Global| Sep 29 2010

Global| Sep 29 2010Consumer Confidence Continues To Lag But EU Indices Advance

Summary

The EMU overall sentiment index rose in September to 103.4 from 103.1 keeping the European advance in play. Of the main five countries four saw increases in their confidence levels, Italy was the exception, but Spain's index rose [...]

The EMU overall sentiment index rose in September to 103.4 from 103.1 keeping the European advance in play.

Of the main five countries four saw increases in their confidence levels, Italy was the exception, but Spain's

index rose strongly for the second month running.

The EMU overall sentiment index rose in September to 103.4 from 103.1 keeping the European advance in play.

Of the main five countries four saw increases in their confidence levels, Italy was the exception, but Spain's

index rose strongly for the second month running.

Ranking the various sectors' performance by their queue standing, the most rigorous comparison, finds the overall index in the 57th percentile of its ranked queue. Retailing leads as it ranks in the 92nd percentile of its queue followed by a 71% standing of the industrial sector, in its queue. Consumer confidence ranks 43rd followed by the services and construction sectors each of which stand below the 30th percentile of their respective ranges. These latter readings are still very low readings after a year of recovery.

Note that the standings in the queue give different measures of strength (relative strength) than the raw EC Commission net diffusion readings. This is because some sectors like services nearly always are expanding so a positive number is not as impressive while in construction, where up and down cycles are common, does not find positive readings so easy to come by.

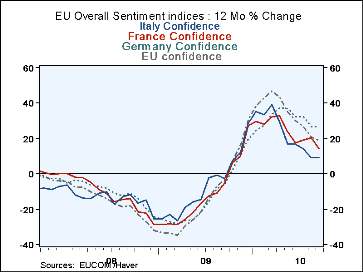

The chart shows that the EU indices continue to chronicle improvement in overall sentiment across most nations. But the improvement is coming at a successively lower rate of improvement.

As for the individual counties Germany is doing best as its overall sentiment reading is in the 92nd percentile of its range of queued observations. After Germany France is the only large country above the 50th percentile in its ordered queue. EU member UK is the low 40th percentile while Italy is in the 30th percentiles and Spain is below 20.

The EMU countries rank just a bit stronger overall than does the broader EU group, but much of this high ranking seems to owe to Germany and its larger weight in the smaller group.

On balance is clear where the progress is. It is surprising that the retailing sector is doing so well with the consumer confidence still lagging. And, like in the US, the services sector- a big part of the economy- is lagging-and that sector is the key jobs sector. Europe takes another small step forward- not backward – in September and that is good but it remains very slow progress and not at a speed or with momentum that encourages us to believe that the improvement will endure.

| EU Sectors and Country level Overall Sentiment | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EU | sep 10 |

aug 10 |

jul 10 |

jun 10 |

%ile | rank | max | min | rng | mean | by Q rank% |

avg level |

| Overall Index |

103.4 | 103.1 | 102.1 | 100.3 | 75.2 | 107 | 115 | 68 | 47 | 100 | 57.7% | 100.2 |

| Ind. | -2 | -2 | -4 | -6 | 80.4 | 73 | 7 | -39 | 46 | -8 | 71.1% | -8.0 |

| Cons- -umer Confid |

-12 | -11 | -14 | -15 | 58.8 | 142 | 2 | -32 | 34 | -11 | 43.9% | -11.3 |

| Retail | 2 | 1 | 0 | -4 | 87.1 | 18 | 6 | -25 | 31 | -6 | 92.9% | -5.7 |

| Const. | -29 | -31 | -31 | -32 | 28.3 | 188 | 4 | -42 | 46 | -18 | 25.7% | -17.9 |

| Serv- -ices |

5 | 5 | 6 | 4 | 57.1 | 125 | 32 | -31 | 63 | 13 | 25.6% | 12.6 |

| %m/m | Sep 10 |

based on level |

level | |||||||||

| EMU | 0.9% | 1.2% | 2.2% | 103.2 | 71.3 | 104 | 116 | 71 | 46 | 100 | 58.9% | 100.2 |

| Germany | 1.8% | 1.0% | 3.8% | 113.2 | 83.3 | 19 | 121 | 75 | 46 | 100 | 92.5% | 100.4 |

| France | 0.1% | 2.9% | 1.9% | 102.7 | 64.1 | 121 | 119 | 74 | 44 | 100 | 52.2% | 100.2 |

| Italy | -1.2% | -0.9% | 1.7% | 96.8 | 52.7 | 171 | 120 | 71 | 50 | 100 | 32.4% | 100.1 |

| Spain | 1.2% | 1.0% | -2.4% | 90.7 | 42.5 | 208 | 116 | 72 | 44 | 100 | 17.8% | 99.8 |

| Memo: UK |

-2.1% | 1.5% | 1.4% | 100.2 | 69.9 | 148 | 115 | 65 | 50 | 100 | 41.5% | 100.0 |

| All since Oct 1994 | 253 -Count | Services: | 168 -Count | |||||||||

| Sentiment is an index, sector readings are net balance diffusion measures | ||||||||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates