bal, ex as noted) | Aug 2007 | July 2007 | June 2007 | Year Ago | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Economic Tendency (100=long run avg.) | 112.3 | 115.7 | 114.7 | 109.3 | 109.4 | 101.8 | 102.5 |

| Consumer Confidence | 19.7 | 21.3 | 21.0 | 16.0 | 17.1 | 10.5 | 8.7 |

| Micro Questions | 14.7 | 17.2 | 15.9 | 15.9 | 14.9 | 14.5 | 12.1 |

| Macro Questions | 24.9 | 26.4 | 27.0 | 8.0 | 11.5 | -10.7 | -12.5 |

| Business Tendency: | |||||||

| Manufacturing | 5 | 9 | 8 | 5 | 4 | -6 | 2 |

| Construction | 47 | 45 | 47 | 20 | 22 | 9 | -20 |

| Retail Trade | 30 | 26 | 21 | 24 | 28 | 8 | 2 |

| Services | 42 | 44 | 40 | 38 | 37 | 33 | 23 |

by Robert Brusca August 29, 2007

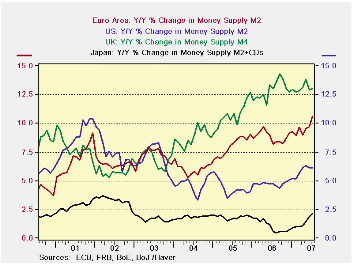

In the UK M4 growth has hovered at a 13% pace.

In the Euro area money supply has accelerated to over 11%.

In Japan money growth edged higher to 2.5%.

In the US growth had flattened at 6%.

Among major countries only the US shows a clear pattern of sequential growth rates becoming weaker (significantly weaker at that) as the pace of growth stepped down in its rate steadily from 3 years to 2 years, and from that to one year, then to six months and then to three months - with the three-month pace at just 3.6%. That is too low to fuel what has been strong nominal GDP growth in Q2 in the US (these figures are all through July 2007). But money generally acts with a lag on the real sector so it’s hard to blame the market problems on a slowing in money growth that occurs only in the US.

In the Euro area in particular, credit to residents and loan growth have remained strong and along with money (M2) have slightly accelerated through July despite some tepid steps by the ECB to hike rates.

On balance, there is no sense of there being deficient liquidity among this grouping of major global money centers. The liquidity problems markets now face are all of their own making, not due to the actions of the central banks.

The lesser ease of transactability is a function of the uncertainty over the value of some key assets in this system - that is far different from it being a quantity problem. There is no quantity problem. What there is, is a quality and an informational problem.

Until there is a way to clearly identify the troubled assets and to establish within reasonable grounds their true market value, markets and certain asset classes in particular – as well those who own them - will continue to suffer this liquidity problem of their own making. It’s a micro- not a macro-liquidity problem. Don’t blame the central banks.

Central banks rightly worry about the other sort of liquidity problem right now - have they made too much? The levels of the growth rates in the table below sure argue for the answer ‘yes’ to that question everywhere but in Japan – there, of course, there are special things in play. Unfortunately this is the wrong time for central banks to be taking up this fight.

Only the Fed seems to have taken action to date to squeeze some of the excess liquidity from the market. And with that, markets now are begging for the Fed to re-inject what it has taken out (or, more correctly, slowed down its injecting).

It’s a curious time for markets and central bankers alike.

| SAARl | Euro Measures (E13): Money & Credit | G-10 Major Markets: Money | ||||

| €-Supply M2 | Credit: Residential | Loans | $US M2 | £UK M4 | ¥Japan M2+CDs | |

| 3-MO | 11.4% | 12.8% | 11.6% | 3.6% | 13.1% | 2.5% |

| 6-MO | 11.0% | 12.7% | 11.3% | 5.6% | 13.6% | 2.0% |

| 12-MO | 10.6% | 11.6% | 10.7% | 6.1% | 13.0% | 2.1% |

| 2Yr | 6.2% | 11.5% | 10.8% | 5.4% | 13.0% | 1.4% |

| 3Yr | 13.9% | 16.3% | 15.4% | 7.5% | 19.0% | 2.2% |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates