Global| Jan 09 2019

Global| Jan 09 2019Confidences Take a Hit in France as Yellow Vested Interests Prevail

Summary

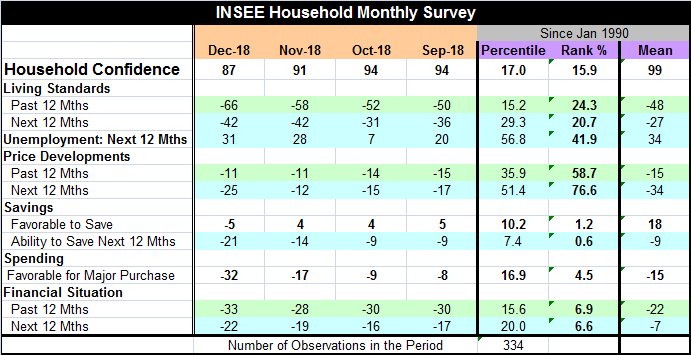

Household confidence in France fell to 87 in December from 91 in November. That leaves confidence at a rank standing in its 15.9 percentile on data back to 1990. All the readings deteriorated in the month or were unchanged. The only [...]

Household confidence in France fell to 87 in December from 91 in November. That leaves confidence at a rank standing in its 15.9 percentile on data back to 1990. All the readings deteriorated in the month or were unchanged. The only increase was for expected unemployment over the next 12 months – and that is a deterioration. Price developments for the past 12 months and living standards for the next 12 months are unchanged on the month while everything else deteriorated.

Household confidence in France fell to 87 in December from 91 in November. That leaves confidence at a rank standing in its 15.9 percentile on data back to 1990. All the readings deteriorated in the month or were unchanged. The only increase was for expected unemployment over the next 12 months – and that is a deterioration. Price developments for the past 12 months and living standards for the next 12 months are unchanged on the month while everything else deteriorated.

The rank percentile standings for the various household components are uniformly and exceptionally low for the saving and spending categories. The rankings for price developments are more firm to middling- but still nothing better than that. And price developments expected for the next 12 months fell sharply from November to December.

The readings under unemployment and living standards have rankings in their 20th percentile range of lining standards and at 41.9 percentile for unemployment.

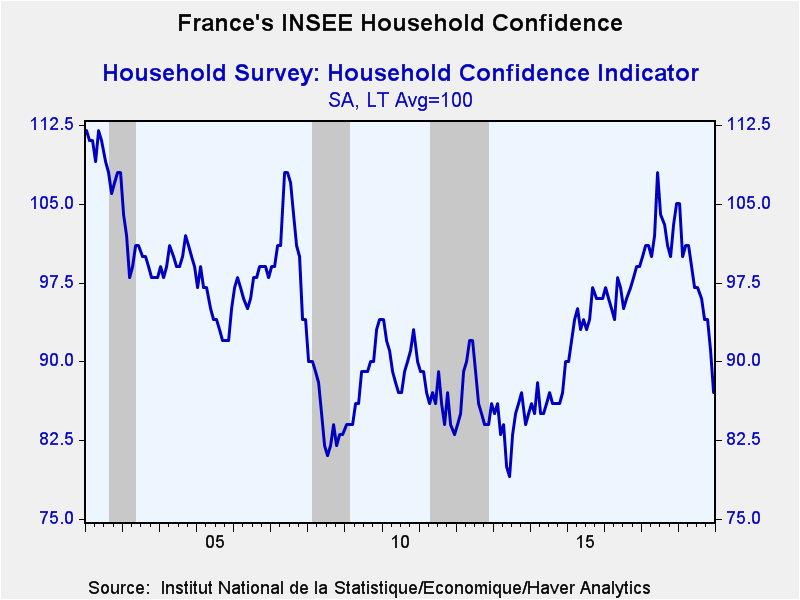

As the chart shows, household confidence has been falling monotonically since December 2017 after peaking in June. The Yellow Vest movement that began having demonstrations beginning in November 2018 has had some effect on reducing household confidence. The movement continues to take a toll. And while President Macron’s ratings have risen from their lows, they are still impacted. His effort to contain and control disagreements in town hall meetings so far have not met with success.

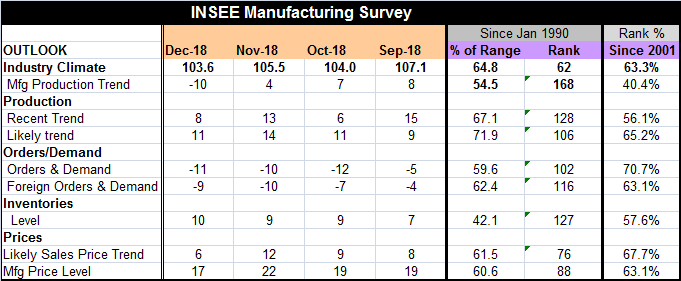

The industry climate fell to 103.6 in December from 105.5 in November. The manufacturing index reached its peak at 113.3 in January. It has been slipping erratically ever since. The industry climate index has a 63rd percentile standing. All standings are in a range of 40.4 to 70.7, a range that goes from moderate weakness to moderate firmness. The production trend has the weak 40.4 percentile standing. The strength is from overall order and demand with a 70.7 percentile standing. Foreign orders and demand have 63.1 percentile standing. The recent trend has a 56th percentile standing; the likely trend has a 65th percentile standing.

Signs of moderation in Europe proliferate. The readings from France are another piece in a deteriorating puzzle. The World Bank sees dark skies and forecasts a soft landing largely because any other forecast is unacceptable. Because of the government shutdown, we have few new indicators from the U.S. economy. It is hard to get a line on the economy’s path. Recently, the ISM data have been weak and yet job growth has been strong. Yesterday’s NFIB survey was only slightly weaker and continues to give off quite strong signals. Growth remains the order of the day, but global economic trends are wavering and the future remains more uncertain than it has been in a while.

Manufacturing has weakened as well

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates